- Fayetteville car insurance rates average $2,470 per year for full coverage, or approximately $206 per month.

- Fayetteville, AR, auto insurance averages $130 per year less than the Arkansas state average cost ($2,600) and $194 per year more than the rate average for the entire United States ($2,276).

- Car insurance rates for a few popular models in Fayetteville include the Subaru Outback at $2,106 per year, Mazda CX-5 at $2,016, and Jeep Grand Cherokee at $2,470.

- SUV models like the Nissan Kicks, Subaru Crosstrek, Hyundai Venue, and Mazda CX-5 have the best chance of getting cheap car insurance in Fayetteville.

- A few vehicles with segment-leading car insurance rates in Fayetteville include the Acura Integra, Kia K5, Jaguar E-Pace, Nissan Titan, and Mercedes-Benz CLA250.

How much does Fayetteville car insurance cost?

In Fayetteville, the average cost of car insurance is $2,470 per year, which is 8.2% more than the national average rate of $2,276. Per month, Fayetteville drivers can expect to pay an average of $206 for a policy with full coverage.

The average cost of car insurance in Arkansas is $2,600 per year, so Fayetteville, AR, drivers pay an average of $130 less per year than the overall Arkansas state-wide average rate. When compared to other larger cities in Arkansas, the cost of auto insurance in Fayetteville is approximately $8 per year more expensive than in Fort Smith, $68 per year less than in Jonesboro, and $352 per year cheaper than in Little Rock.

The chart below summarizes average auto insurance cost in Fayetteville broken out based on a variety of different driver ages and policy risk profiles. Rates are averaged for all 2024 vehicle models including luxury cars and SUVs.

In the chart above, the cost of car insurance in Fayetteville ranges from $2,052 per year for a 40-year-old driver with many policy discounts to $5,680 per year for a 30-year-old driver who has a few accidents and violations and has to buy a high risk policy. When those numbers are converted to a monthly rate, the average cost in the previous chart ranges from $171 to $473 per month.

Car insurance rates are extremely variable and are impacted by many different factors. The likelihood of a wide range of rates stresses the need to get multiple auto insurance quotes when shopping online for the cheapest Fayetteville auto insurance.

The age of the driver is probably the number one factor that determines the cost of auto insurance, so the list below illustrates this point by showing the difference in average car insurance rates for different driver ages.

Fayetteville, AR, car insurance cost for drivers age 16 to 60

- 16 year old – $8,796 per year or $733 per month

- 17 year old – $8,521 per year or $710 per month

- 18 year old – $7,635 per year or $636 per month

- 19 year old – $6,955 per year or $580 per month

- 20 year old – $4,970 per year or $414 per month

- 30 year old – $2,634 per year or $220 per month

- 40 year old – $2,470 per year or $206 per month

- 50 year old – $2,188 per year or $182 per month

- 60 year old – $2,048 per year or $171 per month

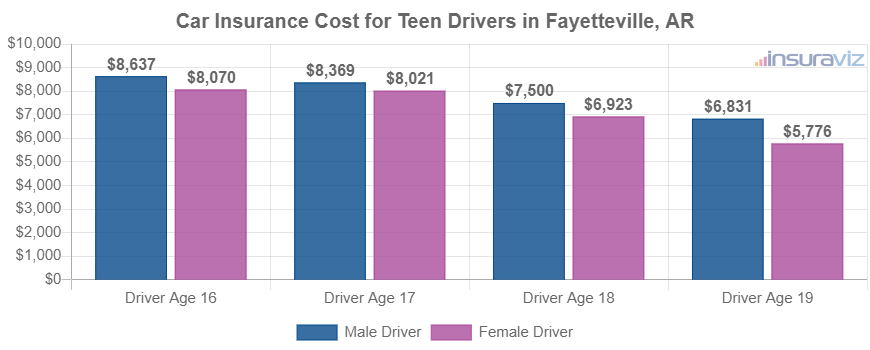

The rates in the list above for drivers age 16 to 19 were based on the rated driver being male. The chart below goes into more detail regarding the cost of insuring teen drivers and breaks out average teen driver car insurance rates by gender. Females are generally slightly cheaper to insure than males, notably at younger ages.

Car insurance for a female 16-year-old driver in Fayetteville costs an average of $579 less per year than the cost for a male driver, while at age 19, the cost difference is less but females still cost $1,075 less per year.

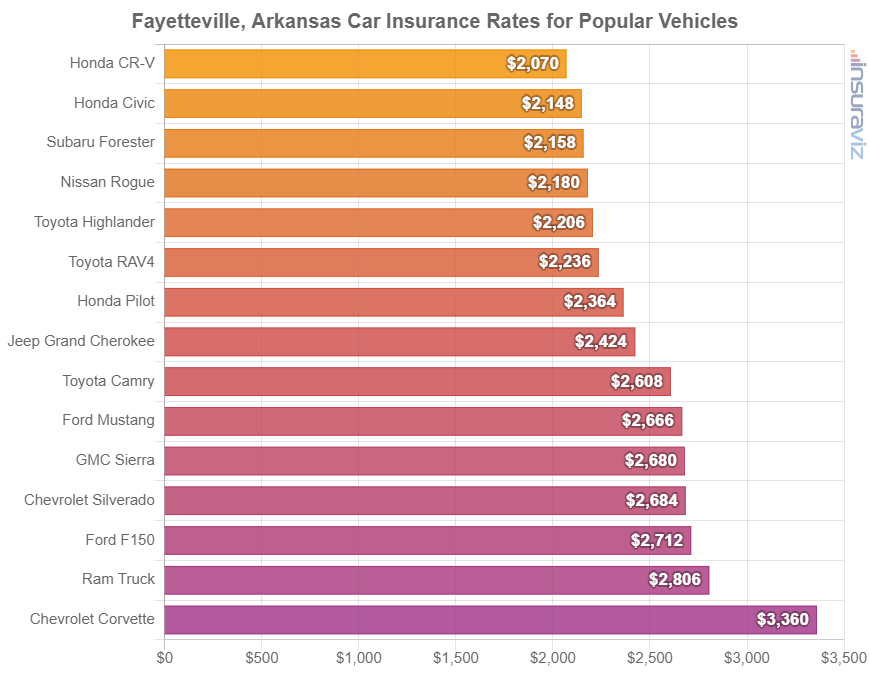

Insuring Fayetteville’s favorite cars, trucks, and SUVs

The previously discussed car insurance rates take all 2024 models and come up with an average cost, which is suitable for making overall comparisons like the difference in average auto insurance cost for two different locations in Arkansas. Average auto insurance rates are perfect when answering questions like “are car insurance rates in Fayetteville cheaper than in Springdale?” or “is Arkansas car insurance cheaper than Texas?”.

For more accurate auto insurance cost comparisons, however, the rates will be more accurate if we look at the specific make and model of vehicle being insured. Every make and model has different characteristics for calculating how much auto insurance costs and this data allows us to perform detailed insurance cost comparisons.

The next chart breaks down average car insurance cost in Fayetteville for the more popular vehicles. Later on, we’ll explore the ins-and-outs of insuring some of these models in more detail.

Which cars have cheap insurance in Fayetteville, Arkansas?

The models with the lowest cost average auto insurance quotes in Fayetteville, AR, tend to be small SUVs like the Subaru Crosstrek, Chevrolet Trailblazer, and Hyundai Venue. Average car insurance quotes for those crossover SUVs cost $167 or less per month to have full coverage.

Some other vehicles that have affordable car insurance rates in our car insurance cost comparison are the Acura RDX, Nissan Murano, Kia Niro, and Ford Bronco Sport.

The average insurance cost is somewhat higher for those models than the cheapest crossovers and small SUVs that rank near the top, but they still have an average insurance cost of $2,146 or less per year in Fayetteville.

The next table ranks the vehicles with the cheapest overall insurance rates in Fayetteville, ordered by cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,826 | $152 |

| 2 | Chevrolet Trailblazer | $1,856 | $155 |

| 3 | Kia Soul | $1,928 | $161 |

| 4 | Nissan Kicks | $1,944 | $162 |

| 5 | Honda Passport | $1,966 | $164 |

| 6 | Buick Envision | $1,980 | $165 |

| 7 | Toyota Corolla Cross | $1,992 | $166 |

| 8 | Hyundai Venue | $2,006 | $167 |

| 9 | Mazda CX-5 | $2,016 | $168 |

| 10 | Ford Bronco Sport | $2,022 | $169 |

| 11 | Volkswagen Tiguan | $2,046 | $171 |

| 12 | Acura RDX | $2,066 | $172 |

| 13 | Nissan Murano | $2,074 | $173 |

| 14 | Buick Encore | $2,098 | $175 |

| 15 | Honda CR-V | $2,104 | $175 |

| 16 | Subaru Outback | $2,106 | $176 |

| 17 | Buick Envista | $2,112 | $176 |

| 18 | Volkswagen Taos | $2,114 | $176 |

| 19 | Kia Niro | $2,126 | $177 |

| 20 | Toyota GR Corolla | $2,146 | $179 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Fayetteville, AR Zip Codes. Updated October 24, 2025

The above table containing 20 of the cheapest vehicles to insure in Fayetteville serves the purpose if you’re just looking for any vehicle with cheap insurance rates. Considering the fact that we rate over 700 vehicles, less than 3% of makes and models are shown in the table. So let’s dig deeper and show the models with the lowest rates in a more sensible format, by vehicle segment.

This next section further discusses the average cost of car insurance for each vehicle segment. The rates shown in the chart should provide a good idea of which types of cars, trucks, and SUVs that have the cheapest average auto insurance rates. Then the six subsequent sections rank the models with the most affordable auto insurance in each segment.

Fayetteville auto insurance rates by vehicle segment

When shopping for a new or used vehicle, it’s useful to know which kinds of vehicles have more affordable car insurance rates in Fayetteville. For example, you may be wondering if SUVs are more affordable to insure than minivans or if sports cars have cheaper insurance than luxury cars.

The chart below shows the average cost of car insurance rates in Fayetteville for different vehicle segments. From an overall average perspective, small and midsize SUVs, vans and minivans, and midsize pickup trucks have the most affordable average auto insurance rates, while sports cars and performance luxury models have the most expensive overall car insurance rates.

Average insurance rates by segment are fine for getting a ballpark comparison, but rates vary substantially within each vehicle segment shown in the chart above.

For example, in the small SUV segment, Fayetteville auto insurance rates range from the Subaru Crosstrek at $1,826 per year up to the Ford Mustang Mach-E at $2,888 per year.

For another example, in the large truck segment, the average cost of insurance ranges from the Nissan Titan at $2,310 per year to the Toyota Tundra at $2,940 per year, a difference of $630 within that segment.

In the next sections of the article, we eliminate much of the variability by analyzing the cost of car insurance in Fayetteville at a model level.

Cheapest car insurance rates in Fayetteville, Arkansas

The four most affordable non-luxury cars to insure in Fayetteville are the Toyota GR Corolla at $2,146 per year, Nissan Leaf at $2,162 per year, Honda Civic at $2,186 per year, and Nissan Sentra at $2,264 per year.

Other models that have affordable average insurance rates include the Toyota Corolla, Chevrolet Malibu, Toyota Prius, and Honda Accord, with an average car insurance cost of $2,404 per year or less.

From a monthly standpoint, auto insurance rates in this segment starts at around $179 per month, depending on where you live and the company you use.

The table below ranks the cars with the lowest-cost car insurance in Fayetteville, starting with the Toyota GR Corolla at $2,146 per year ($179 per month) and ending with the Mazda 3 at $2,552 per year ($213 per month).

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Toyota GR Corolla | Compact | $2,146 | $179 |

| Nissan Leaf | Compact | $2,162 | $180 |

| Honda Civic | Compact | $2,186 | $182 |

| Nissan Sentra | Compact | $2,264 | $189 |

| Subaru Impreza | Compact | $2,268 | $189 |

| Toyota Prius | Compact | $2,308 | $192 |

| Kia K5 | Midsize | $2,380 | $198 |

| Honda Accord | Midsize | $2,386 | $199 |

| Chevrolet Malibu | Midsize | $2,396 | $200 |

| Toyota Corolla | Compact | $2,404 | $200 |

| Kia Forte | Compact | $2,412 | $201 |

| Volkswagen Arteon | Midsize | $2,430 | $203 |

| Nissan Versa | Compact | $2,432 | $203 |

| Subaru Legacy | Midsize | $2,436 | $203 |

| Hyundai Ioniq 6 | Midsize | $2,456 | $205 |

| Mitsubishi Mirage G4 | Compact | $2,492 | $208 |

| Volkswagen Jetta | Compact | $2,498 | $208 |

| Toyota Crown | Midsize | $2,500 | $208 |

| Hyundai Sonata | Midsize | $2,502 | $209 |

| Mazda 3 | Compact | $2,552 | $213 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Fayetteville, AR Zip Codes. Updated October 24, 2025

See our comprehensive guides for compact car insurance, midsize car insurance, and full-size car insurance to view data for vehicles not featured in the table.

Don’t see rates for your vehicle? Enter your zip code at the bottom of the table and click the orange ‘GO’ button to get cheap Fayetteville car insurance quotes from top auto insurance companies in Arkansas.

Cheapest SUV insurance rates in Fayetteville

The four highest ranking SUVs with the lowest-cost average insurance rates in Fayetteville are the Subaru Crosstrek at $1,826 per year, Chevrolet Trailblazer at $1,856 per year, Kia Soul at $1,928 per year, and Nissan Kicks at $1,944 per year.

Not the cheapest in the list, but still ranking well, are models like the Toyota Corolla Cross, Hyundai Venue, Mazda CX-5, and Buick Envision, with an average cost of $2,022 per year or less.

Additional SUVs that rank well include the Buick Encore, Honda HR-V, Subaru Outback, Volkswagen Tiguan, and Subaru Ascent, which average between $2,022 and $2,150 per year for insurance.

Full-coverage insurance in this segment for a middle-age safe driver will start around $152 per month, depending on your location and insurance company. The comparison table below ranks the SUVs with the most affordable car insurance rates in Fayetteville, starting with the Subaru Crosstrek at $152 per month and ending with the Subaru Ascent at $179 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Subaru Crosstrek | Compact | $1,826 | $152 |

| Chevrolet Trailblazer | Compact | $1,856 | $155 |

| Kia Soul | Compact | $1,928 | $161 |

| Nissan Kicks | Compact | $1,944 | $162 |

| Honda Passport | Midsize | $1,966 | $164 |

| Buick Envision | Compact | $1,980 | $165 |

| Toyota Corolla Cross | Compact | $1,992 | $166 |

| Hyundai Venue | Compact | $2,006 | $167 |

| Mazda CX-5 | Compact | $2,016 | $168 |

| Ford Bronco Sport | Compact | $2,022 | $169 |

| Volkswagen Tiguan | Compact | $2,046 | $171 |

| Nissan Murano | Midsize | $2,074 | $173 |

| Buick Encore | Compact | $2,098 | $175 |

| Honda CR-V | Compact | $2,104 | $175 |

| Subaru Outback | Midsize | $2,106 | $176 |

| Buick Envista | Midsize | $2,112 | $176 |

| Volkswagen Taos | Compact | $2,114 | $176 |

| Kia Niro | Compact | $2,126 | $177 |

| Honda HR-V | Compact | $2,148 | $179 |

| Subaru Ascent | Midsize | $2,150 | $179 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Fayetteville, AR Zip Codes. Updated October 24, 2025

See our guides for compact SUV insurance, midsize SUV insurance, and full-size SUV insurance to view any vehicles not shown in the table.

Don’t see insurance rates for your SUV? Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free car insurance quotes from the best auto insurance companies in Arkansas.

Cheapest sports car insurance rates in Fayetteville

The lowest-cost sports cars to insure in Fayetteville are the Mazda MX-5 Miata at $2,284 per year, the Toyota GR86 at $2,602 per year, and the Ford Mustang at $2,714 per year.

Not the cheapest, but still in the top 10, are cars like the Subaru BRZ, Lexus RC F, Toyota GR Supra, and BMW M2, with an average cost to insure of $2,954 per year or less.

Ranking between positions 10 and 20, models like the Porsche 718, Chevrolet Camaro, Jaguar F-Type, Chevrolet Corvette, Porsche Taycan, and BMW M4 average between $2,954 and $4,182 to insure per year.

From a monthly standpoint, full-coverage auto insurance on this segment in Fayetteville for a good driver can cost as low as $190 per month, depending on where you live.

The table below ranks the sports cars with the cheapest average car insurance rates in Fayetteville, starting with the Mazda MX-5 Miata at $190 per month and ending with the Porsche Taycan at $349 per month.

| Make and Model | Vehicle Type | Annual Premium | Cost Per Month |

|---|---|---|---|

| Mazda MX-5 Miata | Sports Car | $2,284 | $190 |

| Toyota GR86 | Sports Car | $2,602 | $217 |

| Ford Mustang | Sports Car | $2,714 | $226 |

| BMW Z4 | Sports Car | $2,728 | $227 |

| Subaru WRX | Sports Car | $2,768 | $231 |

| Toyota GR Supra | Sports Car | $2,774 | $231 |

| BMW M2 | Sports Car | $2,854 | $238 |

| Nissan Z | Sports Car | $2,860 | $238 |

| Lexus RC F | Sports Car | $2,918 | $243 |

| Subaru BRZ | Sports Car | $2,954 | $246 |

| BMW M3 | Sports Car | $3,120 | $260 |

| Porsche 718 | Sports Car | $3,178 | $265 |

| Chevrolet Camaro | Sports Car | $3,208 | $267 |

| Chevrolet Corvette | Sports Car | $3,420 | $285 |

| Porsche 911 | Sports Car | $3,540 | $295 |

| BMW M4 | Sports Car | $3,684 | $307 |

| Lexus LC 500 | Sports Car | $3,706 | $309 |

| Jaguar F-Type | Sports Car | $3,896 | $325 |

| Mercedes-Benz AMG GT53 | Sports Car | $4,088 | $341 |

| Porsche Taycan | Sports Car | $4,182 | $349 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Fayetteville, AR Zip Codes. Updated October 24, 2025

Looking for rates for a different vehicle? No problem! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free car insurance quotes from the best companies in Fayetteville.

Cheapest pickup insurance rates in Fayetteville, AR

The Chevrolet Colorado ranks at #1 for the cheapest pickup truck to insure in Fayetteville, followed by the Nissan Titan, Nissan Frontier, Ford Ranger, and Ford Maverick. The 2024 model has an average cost of $2,174 per year for a full-coverage insurance policy.

Additional models that rank well are the GMC Sierra 2500 HD, GMC Canyon, Honda Ridgeline, and Toyota Tacoma, with average cost of $2,540 per year or less.

On a monthly basis, auto insurance in this segment for a safe driver starts at around $181 per month, depending on your location and insurance company. The comparison table below ranks the twenty pickups with the lowest-cost average auto insurance rates in Fayetteville, starting with the Chevrolet Colorado at $181 per month and ending with the Ram Truck at $238 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Chevrolet Colorado | Midsize | $2,174 | $181 |

| Nissan Titan | Full-size | $2,310 | $193 |

| Nissan Frontier | Midsize | $2,336 | $195 |

| Ford Ranger | Midsize | $2,360 | $197 |

| Ford Maverick | Midsize | $2,396 | $200 |

| Honda Ridgeline | Midsize | $2,450 | $204 |

| Hyundai Santa Cruz | Midsize | $2,492 | $208 |

| Toyota Tacoma | Midsize | $2,500 | $208 |

| GMC Sierra 2500 HD | Heavy Duty | $2,512 | $209 |

| GMC Canyon | Midsize | $2,540 | $212 |

| Jeep Gladiator | Midsize | $2,602 | $217 |

| GMC Sierra 3500 | Heavy Duty | $2,618 | $218 |

| Chevrolet Silverado HD 3500 | Heavy Duty | $2,640 | $220 |

| Chevrolet Silverado HD 2500 | Heavy Duty | $2,710 | $226 |

| GMC Sierra | Full-size | $2,726 | $227 |

| Nissan Titan XD | Heavy Duty | $2,730 | $228 |

| Chevrolet Silverado | Full-size | $2,732 | $228 |

| Ford F150 | Full-size | $2,762 | $230 |

| GMC Hummer EV Pickup | Full-size | $2,832 | $236 |

| Ram Truck | Full-size | $2,854 | $238 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Fayetteville, AR Zip Codes. Updated October 24, 2025

For more pickup insurance comparisons, see our guides for midsize pickup insurance and large pickup insurance.

Is your pickup truck not in the list? That’s no problem! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free car insurance quotes from top-rated auto insurance companies in Arkansas.

Cheapest luxury cars to insure in Fayetteville

Ranking highest for the cheapest Fayetteville auto insurance rates in the luxury car segment are the BMW 330i, Mercedes-Benz CLA250, Acura TLX, Lexus IS 300, and Acura Integra. Car insurance rates for these vehicles average $213 or less per month.

Also ranking well in our comparison are models like the Lexus ES 350, Cadillac CT4, Lexus RC 300, and Mercedes-Benz AMG CLA35, with an average cost to insure of $2,596 per year or less.

Additional vehicles that rank well include the Cadillac CT5, Lexus IS 350, Lexus ES 300h, BMW 228i, and Audi S3, which average between $2,596 and $2,770 per year for insurance in Fayetteville.

Full-coverage insurance in Fayetteville for this segment for a middle-age safe driver can cost as low as $183 per month, depending on your location. The table below ranks the twenty cars with the cheapest car insurance in Fayetteville, starting with the Acura Integra at $183 per month and ending with the Audi S3 at $231 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura Integra | Compact | $2,194 | $183 |

| BMW 330i | Compact | $2,514 | $210 |

| Mercedes-Benz CLA250 | Midsize | $2,540 | $212 |

| Lexus IS 300 | Midsize | $2,546 | $212 |

| Acura TLX | Compact | $2,554 | $213 |

| Cadillac CT4 | Compact | $2,578 | $215 |

| Lexus ES 350 | Midsize | $2,578 | $215 |

| Genesis G70 | Compact | $2,584 | $215 |

| Mercedes-Benz AMG CLA35 | Midsize | $2,590 | $216 |

| Lexus RC 300 | Midsize | $2,596 | $216 |

| Lexus IS 350 | Compact | $2,606 | $217 |

| Jaguar XF | Midsize | $2,612 | $218 |

| Cadillac CT5 | Midsize | $2,660 | $222 |

| Lexus ES 250 | Midsize | $2,672 | $223 |

| Lexus RC 350 | Compact | $2,678 | $223 |

| BMW 330e | Compact | $2,682 | $224 |

| BMW 228i | Compact | $2,686 | $224 |

| BMW 230i | Compact | $2,706 | $226 |

| Lexus ES 300h | Midsize | $2,712 | $226 |

| Audi S3 | Compact | $2,770 | $231 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Fayetteville, AR Zip Codes. Updated October 24, 2025

See our guide for luxury car insurance to compare rates for all makes and models.

Looking for rates for a different vehicle? That’s no problem! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get cheap Fayetteville car insurance quotes from top-rated auto insurance companies in Arkansas.

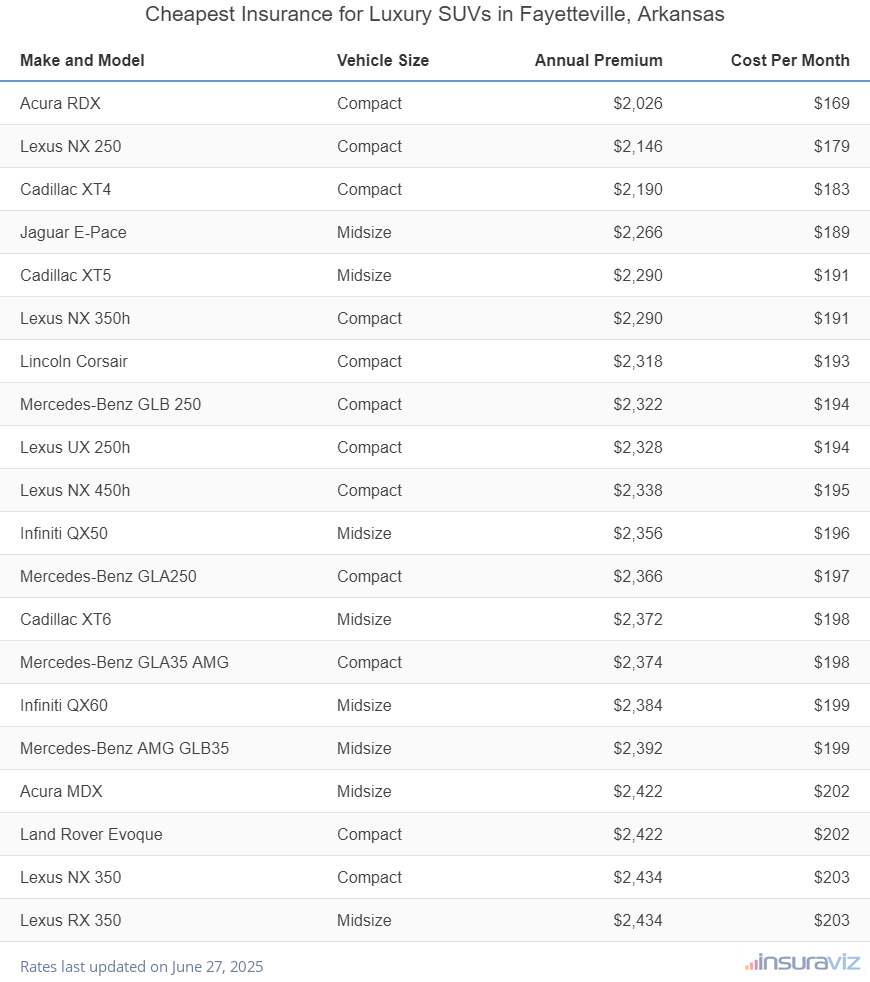

Cheapest luxury SUV insurance rates in Fayetteville, AR

The three top-ranked luxury SUVs with the lowest-cost auto insurance rates in Fayetteville are the Acura RDX at $2,066 per year, the Lexus NX 250 at $2,186 per year, and the Cadillac XT4 at $2,230 per year.

Not the cheapest, but still very affordable, are luxury SUVs like the Lexus UX 250h, Lexus NX 450h, Lexus NX 350h, and Lincoln Corsair, with average insurance cost of $2,384 per year or less.

Ranking between positions 10 and 20, models like the Land Rover Evoque, Mercedes-Benz GLA250, Infiniti QX50, Lexus RX 350, Mercedes-Benz GLA35 AMG, and Mercedes-Benz AMG GLB35 average between $2,384 and $2,480 per year to insure in Fayetteville.

From a cost per month standpoint, car insurance rates on this segment in Fayetteville for a safe driver starts at an average of $172 per month, depending on where you live and the company you use.

The next table ranks the luxury SUVs with the cheapest average insurance rates in Fayetteville.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura RDX | Compact | $2,066 | $172 |

| Lexus NX 250 | Compact | $2,186 | $182 |

| Cadillac XT4 | Compact | $2,230 | $186 |

| Jaguar E-Pace | Midsize | $2,310 | $193 |

| Cadillac XT5 | Midsize | $2,330 | $194 |

| Lexus NX 350h | Compact | $2,330 | $194 |

| Lincoln Corsair | Compact | $2,358 | $197 |

| Mercedes-Benz GLB 250 | Compact | $2,362 | $197 |

| Lexus UX 250h | Compact | $2,368 | $197 |

| Lexus NX 450h | Compact | $2,384 | $199 |

| Infiniti QX50 | Midsize | $2,402 | $200 |

| Mercedes-Benz GLA250 | Compact | $2,408 | $201 |

| Mercedes-Benz GLA35 AMG | Compact | $2,416 | $201 |

| Cadillac XT6 | Midsize | $2,418 | $202 |

| Infiniti QX60 | Midsize | $2,430 | $203 |

| Mercedes-Benz AMG GLB35 | Midsize | $2,434 | $203 |

| Land Rover Evoque | Compact | $2,464 | $205 |

| Acura MDX | Midsize | $2,468 | $206 |

| Lexus NX 350 | Compact | $2,476 | $206 |

| Lexus RX 350 | Midsize | $2,480 | $207 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Fayetteville, AR Zip Codes. Updated October 24, 2025

See our comprehensive guide for luxury SUV insurance to view data for vehicles not featured in the table.

Don’t see insurance rates for your luxury SUV? Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get cheap Fayetteville car insurance quotes from top-rated auto insurance companies in Arkansas.

How to find cheaper auto insurance

Resourceful drivers in Fayetteville are often looking to reduce the monthly expense for car insurance, so take a minute to review the savings tips in the list below to see if you can save a little dough on your next auto insurance policy.

- Your employer could save you money. Many insurance companies offer discounts for specific occupations like high school and elementary teachers, emergency medical technicians, architects, firefighters, accountants, engineers, and others. By qualifying for an occupational discount, you may save between $74 and $240 on your auto insurance bill, subject to policy limits.

- Bring up your credit score to save money. Having an excellent credit rating above 800 may save up to $388 per year compared to a good credit rating of 670-739. Conversely, an imperfect credit score below 579 could cost as much as $450 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Pay small claims out-of-pocket. Most auto insurance companies reduce rates a little if you do not file any claims. Auto insurance should only be used to protect you from large financial hits, not small claims that can be paid out-of-pocket.

- Shop around and save. Setting aside 5-10 minutes to get a few free car insurance quotes is the best way to save money. Rates change often and you can switch companies very easily.

- Driving citations can increase insurance cost. In order to get affordable auto insurance in Fayetteville, it’s necessary to obey traffic laws. A few minor blemishes on your driving record can potentially raise rates by at least $658 per year. Serious violations such as DWI and leaving the scene of an accident could raise rates by an additional $2,294 or more.

- Remove optional coverage on older vehicles. Dropping comprehensive and collision coverage from vehicles whose low value makes coverage cost prohibitive can cheapen the cost substantially.