- Average car insurance cost in Peoria is $2,180 per year, or about $182 per month for full coverage.

- Auto insurance in Peoria costs an average of $124 per year less than the Illinois state average but $96 per year less than the average rate for all 50 states.

- For cheap car insurance in Peoria, some of the vehicles with the best rates in their segments are the Acura RDX ($1,824 per year), Toyota GR Corolla ($1,894 per year), Acura Integra ($1,936 per year), and Subaru Crosstrek ($1,612 per year).

How much does Peoria car insurance cost?

Peoria car insurance costs an average of $2,180 per year, which is 4.3% less than the overall U.S. national average rate of $2,276. Average car insurance cost per month in Peoria is right around $182 for full coverage.

In the state of Illinois, the average cost to insure a vehicle is $2,304 per year, so the cost in Peoria averages $124 less per year.

When prices are compared to other cities in Illinois, the cost of car insurance in Peoria is about $14 per year more than in Naperville, $50 per year cheaper than in Rockford, and $412 per year less than in Chicago.

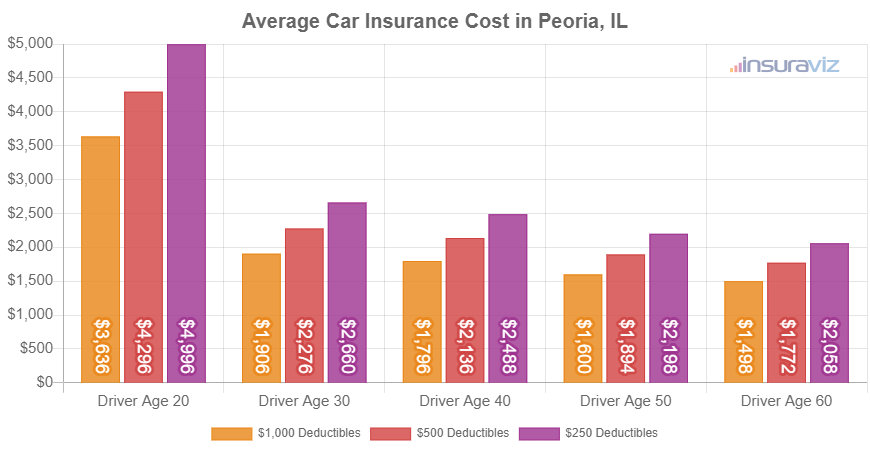

The chart below shows average Peoria, Illinois, car insurance cost for all 2024 models. Rates are averaged for all Peoria Zip Codes and shown not only by driver age, but also by physical damage deductibles.

The average cost of car insurance per month in Peoria is $182, and ranges from $127 to $425 for the data in the prior chart.

Peoria car insurance rates can vary considerably and can also be significantly different between companies. Since there can be such a large difference in rates, it stresses the need to get multiple auto insurance quotes when shopping online for the cheapest auto insurance policy.

Driver age is the factor that has the most impact on the price you pay for auto insurance. The list below illustrates this by showing average car insurance rates for driver ages 16 through 60.

Peoria, Illinois, car insurance cost by driver age

- 16-year-old rated driver – $7,759 per year or $647 per month

- 17-year-old rated driver – $7,516 per year or $626 per month

- 18-year-old rated driver – $6,737 per year or $561 per month

- 19-year-old rated driver – $6,136 per year or $511 per month

- 20-year-old rated driver – $4,382 per year or $365 per month

- 30-year-old rated driver – $2,324 per year or $194 per month

- 40-year-old rated driver – $2,180 per year or $182 per month

- 50-year-old rated driver – $1,930 per year or $161 per month

- 60-year-old rated driver – $1,808 per year or $151 per month

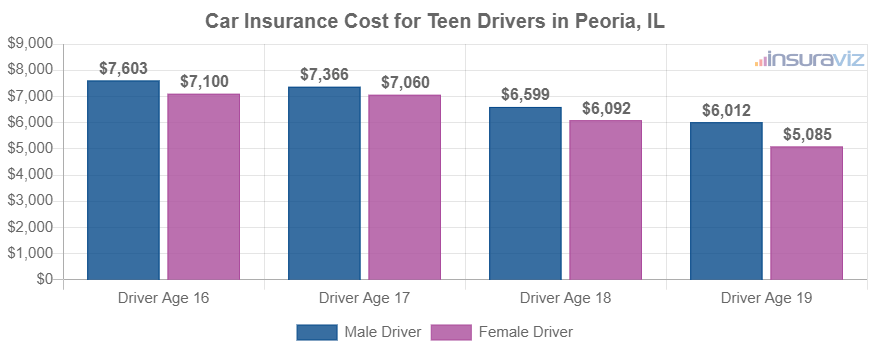

The rates above for average cost of car insurance for teen drivers were based on the rated driver being male. The next chart breaks out average car insurance cost for teenagers in Peoria, IL, by gender. Females are generally slightly cheaper to insure than males, notably at younger ages.

Car insurance for a 16-year-old female in Peoria costs an average of $512 less than a male driver per year, while at age 19, the cost is still $948 less for a female driver.

Popular models and the cost of insurance

The prior rates are averaged for every 2024 model year vehicle, which is practical for making general comparisons such as between locations or by driver risk profile. Average auto insurance rates are fantastic when trying to find the answer to questions like “are Peoria car insurance rates cheaper than in Joliet?” or “is car insurance cheaper in Illinois or Arizona?”.

But for more in-depth price comparisons, we will get better data if we do a rate analysis for the specific model of vehicle being insured. Every make and model has it’s own unique characteristics for physical damage and liability claims, and this data enables us to make more detailed insurance cost analysis.

The list below displays average annual and monthly car insurance cost in Peoria for a small sample of popular cars, pickups, and SUVs. Towards the end of this article, we will examine insurance cost for some of these models in more detail.

Auto insurance cost for popular vehicles in Peoria

- Chevrolet Equinox – $2,150 per year ($179 per month)

- Hyundai Elantra – $2,535 per year ($211 per month)

- Tesla Model 3 – $2,747 per year ($229 per month)

- Subaru Outback – $1,995 per year ($166 per month)

- Ram Truck – $2,701 per year ($225 per month)

- Ford Escape – $2,131 per year ($178 per month)

- Toyota RAV4 – $2,157 per year ($180 per month)

- Ford F150 – $2,616 per year ($218 per month)

- Toyota Camry – $2,513 per year ($209 per month)

- Honda Accord – $2,260 per year ($188 per month)

The models that have high popularity in Peoria tend to be small or midsize sedans like the Nissan Sentra and Honda Accord and compact or midsize SUVs like the Honda CR-V, Toyota RAV4, and Jeep Grand Cherokee.

A few additional popular models from other segments include luxury cars like the Acura ILX, BMW 530i, and Tesla Model S, luxury SUVs like the Lexus RX 350, Acura MDX, and Cadillac XT5, and pickup trucks like the Ford F-150, Toyota Tacoma, and Chevy Silverado.

We will explore additional rates in the upcoming sections, but before we delve that deep, let’s make a quick review of the primary concepts covered so far in the article.

- Average car insurance cost per month ranges from $151 to $647 – That’s the average car insurance price range for drivers age 16 to 60 in Peoria, IL.

- Peoria, IL, car insurance costs less than the U.S. average – $2,180 (Peoria average) versus $2,276 (U.S. average)

- A low deductible policy costs more – A 20-year-old driver pays an average of $1,168 more per year for $250 deductibles compared to $1,000 deductibles.

- Auto insurance rates decline significantly in your twenties – The average 30-year-old Peoria driver will pay $2,058 less per year than a 20-year-old driver, $2,324 compared to $4,382.

- Car insurance is generally cheaper as you get older – Average rates for a 60-year-old driver in Peoria are $2,574 per year cheaper than for a 20-year-old driver.

- Teenage girls pay lower rates than teenage males – Teenage female drivers pay $948 to $512 less each year than male drivers of the same age.

What are the cheapest auto insurance rates in Peoria?

When comparing rates for all vehicles, the models with the lowest cost average car insurance quotes in Peoria, IL, tend to be crossovers and compact SUVs like the Chevrolet Trailblazer, Subaru Crosstrek, and Hyundai Venue. Average auto insurance quotes for those models cost $158 or less per month for a full coverage policy.

Some other vehicles that rank very well in our insurance cost comparison are the Ford Bronco Sport, Volkswagen Tiguan, Subaru Outback, and Nissan Murano.

The average cost is somewhat higher for those models than the cheapest small SUVs and crossovers at the top of the rankings, but they still have an average insurance cost of $169 or less per month in Peoria.

The next table breaks down the 20 cars, trucks, and SUVs with the cheapest insurance rates in Peoria, ordered starting with the cheapest.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,612 | $134 |

| 2 | Chevrolet Trailblazer | $1,636 | $136 |

| 3 | Kia Soul | $1,700 | $142 |

| 4 | Nissan Kicks | $1,716 | $143 |

| 5 | Honda Passport | $1,736 | $145 |

| 6 | Buick Envision | $1,748 | $146 |

| 7 | Toyota Corolla Cross | $1,756 | $146 |

| 8 | Hyundai Venue | $1,770 | $148 |

| 9 | Mazda CX-5 | $1,780 | $148 |

| 10 | Ford Bronco Sport | $1,782 | $149 |

| 11 | Volkswagen Tiguan | $1,804 | $150 |

| 12 | Acura RDX | $1,824 | $152 |

| 13 | Nissan Murano | $1,828 | $152 |

| 14 | Buick Encore | $1,850 | $154 |

| 15 | Honda CR-V | $1,856 | $155 |

| 16 | Subaru Outback | $1,858 | $155 |

| 17 | Buick Envista | $1,864 | $155 |

| 18 | Volkswagen Taos | $1,866 | $156 |

| 19 | Kia Niro | $1,874 | $156 |

| 20 | Toyota GR Corolla | $1,894 | $158 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Peoria, IL Zip Codes. Updated October 24, 2025

A table showing 20 vehicle rankings is fine if you just want a vehicle with dirt cheap insurance rates. But considering we track over 700 vehicles, there is a lot of rate data no being shown. Let’s take a different approach and break out the most affordable vehicles an alternative way, by vehicle segment.

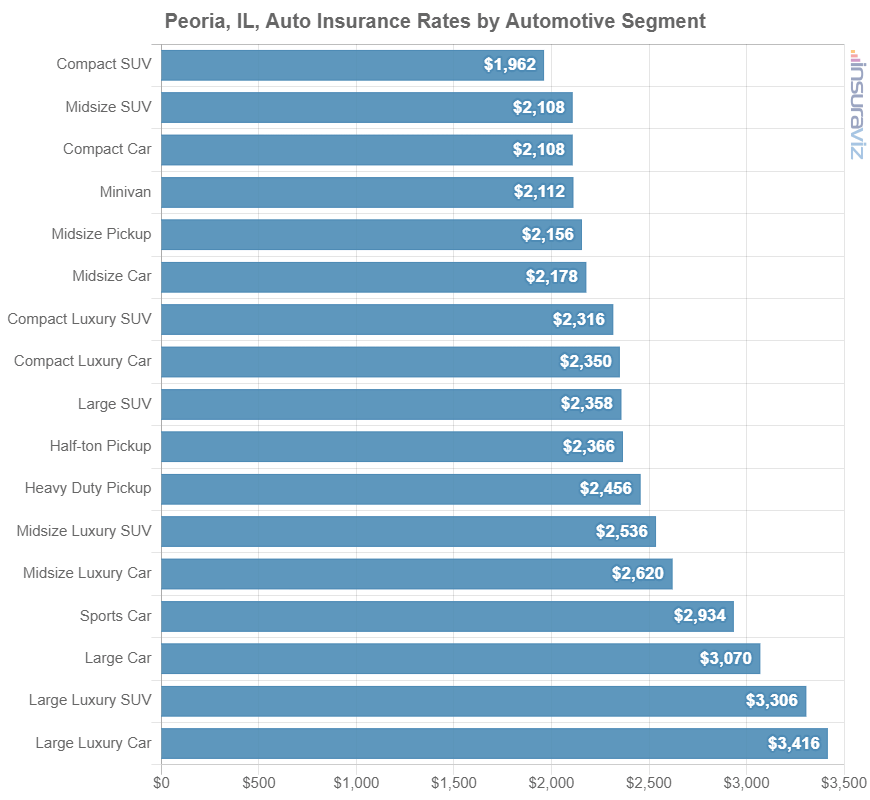

The section below details average car insurance cost by vehicle segment. The rates shown should give a good understanding of which segments have the overall best rates. If you read beyond the chart, the next six sections break out and rank the top 20 cheapest models in the more popular segments.

Cost of insurance by automotive segment

If you’re shopping for a new or used vehicle, it’s a good idea to know which categories of vehicles have more favorable car insurance rates.

To illustrate this, many people wonder if compact cars have cheaper auto insurance than midsize cars or if midsize pickups are cheaper to insure than full-size pickups.

The next chart shows average car insurance cost by vehicle segment in Peoria. As a general rule, compact SUVs, vans, and midsize pickups have the least expensive rates, with luxury and performance models having the highest average insurance cost.

Rates by automotive segment are suitable for getting a ballpark comparison, but rates range substantially within each vehicle segment listed above.

For example, in the small car segment, average Peoria insurance rates range from the Toyota GR Corolla costing $1,894 per year for a full coverage policy to the Toyota Mirai costing $2,712 per year, a difference of $818 within that segment.

For another example, in the midsize truck segment, average rates range from the Chevrolet Colorado at $1,920 per year up to the Rivian R1T costing $2,718 per year, a difference of $798 within that segment.

In the following sections, we reduce this variability by comparing the cost of car insurance in Peoria for specific cars, trucks, and SUVs.

Cheapest car insurance rates in Peoria, IL

The top three non-luxury cars with the most affordable auto insurance in Peoria are the Toyota GR Corolla at $1,894 per year, the Nissan Leaf at $1,908 per year, and the Honda Civic at $1,928 per year.

Not the cheapest in the list, but still ranking well, are cars like the Toyota Corolla, Kia K5, Chevrolet Malibu, and Toyota Prius, with an average car insurance cost of $2,124 per year or less.

Ranked in the bottom half of the top 20 cheapest cars to insure, models like the Volkswagen Jetta, Hyundai Sonata, Hyundai Ioniq 6, Mazda 3, and Nissan Versa average between $2,124 and $2,252 per year for insurance in Peoria.

From a cost per month standpoint, car insurance on the non-luxury car segment starts at around $158 per month, depending on your Zip Code.

When vehicle size is factored in, the most budget-friendly non-luxury compact car to insure in Peoria is the Toyota GR Corolla at $1,894 per year, or $158 per month. For midsize models, the Kia K5 has the best rates at $2,100 per year, or $175 per month. And for full-size sedans, the Chrysler 300 has the cheapest car insurance rates at $2,074 per year, or $173 per month.

The comparison table below ranks the cars with the cheapest car insurance rates in Peoria.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Toyota GR Corolla | Compact | $1,894 | $158 |

| Nissan Leaf | Compact | $1,908 | $159 |

| Honda Civic | Compact | $1,928 | $161 |

| Nissan Sentra | Compact | $1,996 | $166 |

| Subaru Impreza | Compact | $2,002 | $167 |

| Toyota Prius | Compact | $2,036 | $170 |

| Kia K5 | Midsize | $2,100 | $175 |

| Honda Accord | Midsize | $2,106 | $176 |

| Chevrolet Malibu | Midsize | $2,112 | $176 |

| Toyota Corolla | Compact | $2,124 | $177 |

| Kia Forte | Compact | $2,128 | $177 |

| Volkswagen Arteon | Midsize | $2,144 | $179 |

| Nissan Versa | Compact | $2,148 | $179 |

| Subaru Legacy | Midsize | $2,150 | $179 |

| Hyundai Ioniq 6 | Midsize | $2,166 | $181 |

| Mitsubishi Mirage G4 | Compact | $2,200 | $183 |

| Toyota Crown | Midsize | $2,204 | $184 |

| Volkswagen Jetta | Compact | $2,204 | $184 |

| Hyundai Sonata | Midsize | $2,208 | $184 |

| Mazda 3 | Compact | $2,252 | $188 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Peoria, IL Zip Codes. Updated October 24, 2025

The most popular car models in Peoria aren’t guaranteed to have the lowest-cost rates. Some of the more popular models that have car insurance rates higher than the top 20 include the Tesla Model 3 at $2,556 per year ($213 per month), the Toyota Avalon at $2,196 ($183 per month), and the Nissan Maxima costing $2,442 ($204 per month).

See our guides for compact car insurance, midsize car insurance, and full-size car insurance to view any vehicles not shown in the table.

Don’t see your car in the list? That’s no problem! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free car insurance quotes from the best companies in Illinois.

Which SUVs have the cheapest insurance in Peoria, IL?

Sitting at number one in Peoria for cheapest average insurance rates in the SUV segment is the Subaru Crosstrek, coming in at $1,612 per year. Second place is the Chevrolet Trailblazer costing $1,636 per year, and the third cheapest is the Kia Soul, at an average of $1,700 per year.

Other models that rank well in our comparison are the Toyota Corolla Cross, Buick Envision, Mazda CX-5, and Ford Bronco Sport, with an average car insurance cost of $1,782 per year or less.

Ranked in the lower half of the top 20, models like the Buick Envista, Subaru Outback, Nissan Murano, Kia Niro, and Buick Encore cost between $1,782 and $1,896 per year for full-coverage insurance.

On a monthly basis, auto insurance in Peoria on this segment for a middle-age safe driver will start around $134 per month, depending on your exact address and insurer.

The rate comparison table below ranks the SUVs with the most affordable insurance rates in Peoria, starting with the Subaru Crosstrek at $1,612 per year ($134 per month) and ending with the Subaru Ascent at $1,896 per year ($158 per month).

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Subaru Crosstrek | Compact | $1,612 | $134 |

| Chevrolet Trailblazer | Compact | $1,636 | $136 |

| Kia Soul | Compact | $1,700 | $142 |

| Nissan Kicks | Compact | $1,716 | $143 |

| Honda Passport | Midsize | $1,736 | $145 |

| Buick Envision | Compact | $1,748 | $146 |

| Toyota Corolla Cross | Compact | $1,756 | $146 |

| Hyundai Venue | Compact | $1,770 | $148 |

| Mazda CX-5 | Compact | $1,780 | $148 |

| Ford Bronco Sport | Compact | $1,782 | $149 |

| Volkswagen Tiguan | Compact | $1,804 | $150 |

| Nissan Murano | Midsize | $1,828 | $152 |

| Buick Encore | Compact | $1,850 | $154 |

| Honda CR-V | Compact | $1,856 | $155 |

| Subaru Outback | Midsize | $1,858 | $155 |

| Buick Envista | Midsize | $1,864 | $155 |

| Volkswagen Taos | Compact | $1,866 | $156 |

| Kia Niro | Compact | $1,874 | $156 |

| Honda HR-V | Compact | $1,896 | $158 |

| Subaru Ascent | Midsize | $1,896 | $158 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Peoria, IL Zip Codes. Updated October 24, 2025

The top-selling SUVs in Peoria often have pricier car insurance rates. For example, a few popular SUV models that did not rank in the top 20 include the Ford Escape at an average of $1,988 per year ($166 per month), the Subaru Outback costing an average of $1,858 ($155 per month), and the Chevrolet Traverse costing $2,034 ($170 per month).

See our comprehensive guides for compact SUV insurance, midsize SUV insurance, and full-size SUV insurance to view data for vehicles not featured in the table.

Don’t see your SUV in the list? No sweat! Enter your zip code at the bottom of the table and click the orange ‘GO’ button to get cheap Peoria car insurance quotes from the best companies in Illinois.

Most affordable luxury cars to insure in Peoria

The top-ranked vehicle in Peoria for the lowest-cost insurance in the luxury sedan segment is the Acura Integra, at $1,936 per year. Second place is the BMW 330i costing $2,218 per year, and the third cheapest is the Mercedes-Benz CLA250, at an average of $2,240 per year.

Other models that rank well in our comparison are the Cadillac CT4, Lexus ES 350, Mercedes-Benz AMG CLA35, and Lexus RC 300, with an average cost of $2,290 per year or less.

From a cost per month standpoint, car insurance on this segment for a good driver can cost as low as $161 per month, depending on the company and your address.

The most budget-friendly compact luxury car to insure in Peoria is the Acura Integra at $1,936 per year. For midsize luxury cars, the Mercedes-Benz CLA250 has the best rates at $2,240 per year. And for full-size models, the Audi A5 is cheapest to insure at $2,590 per year.

The table below ranks the twenty luxury cars with the lowest-cost average car insurance rates in Peoria.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura Integra | Compact | $1,936 | $161 |

| BMW 330i | Compact | $2,218 | $185 |

| Mercedes-Benz CLA250 | Midsize | $2,240 | $187 |

| Lexus IS 300 | Midsize | $2,246 | $187 |

| Acura TLX | Compact | $2,252 | $188 |

| Lexus ES 350 | Midsize | $2,272 | $189 |

| Cadillac CT4 | Compact | $2,274 | $190 |

| Genesis G70 | Compact | $2,280 | $190 |

| Mercedes-Benz AMG CLA35 | Midsize | $2,284 | $190 |

| Lexus RC 300 | Midsize | $2,290 | $191 |

| Lexus IS 350 | Compact | $2,298 | $192 |

| Jaguar XF | Midsize | $2,304 | $192 |

| Cadillac CT5 | Midsize | $2,348 | $196 |

| Lexus ES 250 | Midsize | $2,354 | $196 |

| Lexus RC 350 | Compact | $2,362 | $197 |

| BMW 330e | Compact | $2,366 | $197 |

| BMW 228i | Compact | $2,370 | $198 |

| BMW 230i | Compact | $2,388 | $199 |

| Lexus ES 300h | Midsize | $2,392 | $199 |

| Audi S3 | Compact | $2,440 | $203 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Peoria, IL Zip Codes. Updated October 24, 2025

See our guide for luxury car insurance to view any vehicles not shown in the table.

Don’t see your luxury car? No problem! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free Peoria car insurance quotes from top-rated auto insurance companies in Illinois.

Cheapest luxury SUV insurance rates

The top four luxury SUVs with the lowest-cost car insurance in Peoria are the Acura RDX at $1,824 per year, Lexus NX 250 at $1,932 per year, Cadillac XT4 at $1,966 per year, and Jaguar E-Pace at $2,038 per year.

Not the cheapest luxury SUVs to insure, but still affordable, are SUVs like the Lexus NX 450h, Lexus UX 250h, Mercedes-Benz GLB 250, and Lexus NX 350h, with an average cost of $2,102 per year or less.

On a monthly basis, full-coverage insurance on luxury SUV models can cost as low as $152 per month, depending on your Zip Code.

The comparison table below ranks the twenty SUVs with the cheapest auto insurance rates in Peoria, starting with the Acura RDX at $1,824 per year ($152 per month) and ending with the Lexus RX 350 at $2,190 per year ($183 per month).

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura RDX | Compact | $1,824 | $152 |

| Lexus NX 250 | Compact | $1,932 | $161 |

| Cadillac XT4 | Compact | $1,966 | $164 |

| Jaguar E-Pace | Midsize | $2,038 | $170 |

| Cadillac XT5 | Midsize | $2,054 | $171 |

| Lexus NX 350h | Compact | $2,054 | $171 |

| Lincoln Corsair | Compact | $2,080 | $173 |

| Mercedes-Benz GLB 250 | Compact | $2,084 | $174 |

| Lexus UX 250h | Compact | $2,088 | $174 |

| Lexus NX 450h | Compact | $2,102 | $175 |

| Infiniti QX50 | Midsize | $2,118 | $177 |

| Mercedes-Benz GLA250 | Compact | $2,122 | $177 |

| Mercedes-Benz GLA35 AMG | Compact | $2,130 | $178 |

| Cadillac XT6 | Midsize | $2,132 | $178 |

| Infiniti QX60 | Midsize | $2,144 | $179 |

| Mercedes-Benz AMG GLB35 | Midsize | $2,144 | $179 |

| Land Rover Evoque | Compact | $2,172 | $181 |

| Acura MDX | Midsize | $2,180 | $182 |

| Lexus NX 350 | Compact | $2,184 | $182 |

| Lexus RX 350 | Midsize | $2,190 | $183 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Peoria, IL Zip Codes. Updated October 24, 2025

For more car insurance comparisons, see our guide for luxury SUV insurance.

Looking for rates for a different model? Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free Peoria car insurance quotes from the best auto insurance companies in Illinois.

Sports car insurance rates

The Mazda MX-5 Miata ranks at #1 for the cheapest sports car to insure in Peoria, followed by the Toyota GR86, Ford Mustang, BMW Z4, and Subaru WRX. The 2024 model has an average cost of $2,016 per year for full-coverage auto insurance.

Not the cheapest, but still very affordable, are cars like the Nissan Z, Toyota GR Supra, Lexus RC F, and Subaru BRZ, with average cost of $2,606 per year or less.

Auto insurance in this segment for a good driver starts at an average of $168 per month, depending on the company.

The comparison table below ranks the twenty sports cars with the cheapest average insurance rates in Peoria.

| Make and Model | Vehicle Type | Annual Premium | Cost Per Month |

|---|---|---|---|

| Mazda MX-5 Miata | Sports Car | $2,016 | $168 |

| Toyota GR86 | Sports Car | $2,294 | $191 |

| Ford Mustang | Sports Car | $2,394 | $200 |

| BMW Z4 | Sports Car | $2,408 | $201 |

| Subaru WRX | Sports Car | $2,444 | $204 |

| Toyota GR Supra | Sports Car | $2,446 | $204 |

| BMW M2 | Sports Car | $2,518 | $210 |

| Nissan Z | Sports Car | $2,524 | $210 |

| Lexus RC F | Sports Car | $2,574 | $215 |

| Subaru BRZ | Sports Car | $2,606 | $217 |

| BMW M3 | Sports Car | $2,752 | $229 |

| Porsche 718 | Sports Car | $2,806 | $234 |

| Chevrolet Camaro | Sports Car | $2,832 | $236 |

| Chevrolet Corvette | Sports Car | $3,016 | $251 |

| Porsche 911 | Sports Car | $3,122 | $260 |

| BMW M4 | Sports Car | $3,252 | $271 |

| Lexus LC 500 | Sports Car | $3,270 | $273 |

| Jaguar F-Type | Sports Car | $3,438 | $287 |

| Mercedes-Benz AMG GT53 | Sports Car | $3,606 | $301 |

| Porsche Taycan | Sports Car | $3,690 | $308 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Peoria, IL Zip Codes. Updated October 24, 2025

Looking for rates for a different vehicle? That’s no problem! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free car insurance quotes from top-rated auto insurance companies in Illinois.

Which pickups are cheap to insure in Peoria?

The Chevrolet Colorado ranks #1 as the cheapest pickup truck to insure in Peoria, followed by the Nissan Titan, Nissan Frontier, Ford Ranger, and Ford Maverick. The 2024 model has an average cost of $1,920 per year to insure for full coverage.

Additional pickups that have affordable insurance rates are the Toyota Tacoma, Honda Ridgeline, Hyundai Santa Cruz, and GMC Sierra 2500 HD, with average rates of $2,242 per year or less.

Auto insurance in this vehicle segment starts at around $160 per month, depending on your location and insurance company.

The next table ranks the twenty pickups with the cheapest car insurance in Peoria, starting with the Chevrolet Colorado at $1,920 per year and ending with the Ram Truck at $2,518 per year.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Chevrolet Colorado | Midsize | $1,920 | $160 |

| Nissan Titan | Full-size | $2,036 | $170 |

| Nissan Frontier | Midsize | $2,060 | $172 |

| Ford Ranger | Midsize | $2,082 | $174 |

| Ford Maverick | Midsize | $2,114 | $176 |

| Honda Ridgeline | Midsize | $2,162 | $180 |

| Hyundai Santa Cruz | Midsize | $2,198 | $183 |

| Toyota Tacoma | Midsize | $2,206 | $184 |

| GMC Sierra 2500 HD | Heavy Duty | $2,218 | $185 |

| GMC Canyon | Midsize | $2,242 | $187 |

| Jeep Gladiator | Midsize | $2,294 | $191 |

| GMC Sierra 3500 | Heavy Duty | $2,308 | $192 |

| Chevrolet Silverado HD 3500 | Heavy Duty | $2,328 | $194 |

| Chevrolet Silverado HD 2500 | Heavy Duty | $2,392 | $199 |

| GMC Sierra | Full-size | $2,406 | $201 |

| Nissan Titan XD | Heavy Duty | $2,408 | $201 |

| Chevrolet Silverado | Full-size | $2,410 | $201 |

| Ford F150 | Full-size | $2,438 | $203 |

| GMC Hummer EV Pickup | Full-size | $2,500 | $208 |

| Ram Truck | Full-size | $2,518 | $210 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Peoria, IL Zip Codes. Updated October 24, 2025

See our comprehensive guides for midsize pickup insurance and large pickup insurance to view data for pickups not featured in the table.

Looking for insurance rates for a different truck? That’s no problem! Enter your zip code at the bottom of the table and click the orange ‘GO’ button to get cheap Peoria car insurance quotes from top auto insurance companies in Illinois.

Peoria car insurance price variability

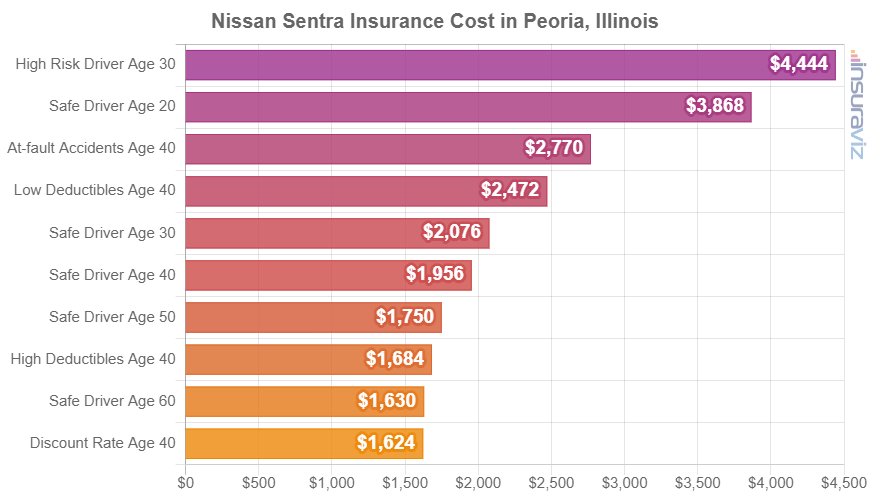

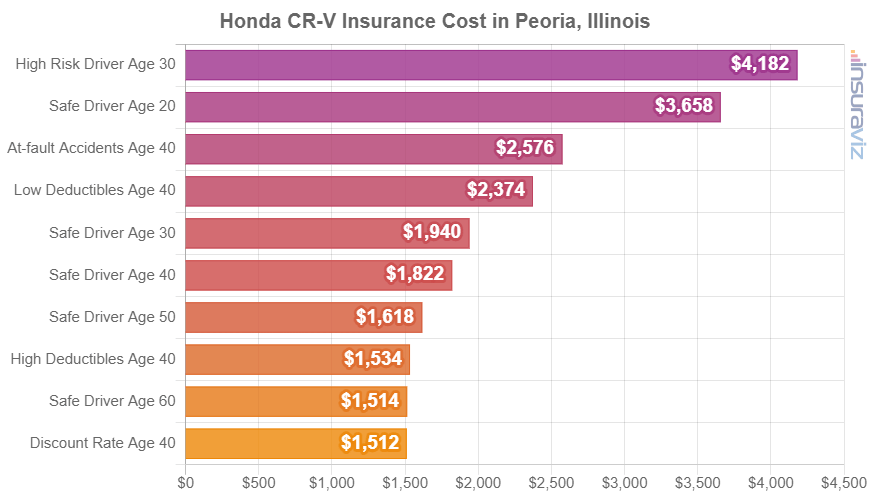

In an effort to clarify the extent to which car insurance cost can vary from one person to the next (and also reiterate the importance of getting lots of rate quotes), the charts below have detailed auto insurance rates for three popular vehicles in Peoria: the Chevrolet Silverado, Nissan Sentra, and Honda CR-V.

Each example uses different risk profiles to demonstrate the potential rate difference based on driver and coverage changes.

Chevrolet Silverado insurance rates

Chevrolet Silverado insurance in Peoria averages $2,410 per year (about $201 per month) and varies from $1,998 to $5,592 annually.

The Chevrolet Silverado is classified as a full-size truck, and additional similar models from the same segment include the Ram Truck, Ford F150, Nissan Titan, and GMC Sierra.

Nissan Sentra insurance rates

Insurance for a Nissan Sentra in Peoria averages $1,996 per year, or about $166 per month, and ranges from $1,658 to $4,534.

The Nissan Sentra is a compact car, and other models in the same segment include the Volkswagen Jetta, Honda Civic, and Chevrolet Cruze.

Honda CR-V insurance rates

Auto insurance for a Honda CR-V in Peoria costs an average of $1,856 per year ($155 per month) and ranges from $1,546 to $4,270.

The Honda CR-V belongs to the compact SUV segment, and other popular models in the same segment include the Subaru Forester, Nissan Rogue, Chevrolet Equinox, and Mazda CX-5.

Best practices for saving money on auto insurance

Resourceful drivers are always searching for ways to save money on car insurance So glance at the tips and ideas below and it’s very likely you can save some money.

- Being a good driver saves money. Too many at-fault accidents will increase rates, possibly up to $3,108 per year for a 20-year-old driver and even $904 per year for a 40-year-old driver. So be safe and save.

- Shop around for better rates. Setting aside a few minutes every year or so to get free car insurance quotes could save you more than you think. Rates are always changing and switching companies is very easy to do.

- Compare insurance cost before you buy the car. Different vehicles, and even different trims of the same vehicle, have very different car insurance rates, and insurers can sell coverages with a wide range of costs. Get plenty of comparison quotes before you buy a different vehicle so you can avoid insurance sticker shock when you see your first bill.

- Get a discount from your job. The vast majority of auto insurance providers offer discounts for having a job in professions like college professors, dentists, engineers, lawyers, accountants, architects, and others. If you qualify for this occupational discount, you could save between $65 and $212 on your insurance premium, depending on the age of the rated driver.

- Raising deductibles results in a cheaper policy. Boosting your physical damage deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.

- Remove unneeded coverage on older cars. Removing physical damage coverage (comprehensive and collision) from vehicles whose low value makes coverage cost prohibitive will reduce the cost of insurance considerably.

- Raise your credit score for cheaper insurance rates. Having a credit score above 800 may save up to $342 per year versus a credit rating between 670-739. Conversely, a weak credit score could cost around $397 more per year. Not all states use credit score as a rating factor, so check with your agent or company.