- The average cost of car insurance in New York City is $3,848 per year, or about $321 per month for full coverage.

- Monthly car insurance rates for a few popular models in the city of New York include the Jeep Cherokee at $346, Toyota Highlander at $292, and Ford F150 at $359.

- Small crossovers like the Subaru Crosstrek, Chevrolet Trailblazer, and Kia Soul are the top picks for cheap car insurance in NYC.

- A few vehicles with segment-leading car insurance rates in New York include the Jaguar E-Pace ($3,596 per year), Mercedes-Benz CLA250 ($3,956 per year), Honda Passport ($3,066 per year), and Kia K5 ($3,708 per year).

How much does car insurance cost in New York City?

Average auto insurance cost in New York City is $3,848 per year, or about $321 per month for a policy that provides full coverage. It costs 51.3% more to insure the average vehicle in NYC than the U.S. average rate of $2,276.

In the state of New York, the average price for car insurance is $2,796 per year, so the average cost in New York City is $1,052 more per year. When rates are compared to other cities in New York, the cost to insure a car in New York City is $1,264 per year more than in Buffalo, $608 per year more expensive than in Rochester, and $1,540 per year more expensive than in Syracuse.

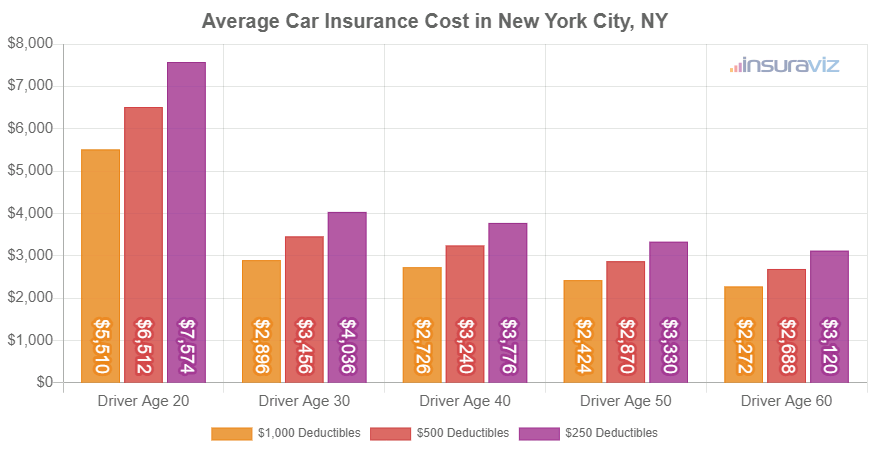

The chart below shows average car insurance cost in New York, NY for all 2024 models. Rates are averaged for all NYC Zip Codes and shown not only by driver age, but also by physical damage deductibles.

In the chart above, the cost of car insurance in New York ranges from $2,698 per year for a 60-year-old driver with a policy with high deductibles to $9,004 per year for a 20-year-old driver with a low deductible. From a monthly standpoint, the average cost in the prior chart ranges from $225 to $750 per month.

NYC car insurance rates are different for every driver and can also be very different depending on the company. Since there can be such a large difference in rates, it stresses the need for accurate free auto insurance quotes when shopping online for more affordable car insurance.

The age of the driver influences the price you pay for auto insurance. The list below illustrates these differences by breaking down average car insurance rates for driver ages from 16 to 60.

Average car insurance rates in New York for drivers age 16 to 60

- 16 year old – $13,704 per year or $1,142 per month

- 17 year old – $13,276 per year or $1,106 per month

- 18 year old – $11,899 per year or $992 per month

- 19 year old – $10,836 per year or $903 per month

- 20 year old – $7,742 per year or $645 per month

- 30 year old – $4,108 per year or $342 per month

- 40 year old – $3,848 per year or $321 per month

- 50 year old – $3,408 per year or $284 per month

- 60 year old – $3,192 per year or $266 per month

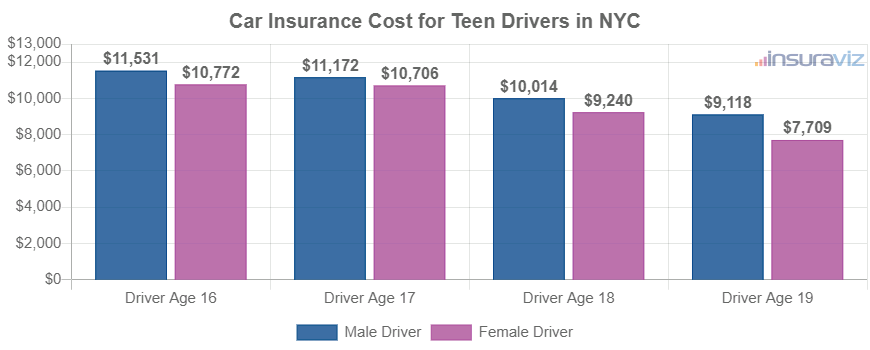

The rates in the list above for average cost of car insurance for teen drivers assumed the gender of the driver was male. The next chart goes into more detail for teenage car insurance rates and breaks out car insurance cost for teens by gender. Females are generally slightly cheaper to insure than males, notably at younger ages.

Car insurance for a 16-year-old female driver in New York City costs an average of $902 less per year than the cost to insure a 16-year-old male driver, while at age 19, the cost difference is smaller but males still pay $1,672 more per year.

New York City’s favorite vehicles and the cost to insure them

The previously discussed car insurance rates take the cost to insure each 2024 vehicle model and average them, which is helpful for making big picture comparisons like the cost difference between two locations. Average auto insurance rates work very well when presented with a question like “is car insurance cheaper in NYC or Rochester?” or “is car insurance in the state of New York cheaper than Colorado?”.

For deeper auto insurance rate comparisons, however, the data will be more precise if we compare rates for the exact make and model of vehicle being insured. Each individual vehicle model has it’s own risk profile for determining how much it costs to insure it and this data enables us to make more detailed cost comparisons.

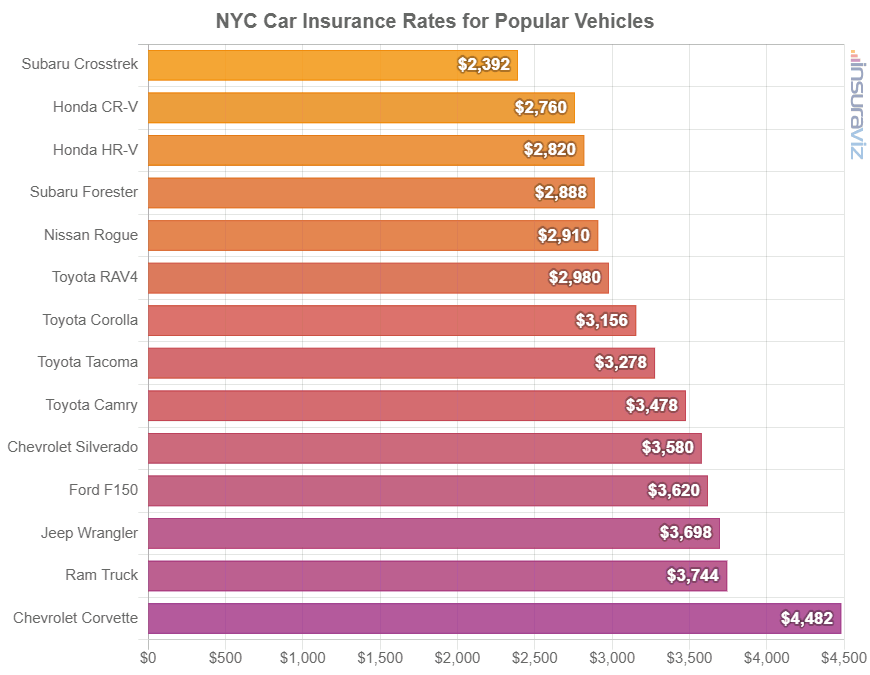

This next chart shows average insurance cost in NYC for a handful of the more popular vehicles.

In New York City, which vehicles are cheapest to insure?

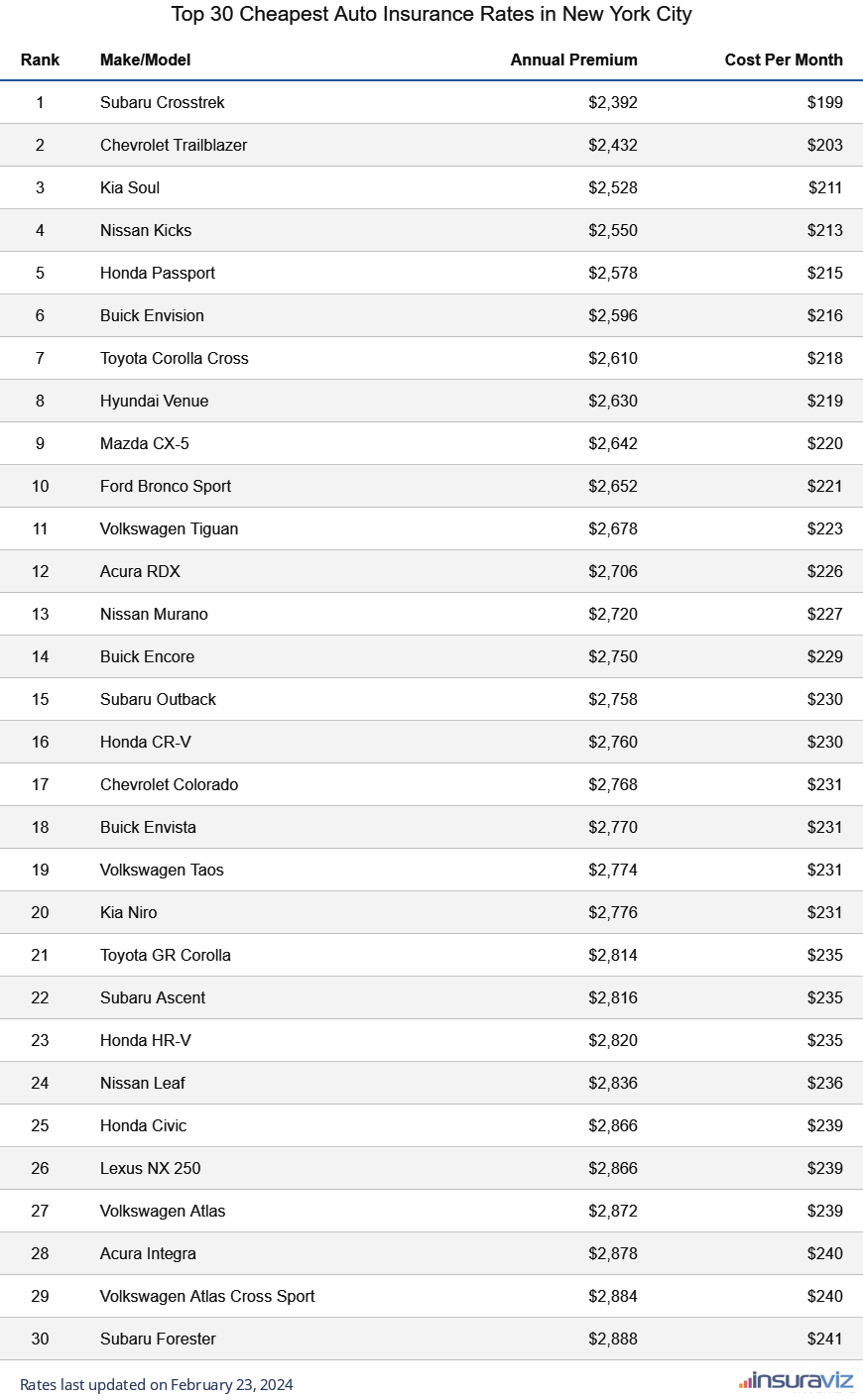

The vehicles with the lowest cost average auto insurance prices in New York City tend to be crossovers and small SUVs like the Subaru Crosstrek, Chevrolet Trailblazer, Toyota Corolla Cross, and Hyundai Venue.

Average car insurance rates for those crossover SUVs cost $3,124 or less per year to have full coverage.

Other models that rank towards the top in our overall cost comparison are the Volkswagen Taos, Honda CR-V, Subaru Outback, and Nissan Murano.

Average auto insurance rates are a few dollars per month higher for those models than the compact SUVs that rank near the top, but they still have average rates of $279 or less per month.

The following table details the cheapest vehicles to insure in NYC, ordered starting with the cheapest.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $2,844 | $237 |

| 2 | Chevrolet Trailblazer | $2,890 | $241 |

| 3 | Kia Soul | $3,002 | $250 |

| 4 | Nissan Kicks | $3,028 | $252 |

| 5 | Honda Passport | $3,066 | $256 |

| 6 | Buick Envision | $3,084 | $257 |

| 7 | Toyota Corolla Cross | $3,098 | $258 |

| 8 | Hyundai Venue | $3,124 | $260 |

| 9 | Mazda CX-5 | $3,138 | $262 |

| 10 | Ford Bronco Sport | $3,150 | $263 |

| 11 | Volkswagen Tiguan | $3,184 | $265 |

| 12 | Acura RDX | $3,216 | $268 |

| 13 | Nissan Murano | $3,230 | $269 |

| 14 | Buick Encore | $3,266 | $272 |

| 15 | Honda CR-V | $3,278 | $273 |

| 16 | Subaru Outback | $3,278 | $273 |

| 17 | Buick Envista | $3,290 | $274 |

| 18 | Volkswagen Taos | $3,296 | $275 |

| 19 | Kia Niro | $3,310 | $276 |

| 20 | Toyota GR Corolla | $3,342 | $279 |

| 21 | Honda HR-V | $3,350 | $279 |

| 22 | Subaru Ascent | $3,350 | $279 |

| 23 | Nissan Leaf | $3,370 | $281 |

| 24 | Chevrolet Colorado | $3,390 | $283 |

| 25 | Lexus NX 250 | $3,404 | $284 |

| 26 | Honda Civic | $3,406 | $284 |

| 27 | Volkswagen Atlas | $3,412 | $284 |

| 28 | Acura Integra | $3,418 | $285 |

| 29 | Subaru Forester | $3,424 | $285 |

| 30 | Volkswagen Atlas Cross Sport | $3,428 | $286 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all New York, NY Zip Codes. Updated October 24, 2025

A list of 30 vehicle models with cheap New York City car insurance is great if you just want the lowest rates. But considering we track over 700 vehicles, there are a lot of rates not being shown. So let’s rethink this and list the models with the lowest rates in a format that is more usable, by automotive segment.

The next section of this article further discusses the average cost of car insurance for each vehicle segment. This will provide a decent idea of the general vehicle types that have the overall least expensive NYC auto insurance rates. Then the following six sections show the most affordable auto insurance for each segment.

NYC auto insurance rates by vehicle segment

If you’re shopping for a new or used vehicle, it’s in your best interest to know which kinds of vehicles are cheaper to insure. To illustrate this, maybe you’re wondering if midsize SUVs have cheaper insurance than small SUVs or if heavy duty pickups have more expensive insurance than half-ton pickups.

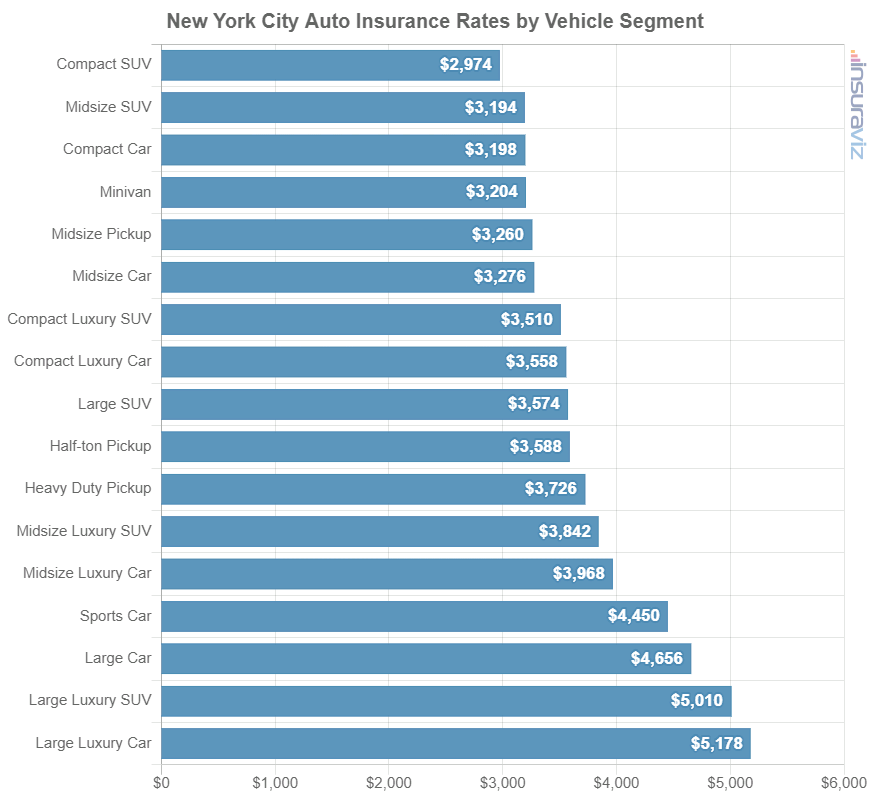

The chart below displays the average cost of car insurance rates in New York City for different vehicle segments. From a segment perspective, compact and midsize SUVs, vans, and midsize pickups tend to have the best rates, with luxury and performance models having the highest average cost to insure.

Average rates by automotive segment are sufficient for overall comparisons, but the insurance cost for specific vehicles ranges considerably within each vehicle segment listed in the above chart.

For example, in the midsize luxury car segment, rates range from the Mercedes-Benz CLA250 at $3,956 per year for a full coverage policy up to the BMW M8 at $6,482 per year. As another example, in the large truck segment, the cost of insurance ranges from the Nissan Titan costing $3,598 per year up to the Toyota Tundra at $4,580 per year, a difference of $982 within that segment.

In the next sections, we reduce this variability by looking at car insurance cost in NYC for specific vehicles.

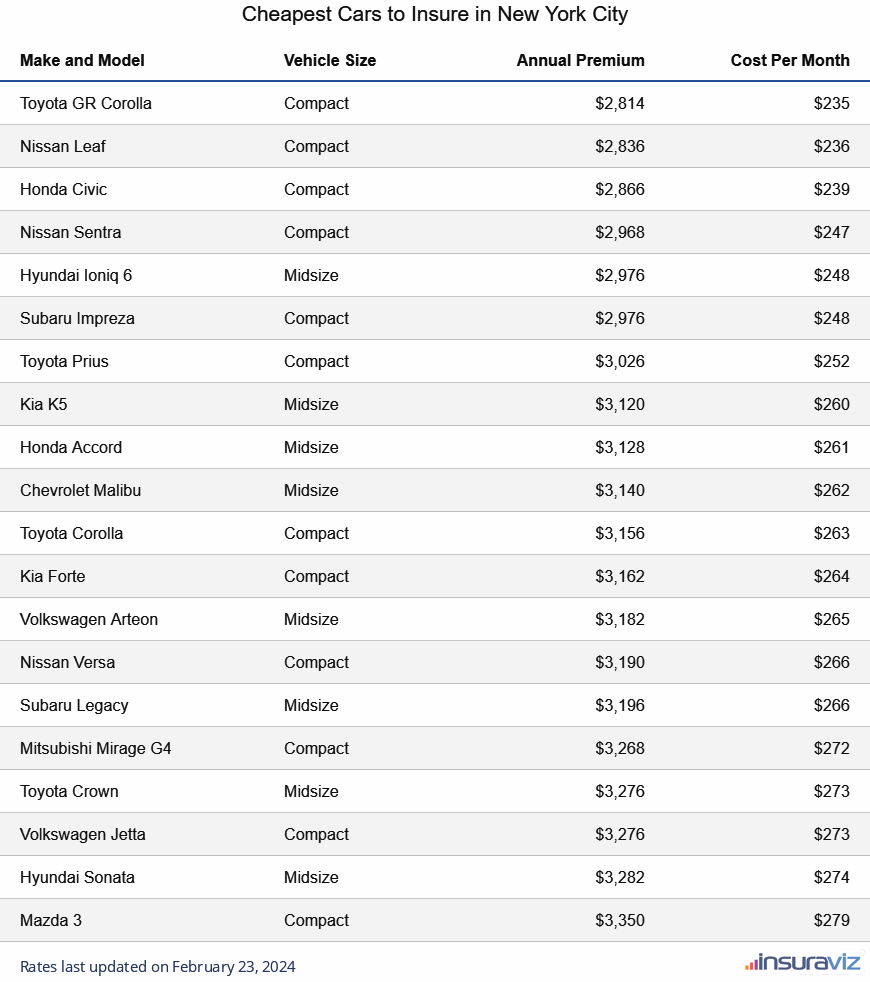

Cheapest cars to insure in New York City

Ranking at the top of the list for the most affordable New York City auto insurance rates in the non-luxury sedan or hatchback segment are the Subaru Impreza, Toyota GR Corolla, Honda Civic, Nissan Sentra, and Nissan Leaf. Car insurance prices for these vehicles average $3,538 or less per year, or around $295 per month.

Other cars that rank well in our comparison are the Chevrolet Malibu, Kia K5, Toyota Prius, and Honda Accord, with average insurance cost of $3,748 per year or less.

The cheapest compact car to insure in New York City is the Toyota GR Corolla at $3,342 per year. For midsize cars, the Kia K5 is cheapest to insure at $3,708 per year. And for large cars, the Chrysler 300 has the best rates at $3,664 per year.

The following table shows the models with the cheapest car insurance rates in NYC, ordered starting with the cheapest.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Toyota GR Corolla | Compact | $3,342 | $279 |

| Nissan Leaf | Compact | $3,370 | $281 |

| Honda Civic | Compact | $3,406 | $284 |

| Nissan Sentra | Compact | $3,526 | $294 |

| Subaru Impreza | Compact | $3,538 | $295 |

| Toyota Prius | Compact | $3,596 | $300 |

| Kia K5 | Midsize | $3,708 | $309 |

| Honda Accord | Midsize | $3,716 | $310 |

| Chevrolet Malibu | Midsize | $3,730 | $311 |

| Toyota Corolla | Compact | $3,748 | $312 |

| Kia Forte | Compact | $3,756 | $313 |

| Volkswagen Arteon | Midsize | $3,780 | $315 |

| Nissan Versa | Compact | $3,790 | $316 |

| Subaru Legacy | Midsize | $3,798 | $317 |

| Hyundai Ioniq 6 | Midsize | $3,826 | $319 |

| Mitsubishi Mirage G4 | Compact | $3,882 | $324 |

| Volkswagen Jetta | Compact | $3,890 | $324 |

| Toyota Crown | Midsize | $3,892 | $324 |

| Hyundai Sonata | Midsize | $3,902 | $325 |

| Mazda 3 | Compact | $3,978 | $332 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all New York, NY Zip Codes. Updated October 24, 2025

A few popular car models that did not make the list include the Hyundai Sonata costing $3,902 per year, the Tesla Model 3 at an average of $4,516, and the Hyundai Elantra at $4,180.

See our guides for compact car insurance, midsize car insurance, and full-size car insurance to compare rates for all makes and models.

Don’t see rates for your vehicle? No sweat! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get cheap NYC car insurance quotes from top-rated companies in New York.

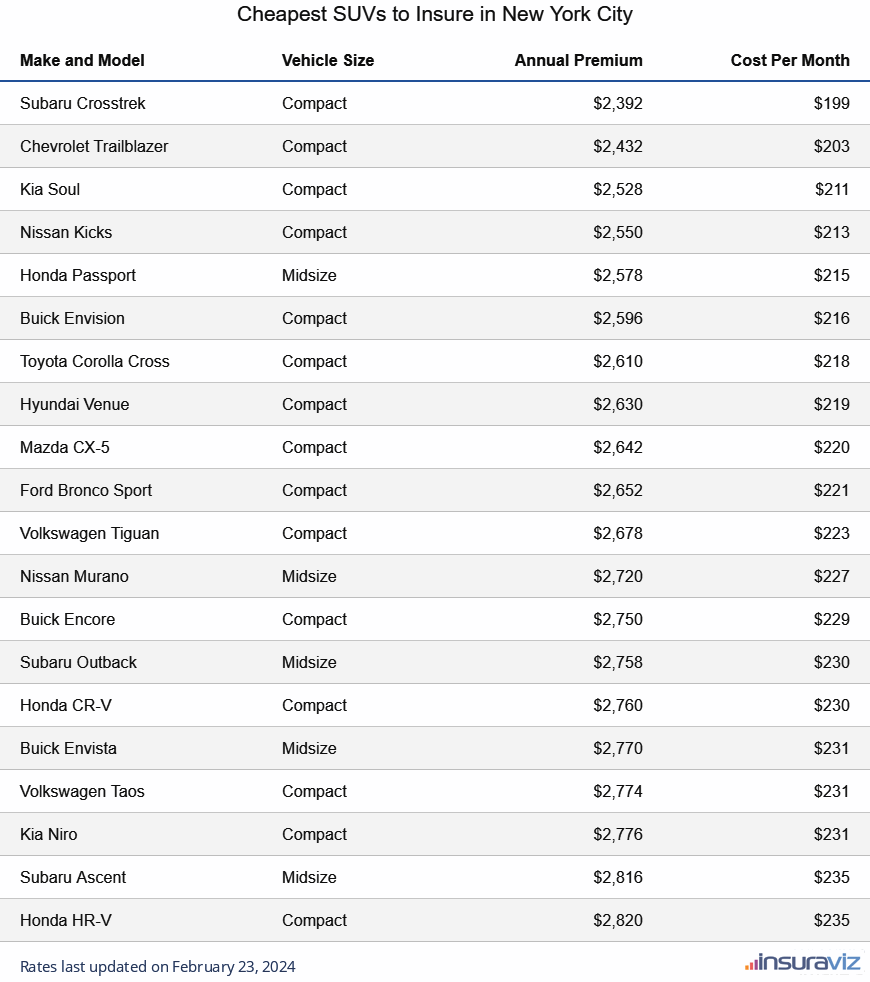

Cheapest SUV insurance rates in NYC

The Subaru Crosstrek comes in at #1 as the most budget-friendly non-luxury SUV to insure in New York City, followed closely by the Chevrolet Trailblazer, Kia Soul, Nissan Kicks, and Honda Passport. The 2024 model costs an average of $2,844 per year to insure for full coverage.

Other SUVs that are affordable to insure are the Buick Envision, Hyundai Venue, Toyota Corolla Cross, and Mazda CX-5, with average rates of $3,150 per year or less.

Additional models that rank well include the Subaru Outback, Volkswagen Taos, Kia Niro, and Volkswagen Tiguan, which cost between $3,150 and $3,350 per year for insurance.

Car insurance rates for this segment in NYC will start around $237 per month, depending on your location and insurance company. The table below ranks the twenty SUVs with the cheapest insurance in New York, starting with the Subaru Crosstrek at $237 per month and ending with the Subaru Ascent at $279 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Subaru Crosstrek | Compact | $2,844 | $237 |

| Chevrolet Trailblazer | Compact | $2,890 | $241 |

| Kia Soul | Compact | $3,002 | $250 |

| Nissan Kicks | Compact | $3,028 | $252 |

| Honda Passport | Midsize | $3,066 | $256 |

| Buick Envision | Compact | $3,084 | $257 |

| Toyota Corolla Cross | Compact | $3,098 | $258 |

| Hyundai Venue | Compact | $3,124 | $260 |

| Mazda CX-5 | Compact | $3,138 | $262 |

| Ford Bronco Sport | Compact | $3,150 | $263 |

| Volkswagen Tiguan | Compact | $3,184 | $265 |

| Nissan Murano | Midsize | $3,230 | $269 |

| Buick Encore | Compact | $3,266 | $272 |

| Honda CR-V | Compact | $3,278 | $273 |

| Subaru Outback | Midsize | $3,278 | $273 |

| Buick Envista | Midsize | $3,290 | $274 |

| Volkswagen Taos | Compact | $3,296 | $275 |

| Kia Niro | Compact | $3,310 | $276 |

| Honda HR-V | Compact | $3,350 | $279 |

| Subaru Ascent | Midsize | $3,350 | $279 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all New York, NY Zip Codes. Updated October 24, 2025

The favorite SUVs of drivers in New York City don’t always have the best auto insurance rates. For example, some popular non-luxury SUVs that did not rank in the top 20 include the Toyota Highlander at $3,500 ($292 per month), and the GMC Yukon at $4,140 ($345 per month).

See our guides for compact SUV insurance, midsize SUV insurance, and full-size SUV insurance to view any vehicles not shown in the table.

Don’t see insurance cost for your SUV? Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free car insurance quotes from top auto insurance companies in New York.

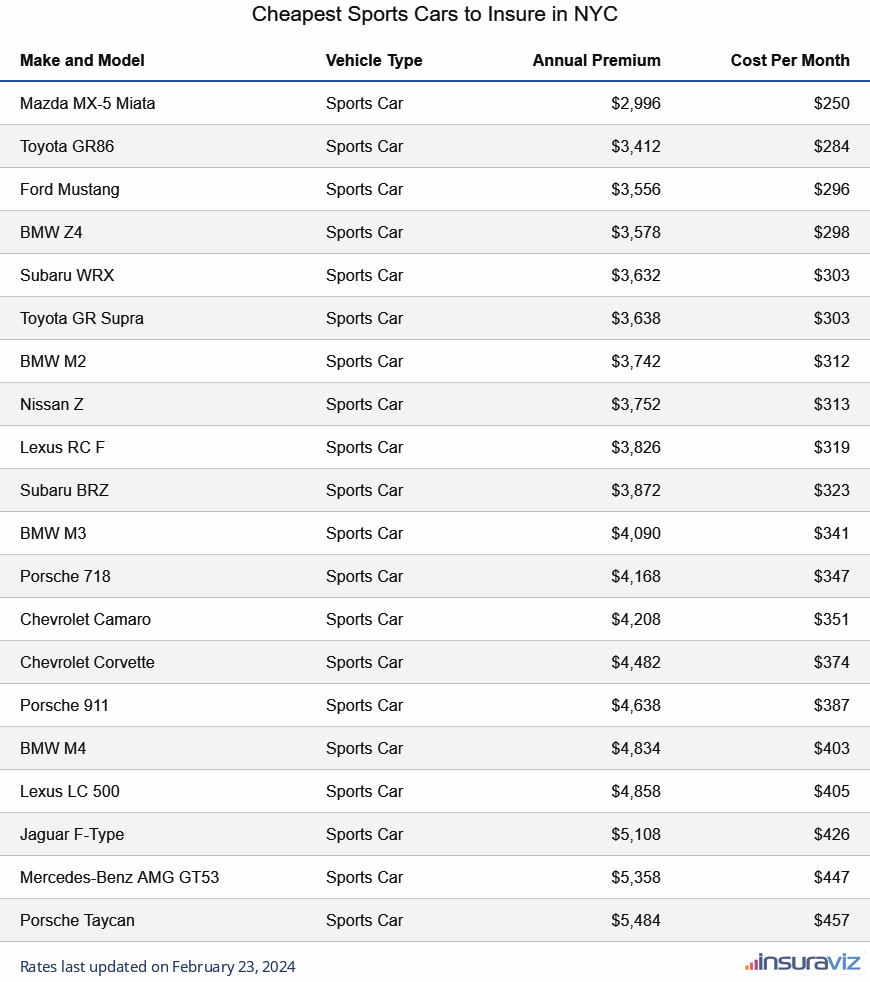

Cheapest sports car insurance rates in NYC

Ranking highest for the cheapest New York City auto insurance rates in the sports car segment are the Ford Mustang, Mazda MX-5 Miata, Toyota GR86, Subaru WRX, and BMW Z4. Insurance rates for these models average $360 or less per month.

Not the cheapest in the list but still ranking well are cars like the Toyota GR Supra, Subaru BRZ, Nissan Z, and BMW M2, with average cost of $4,600 per year or less.

Full-coverage car insurance in this segment for a middle-age safe driver starts at around $297 per month, depending on the company. The table below ranks the sports cars with the cheapest car insurance rates in New York.

The following table breaks down the sports cars with the cheapest overall insurance rates in NYC, sorted by annual and monthly insurance cost.

| Make and Model | Vehicle Type | Annual Premium | Cost Per Month |

|---|---|---|---|

| Mazda MX-5 Miata | Sports Car | $3,558 | $297 |

| Toyota GR86 | Sports Car | $4,054 | $338 |

| Ford Mustang | Sports Car | $4,228 | $352 |

| BMW Z4 | Sports Car | $4,250 | $354 |

| Subaru WRX | Sports Car | $4,314 | $360 |

| Toyota GR Supra | Sports Car | $4,322 | $360 |

| BMW M2 | Sports Car | $4,446 | $371 |

| Nissan Z | Sports Car | $4,458 | $372 |

| Lexus RC F | Sports Car | $4,544 | $379 |

| Subaru BRZ | Sports Car | $4,600 | $383 |

| BMW M3 | Sports Car | $4,860 | $405 |

| Porsche 718 | Sports Car | $4,954 | $413 |

| Chevrolet Camaro | Sports Car | $5,000 | $417 |

| Chevrolet Corvette | Sports Car | $5,328 | $444 |

| Porsche 911 | Sports Car | $5,512 | $459 |

| BMW M4 | Sports Car | $5,742 | $479 |

| Lexus LC 500 | Sports Car | $5,770 | $481 |

| Jaguar F-Type | Sports Car | $6,072 | $506 |

| Mercedes-Benz AMG GT53 | Sports Car | $6,368 | $531 |

| Porsche Taycan | Sports Car | $6,518 | $543 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all New York, NY Zip Codes. Updated October 24, 2025

Looking for a different vehicle? That’s no problem! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free car insurance quotes from top-rated auto insurance companies in New York.

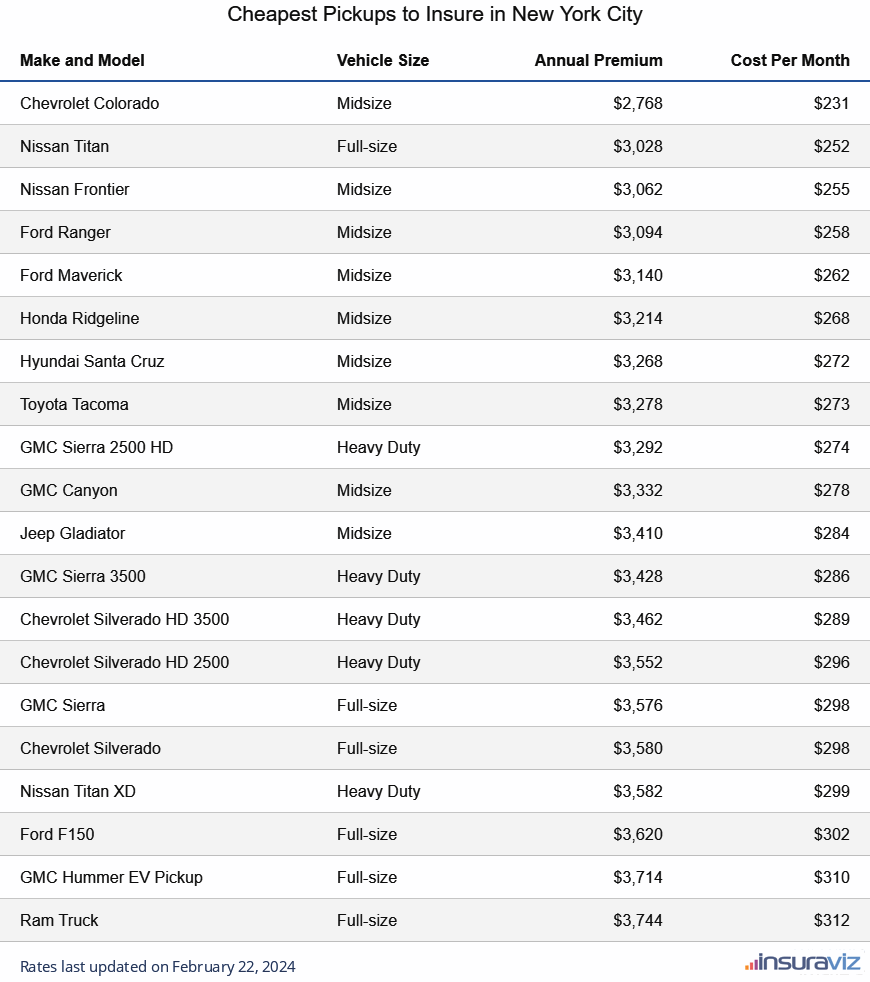

Cheapest pickup trucks to insure in New York City

The top four pickup trucks with the cheapest auto insurance rates are the Chevrolet Colorado at $3,390 per year, Nissan Titan at $3,598 per year, Nissan Frontier at $3,636 per year, and Ford Ranger at $3,678 per year.

Other pickups that have cheaper rates include the GMC Sierra 2500 HD, Hyundai Santa Cruz, Honda Ridgeline, and Toyota Tacoma, with an average car insurance cost of $3,958 per year or less.

Car insurance rates in this segment for a middle-age safe driver starts at around $283 per month, depending on the company.

The rate comparison table below ranks the pickups with the most affordable auto insurance rates in New York City, starting with the Chevrolet Colorado at $283 per month and ending with the Ram Truck at $371 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Chevrolet Colorado | Midsize | $3,390 | $283 |

| Nissan Titan | Full-size | $3,598 | $300 |

| Nissan Frontier | Midsize | $3,636 | $303 |

| Ford Ranger | Midsize | $3,678 | $307 |

| Ford Maverick | Midsize | $3,732 | $311 |

| Honda Ridgeline | Midsize | $3,818 | $318 |

| Hyundai Santa Cruz | Midsize | $3,884 | $324 |

| Toyota Tacoma | Midsize | $3,896 | $325 |

| GMC Sierra 2500 HD | Heavy Duty | $3,914 | $326 |

| GMC Canyon | Midsize | $3,958 | $330 |

| Jeep Gladiator | Midsize | $4,052 | $338 |

| GMC Sierra 3500 | Heavy Duty | $4,074 | $340 |

| Chevrolet Silverado HD 3500 | Heavy Duty | $4,114 | $343 |

| Chevrolet Silverado HD 2500 | Heavy Duty | $4,224 | $352 |

| GMC Sierra | Full-size | $4,248 | $354 |

| Chevrolet Silverado | Full-size | $4,254 | $355 |

| Nissan Titan XD | Heavy Duty | $4,254 | $355 |

| Ford F150 | Full-size | $4,304 | $359 |

| GMC Hummer EV Pickup | Full-size | $4,412 | $368 |

| Ram Truck | Full-size | $4,450 | $371 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all New York, NY Zip Codes. Updated October 24, 2025

For all pickup insurance comparisons, see our guides for midsize pickup insurance and large pickup insurance.

Is your pickup truck missing from the table above? Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free car insurance quotes from top companies in New York.

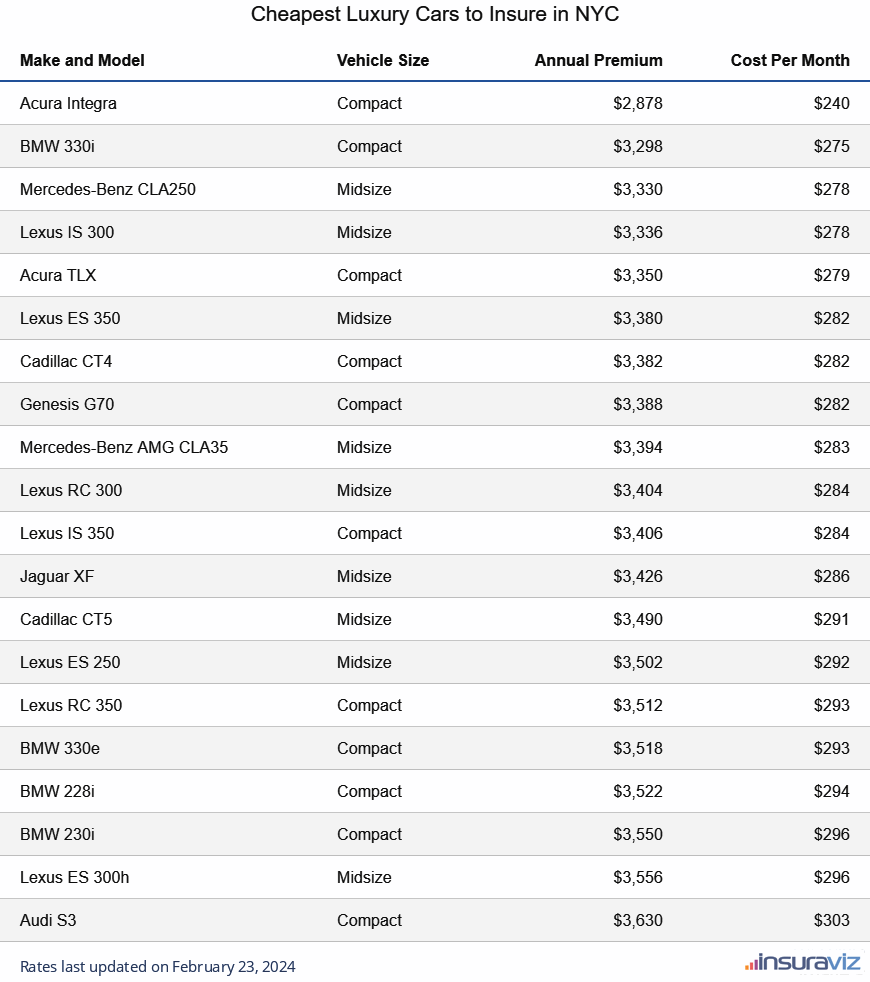

Cheapest luxury car insurance rates in NYC

The Acura Integra ranks at #1 for the cheapest luxury car model to insure, followed by the BMW 330i, Mercedes-Benz CLA250, Lexus IS 300, and Acura TLX. The 2024 model averages $3,418 per year for full-coverage auto insurance.

Other models that have cheaper rates are the Lexus ES 350, Genesis G70, Mercedes-Benz AMG CLA35, and Cadillac CT4, with average cost of $4,042 per year or less.

Ranked in the bottom half of the top 20 cheapest luxury cars to insure, models like the BMW 230i, Lexus ES 250, Lexus ES 300h, BMW 330e, and Audi S3 cost between $4,042 and $4,314 per year to insure in New York City.

From a monthly standpoint, full-coverage auto insurance on this segment in New York for the average driver will start around $285 per month, depending on your company and location.

The next table ranks the cars with the cheapest average auto insurance rates in New York City, starting with the Acura Integra at $3,418 per year ($285 per month) and ending with the Audi S3 at $4,314 per year ($360 per month).

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura Integra | Compact | $3,418 | $285 |

| BMW 330i | Compact | $3,916 | $326 |

| Mercedes-Benz CLA250 | Midsize | $3,956 | $330 |

| Lexus IS 300 | Midsize | $3,962 | $330 |

| Acura TLX | Compact | $3,980 | $332 |

| Lexus ES 350 | Midsize | $4,016 | $335 |

| Cadillac CT4 | Compact | $4,018 | $335 |

| Genesis G70 | Compact | $4,026 | $336 |

| Mercedes-Benz AMG CLA35 | Midsize | $4,032 | $336 |

| Lexus RC 300 | Midsize | $4,042 | $337 |

| Lexus IS 350 | Compact | $4,058 | $338 |

| Jaguar XF | Midsize | $4,068 | $339 |

| Cadillac CT5 | Midsize | $4,146 | $346 |

| Lexus ES 250 | Midsize | $4,160 | $347 |

| Lexus RC 350 | Compact | $4,172 | $348 |

| BMW 330e | Compact | $4,178 | $348 |

| BMW 228i | Compact | $4,184 | $349 |

| BMW 230i | Compact | $4,216 | $351 |

| Lexus ES 300h | Midsize | $4,224 | $352 |

| Audi S3 | Compact | $4,314 | $360 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all New York, NY Zip Codes. Updated October 24, 2025

See our comprehensive guide for luxury car insurance to view data for vehicles not featured in the table.

Need rates for a different vehicle? No problem! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free NYC car insurance quotes from top auto insurance companies in the state of New York.

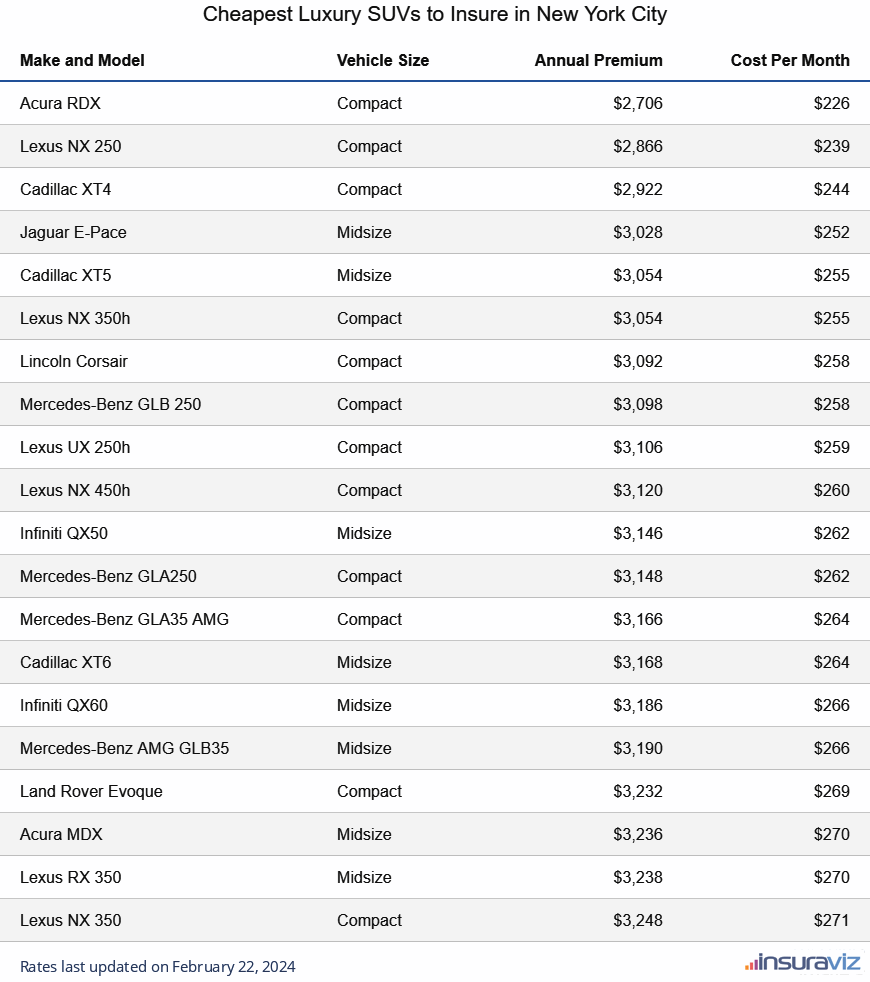

Cheapest luxury SUV insurance rates in New York City

The four highest ranking luxury SUVs with the most affordable auto insurance in New York City are the Acura RDX at $3,216 per year, Lexus NX 250 at $3,404 per year, Cadillac XT4 at $3,474 per year, and Jaguar E-Pace at $3,596 per year.

Not the cheapest, but still in the top 10, are models like the Lexus UX 250h, Lincoln Corsair, Mercedes-Benz GLB 250, and Lexus NX 350h, with average insurance cost of $3,708 per year or less.

Ranked from number 10 to 20, models like the Infiniti QX50, Mercedes-Benz AMG GLB35, Mercedes-Benz GLA35 AMG, Infiniti QX60, Lexus RX 350, and Acura MDX cost between $3,708 and $3,862 per year for full-coverage insurance in NYC.

Car insurance in New York for this segment for a safe driver can cost as low as $268 per month, depending on where you live.

When prices are compared by vehicle size, the lowest-cost compact luxury SUV to insure is the Acura RDX at $3,216 per year. For midsize luxury models, the Jaguar E-Pace is the cheapest model to insure at $3,596 per year. And for large luxury SUVs, the Infiniti QX80 has the best rates at $4,314 per year.

The rate comparison table below ranks the twenty SUVs with the most affordable insurance in New York, starting with the Acura RDX at $268 per month and ending with the Lexus RX 350 at $322 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura RDX | Compact | $3,216 | $268 |

| Lexus NX 250 | Compact | $3,404 | $284 |

| Cadillac XT4 | Compact | $3,474 | $290 |

| Jaguar E-Pace | Midsize | $3,596 | $300 |

| Cadillac XT5 | Midsize | $3,628 | $302 |

| Lexus NX 350h | Compact | $3,628 | $302 |

| Lincoln Corsair | Compact | $3,672 | $306 |

| Mercedes-Benz GLB 250 | Compact | $3,680 | $307 |

| Lexus UX 250h | Compact | $3,690 | $308 |

| Lexus NX 450h | Compact | $3,708 | $309 |

| Infiniti QX50 | Midsize | $3,738 | $312 |

| Mercedes-Benz GLA250 | Compact | $3,750 | $313 |

| Mercedes-Benz GLA35 AMG | Compact | $3,762 | $314 |

| Cadillac XT6 | Midsize | $3,764 | $314 |

| Infiniti QX60 | Midsize | $3,784 | $315 |

| Mercedes-Benz AMG GLB35 | Midsize | $3,788 | $316 |

| Land Rover Evoque | Compact | $3,838 | $320 |

| Acura MDX | Midsize | $3,846 | $321 |

| Lexus NX 350 | Compact | $3,856 | $321 |

| Lexus RX 350 | Midsize | $3,862 | $322 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all New York, NY Zip Codes. Updated October 24, 2025

See our guide for luxury SUV insurance to view luxury vehicles not shown in the table.

Need rates for a different luxury SUV? No problem! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get cheap NYC car insurance quotes from top companies in New York.

How to find cheaper New York City auto insurance

New York drivers should always be searching for ways to reduce the monthly expense for insurance, so take a minute and read through the money-saving ideas in the list below and maybe you’ll find a way to save a little cash on your next policy.

- Credit ratings can impact car insurance rates. Insureds with excellent credit scores of 800+ could save an average of $604 per year compared to a slightly lower credit rating between 670-739. Conversely, a below average credit rating could cost as much as $700 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Get better rates due to your employment. The vast majority of insurance companies offer discounts for certain professions like dentists, members of the military, scientists, police officers and law enforcement, nurses, and others. If your job can earn you this discount, you may save between $115 and $374 on your yearly car insurance bill, depending on the policy coverages selected.

- Pay small claims out-of-pocket. Car insurance companies give a discounted rate for not filing any claims. Insurance should be used to protect you from significant financial loss, not nickel-and-dime type claims.

- Qualify for discounts to save money. Discounted rates may be available if the insured drivers belong to certain professional organizations, choose electronic billing, insure their home and car with the same company, are loyal customers, work in certain occupations, or many other discounts which could save the average NYC driver as much as $652 per year on their insurance cost.

- Shop around anytime. Taking the time to get a few free car insurance quotes could save you a significant amount. Companies make rate modifications frequently and switching to a different company is very easy to do.

- The higher the deductibles, the lower the cost. Raising the comprehensive and collision deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.

- Choose a vehicle with cheaper auto insurance rates. Vehicle type has a huge impact on the cost of auto insurance. As an example, a Subaru Forester costs $4,066 less per year to insure in New York than a Nissan GT-R. Lower performance vehicles save money.