- Drivers can expect to pay an average of $2,148 per year, $1,074 for a 6-month policy, or $179 per month for full coverage insurance on a GMC Terrain, depending on the trim level.

- The Terrain SLE 2WD trim level is the cheapest to insure at around $2,030 per year. The most expensive trim is the Denali AWD at $2,272 per year.

- When compared to the entire small SUV segment, the Terrain ranks in the lower half at 18th out of 47 total comparison vehicles.

How much does GMC Terrain insurance cost?

Ranked 18th out of 47 vehicles in the 2024 small SUV class, GMC Terrain insurance rates average $2,148 per year, or around $179 monthly. With the average small SUV costing $2,206 a year to insure, the Terrain costs an average of $58 less per year.

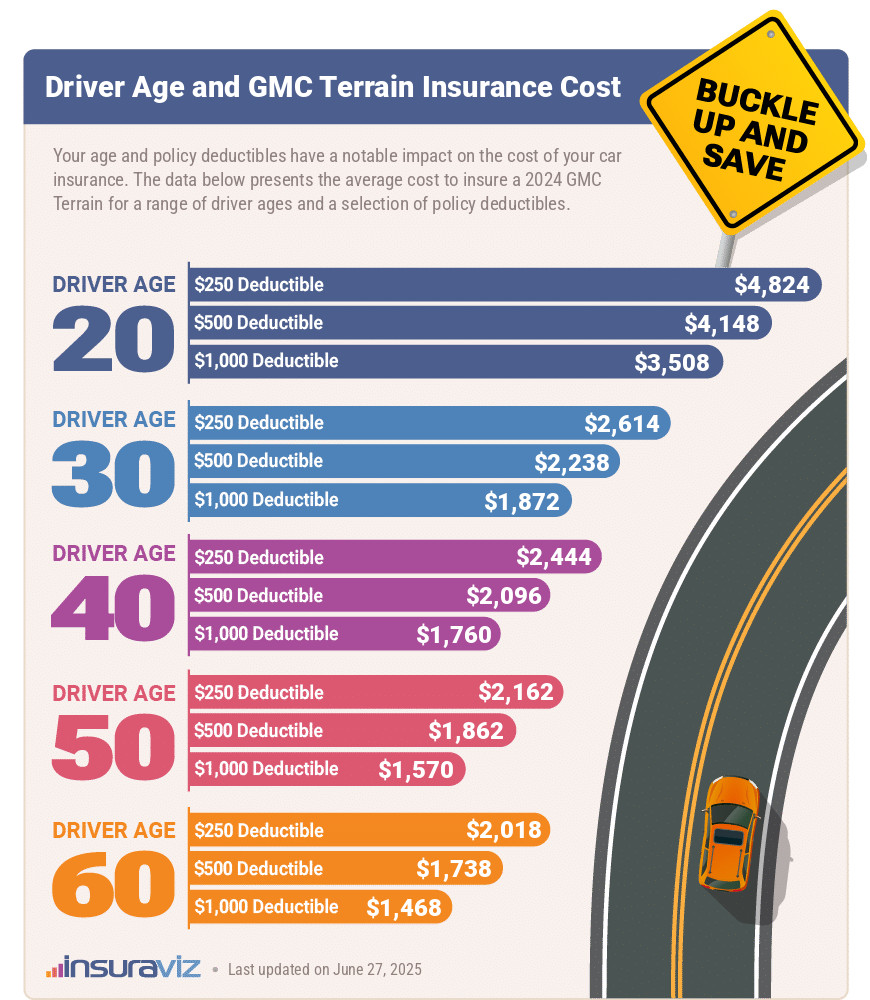

The following infographic illustrates how average Terrain car insurance rates vary based on the age of the driver and different policy deductibles.

Prices range from the lowest cost of $1,504 per year for a 60-year-old driver with $1,000 physical damage deductibles to the highest policy cost (excluding teenager drivers) of $4,940 annually for a driver age 20 with low policy deductibles.

What can you learn from this data? Basically two things.

First, driver age is one of the biggest factors that impact the rate you pay. As you get older, you generally get smarter behind the wheel. This results in fewer accidents and claims so car insurance rates trend downward.

Second, the deductible you set for the comprehensive and collision coverages on your policy also affect rates considerably.

If your goal is to have the cheapest rate possible, then a high deductible is what you want (as long as you have enough set aside to cover it if you have a claim).

If the least out-of-pocket expense at claim time is what you want, then a low deductible is a better choice. Just beware that a lower deductible will cost you more each year.

What is the cheapest model of Terrain to insure?

The cheapest trim level of GMC Terrain to insure is the SLE 2WD at around $2,030 per year, or about $169 per month. The second cheapest model is the SLE AWD at $2,076 per year, and the third cheapest trim to insure is the SLT 2WD also at $2,136 per year.

The highest cost trim levels of GMC Terrain to insure are the Denali AWD and the AT4 AWD trims, both costing around $2,272 per year. Those models will cost an extra $242 per year over the cheapest SLE 2WD model.

The rate table below shows average annual, semi-annual, and monthly insurance rates for the different trim levels available for the 2024 Terrain.

| 2024 GMC Terrain Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| SLE 2WD | $2,030 | $169 |

| SLE AWD | $2,076 | $173 |

| SLT 2WD | $2,136 | $178 |

| SLT AWD | $2,172 | $181 |

| AT4 AWD | $2,208 | $184 |

| Denali AWD | $2,272 | $189 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Is a GMC Terrain expensive to insure?

The GMC Terrain ranks 18th out of 47 total comparison vehicles in the 2024 small SUV segment. The Terrain costs an average of $2,148 per year to insure and the category average cost is $2,206 per year, a difference of $58 per year.

When car insurance rates are compared to the best-selling models in the small SUV category, the GMC Terrain costs $64 less per year than the Toyota RAV4, $102 more than the Honda CR-V, $62 less than the Chevrolet Equinox, and $6 less than the Nissan Rogue.

The chart below shows how average Terrain auto insurance cost compares to the top 10 selling small SUVs in America. In addition, we included a table following the chart that ranks insurance affordability for the entire 2024 compact SUV and crossover class.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,772 | -$376 |

| 2 | Chevrolet Trailblazer | $1,804 | -$344 |

| 3 | Kia Soul | $1,872 | -$276 |

| 4 | Nissan Kicks | $1,888 | -$260 |

| 5 | Buick Envision | $1,922 | -$226 |

| 6 | Toyota Corolla Cross | $1,932 | -$216 |

| 7 | Hyundai Venue | $1,950 | -$198 |

| 8 | Mazda CX-5 | $1,956 | -$192 |

| 9 | Ford Bronco Sport | $1,966 | -$182 |

| 10 | Volkswagen Tiguan | $1,984 | -$164 |

| 11 | Buick Encore | $2,038 | -$110 |

| 12 | Honda CR-V | $2,046 | -$102 |

| 13 | Volkswagen Taos | $2,056 | -$92 |

| 14 | Kia Niro | $2,066 | -$82 |

| 15 | Honda HR-V | $2,088 | -$60 |

| 16 | Subaru Forester | $2,134 | -$14 |

| 17 | Kia Seltos | $2,144 | -$4 |

| 18 | GMC Terrain | $2,148 | -- |

| 19 | Nissan Rogue | $2,154 | $6 |

| 20 | Hyundai Kona | $2,158 | $10 |

| 21 | Mazda CX-30 | $2,164 | $16 |

| 22 | Volkswagen ID4 | $2,176 | $28 |

| 23 | Ford Escape | $2,188 | $40 |

| 24 | Chevrolet Equinox | $2,210 | $62 |

| 25 | Toyota RAV4 | $2,212 | $64 |

| 26 | Mazda MX-30 | $2,226 | $78 |

| 27 | Hyundai Tucson | $2,232 | $84 |

| 28 | Chevrolet Trax | $2,264 | $116 |

| 29 | Mini Cooper Clubman | $2,274 | $126 |

| 30 | Mini Cooper | $2,278 | $130 |

| 31 | Mitsubishi Eclipse Cross | $2,302 | $154 |

| 32 | Jeep Renegade | $2,308 | $160 |

| 33 | Mitsubishi Outlander | $2,336 | $188 |

| 34 | Kia Sportage | $2,350 | $202 |

| 35 | Hyundai Ioniq 5 | $2,358 | $210 |

| 36 | Fiat 500X | $2,368 | $220 |

| 37 | Mini Cooper Countryman | $2,374 | $226 |

| 38 | Subaru Solterra | $2,376 | $228 |

| 39 | Mazda CX-50 | $2,380 | $232 |

| 40 | Nissan Ariya | $2,386 | $238 |

| 41 | Toyota bz4X | $2,390 | $242 |

| 42 | Mitsubishi Mirage | $2,398 | $250 |

| 43 | Kia EV6 | $2,474 | $326 |

| 44 | Dodge Hornet | $2,554 | $406 |

| 45 | Jeep Compass | $2,594 | $446 |

| 46 | Hyundai Nexo | $2,648 | $500 |

| 47 | Ford Mustang Mach-E | $2,806 | $658 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

How much is insurance on a used Terrain?

Opting for a 2013 GMC Terrain in place of a more expensive 2024 version will save as much as $610 on a yearly basis. In general, older models cost less to insure due to having lower replacement cost value.

The next table illustrates average car insurance cost data for a GMC Terrain for various driver age groups for the 2013 to 2024 model years. Costs range from a minimum of $1,290 for a 60-year-old driver rated on a 2015 GMC Terrain to the highest rate of $4,248 for a 20-year-old with a 2019 model.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 GMC Terrain | $4,248 | $2,148 | $1,782 |

| 2023 GMC Terrain | $4,108 | $2,074 | $1,720 |

| 2022 GMC Terrain | $4,006 | $2,016 | $1,674 |

| 2021 GMC Terrain | $3,824 | $1,916 | $1,596 |

| 2020 GMC Terrain | $3,734 | $1,870 | $1,556 |

| 2019 GMC Terrain | $3,870 | $1,926 | $1,606 |

| 2018 GMC Terrain | $3,708 | $1,846 | $1,542 |

| 2017 GMC Terrain | $3,538 | $1,762 | $1,472 |

| 2016 GMC Terrain | $3,008 | $1,520 | $1,270 |

| 2015 GMC Terrain | $2,950 | $1,472 | $1,234 |

| 2014 GMC Terrain | $2,934 | $1,474 | $1,232 |

| 2013 GMC Terrain | $3,088 | $1,538 | $1,290 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all GMC Terrain trim levels for each model year. Updated October 24, 2025

Ultimately, as the years go by, it will probably make good financial sense to delete coverage for physical damage from an insurance policy. As a GMC Terrain loses value as it ages, the costs required to maintain physical damage insurance are more than the benefits.

Removing physical damage insurance coverage on an older GMC Terrain may save $862 a year, depending on the prior deductible level and the driver age.

Average rates by U.S. city and state

GMC Terrain insurance can have very different prices depending on where you live. Even within a single state or city, rates can vary substantially.

The chart below shows average insurance rates for a 2024 GMC Terrain for thirty of the largest cities in the U.S.

States like Idaho ($1,806), Iowa ($1,738), and Maine ($1,636) have better insurance rates, while states like Louisiana ($2,412), Michigan ($2,586), and Florida ($2,498) have higher insurance rates.

Most of the other states do not tend to be extremely cheap or expensive, with states like Maryland, New Mexico, and West Virginia included in this group with average GMC Terrain insurance rates of $2,144, $1,976, and $2,084 per year, respectively.

The table below shows average annual, 6-month, and monthly insurance rates for all 50 states.

| U.S. State | Annual Premium | Cost Per Month |

|---|---|---|

| Alabama | $2,100 | $175 |

| Alaska | $1,878 | $157 |

| Arizona | $2,124 | $177 |

| Arkansas | $2,326 | $194 |

| California | $2,580 | $215 |

| Colorado | $2,368 | $197 |

| Connecticut | $2,432 | $203 |

| Delaware | $2,470 | $206 |

| Florida | $2,498 | $208 |

| Georgia | $2,290 | $191 |

| Hawaii | $1,760 | $147 |

| Idaho | $1,806 | $151 |

| Illinois | $2,064 | $172 |

| Indiana | $1,860 | $155 |

| Iowa | $1,738 | $145 |

| Kansas | $2,230 | $186 |

| Kentucky | $2,366 | $197 |

| Louisiana | $2,412 | $201 |

| Maine | $1,636 | $136 |

| Maryland | $2,144 | $179 |

| Massachusetts | $2,394 | $200 |

| Michigan | $2,586 | $216 |

| Minnesota | $2,034 | $170 |

| Mississippi | $2,216 | $185 |

| Missouri | $2,454 | $205 |

| Montana | $2,124 | $177 |

| Nebraska | $1,998 | $167 |

| Nevada | $2,562 | $214 |

| New Hampshire | $1,740 | $145 |

| New Jersey | $2,586 | $216 |

| New Mexico | $1,976 | $165 |

| New York | $2,500 | $208 |

| North Carolina | $1,670 | $139 |

| North Dakota | $1,986 | $166 |

| Ohio | $1,784 | $149 |

| Oklahoma | $2,416 | $201 |

| Oregon | $2,150 | $179 |

| Pennsylvania | $2,192 | $183 |

| Rhode Island | $2,628 | $219 |

| South Carolina | $2,000 | $167 |

| South Dakota | $2,298 | $192 |

| Tennessee | $2,180 | $182 |

| Texas | $2,144 | $179 |

| Utah | $2,062 | $172 |

| Vermont | $1,828 | $152 |

| Virginia | $1,732 | $144 |

| Washington | $2,102 | $175 |

| West Virginia | $2,084 | $174 |

| Wisconsin | $1,810 | $151 |

| Wyoming | $2,080 | $173 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

Additional facts and figures related to insuring a Terrain include:

- Younger drivers pay higher rates. The difference in 2024 GMC Terrain insurance cost between a 40-year-old driver ($2,148 per year) and a 20-year-old driver ($4,248 per year) is $2,100, or a savings of 65.7%.

- GMC Terrain insurance for teen drivers is expensive. Average rates for full coverage Terrain insurance costs $7,470 per year for a 16-year-old driver, $7,237 per year for a 17-year-old driver, and $6,488 per year for an 18-year-old driver.

- Lower policy cost by raising deductibles. Raising deductibles from $500 to $1,000 could save around $344 per year for a 40-year-old driver and $656 per year for a 20-year-old driver.

- Choosing a low deductible will increase insurance policy costs. Decreasing deductibles from $500 to $250 could cost an additional $358 per year for a 40-year-old driver and $692 per year for a 20-year-old driver.

- High-risk drivers pay a lot more for insurance. For a 30-year-old driver, having too many accidents or violations could increase the cost by $2,580 or more per year.

- Policyholder gender affects insurance cost. For a 2024 GMC Terrain, a 20-year-old male driver pays an average rate of $4,248 per year, while a 20-year-old woman pays an estimated $3,076, a difference of $1,172 per year in the women’s favor by a large margin. But by age 50, male driver rates are $1,906 and the rate for females is $1,860, a difference of only $46.