- Average car insurance cost in Worcester is $2,742 per year, or $229 per month, for a full-coverage policy.

- Worcester, Massachusetts, auto insurance averages $66 per year more than the Massachusetts state average cost ($2,676) and $466 per year more than the U.S. national average ($2,276).

- Monthly car insurance rates for a few popular models in Worcester include the Ford F150 at $256, Honda Civic at $202, and Ram Truck at $264.

- For cheap car insurance in Worcester, MA, compact SUVs like the Subaru Crosstrek, Hyundai Venue, Mazda CX-5, and Chevrolet Trailblazer cost less than most other models.

How much does car insurance cost in Worcester?

In Worcester, the average car insurance expense is $2,742 per year, which is 18.6% more than the overall U.S. national average rate of $2,276. Per month, Worcester car insurance costs about $229 for full coverage.

In the state of Massachusetts, the average car insurance expense is $2,676 per year, so the cost in Worcester averages $66 more per year. The cost of auto insurance in Worcester compared to other Massachusetts locations is $280 per year more than in Cambridge, $204 per year more than in Lowell, and $150 per year less than in Springfield.

The chart below displays additional costs for drivers age 20 to 60 by including rates for three different policy deductible limits. This can help you understand how auto insurance rates increase with lower deductibles, and decreases when higher deductibles are used.

The average cost of car insurance per month in Worcester is $229, with policy premium ranging from $160 to $535 for the data in the prior chart.

Car insurance rates can be extremely variable and are impacted by many different factors. The potential for large premium differences increases the need to get accurate auto insurance quotes when trying to find the cheapest auto insurance policy.

The age of the driver has the single biggest impact on the price you pay for auto insurance. The list below illustrates this by showing average car insurance rates in Worcester for drivers from 16 to 60.

Worcester, Massachusetts, car insurance cost for drivers age 16 to 60

- 16-year-old driver – $9,768 per year or $814 per month

- 17-year-old driver – $9,464 per year or $789 per month

- 18-year-old driver – $8,480 per year or $707 per month

- 19-year-old driver – $7,723 per year or $644 per month

- 20-year-old driver – $5,518 per year or $460 per month

- 30-year-old driver – $2,928 per year or $244 per month

- 40-year-old driver – $2,742 per year or $229 per month

- 50-year-old driver – $2,432 per year or $203 per month

- 60-year-old driver – $2,274 per year or $190 per month

The cost to insure popular vehicles in Worcester, MA

The previously discussed car insurance rates are averaged for every 2024 model year vehicle, which is practical when making generalized comparisons such as the cost difference between two locations.

Average auto insurance rates work very well when presented with a question like “are car insurance rates in Worcester cheaper than in Boston?” or “is car insurance cheaper in Massachusetts or Illinois?”.

For more in-depth auto insurance cost comparisons, however, the data will be more accurate if we look at the exact make and model of vehicle being insured. Each individual vehicle model has slightly different risk characteristics for determining the cost of auto insurance and this data allows us to make more detailed cost comparisons.

The next chart details average insurance rates for a handful of the more popular vehicles on Worcester streets. Later in this article, there is a section that covers insurance cost for a few of these models in more detail.

The most popular vehicle models in Worcester tend to be small or midsize cars like the Honda Civic, Nissan Sentra, and Nissan Altima and small or midsize SUVs like the Nissan Rogue, Chevy Equinox, and Ford Explorer.

Some additional popular models in Worcester from different automotive segments include luxury cars like the Infiniti Q50, BMW 530i, and Tesla Model S, luxury SUVs like the Lexus RX 350, BMW X5, and Cadillac XT5, and pickup trucks like the Chevy Silverado, Toyota Tacoma, and Ram 1500.

We will get into more rates a little later in this article, but before that, let’s quickly revisit some of the general concepts we tackled so far in the article.

- Worcester, Massachusetts, car insurance cost is more than the U.S. average – $2,742 (Worcester average) compared to $2,276 (U.S. average)

- Lower deductible insurance is more expensive than high deductible – A 40-year-old driver pays an average of $888 more per year for $250 physical damage deductibles versus $1,000.

- Insurance for a teenager costs a lot – Cost ranges from $6,530 to $9,768 per year for insurance on a teen driver in Worcester.

- Worcester auto insurance prices are more expensive than the Massachusetts state average – $2,742 (Worcester average) versus $2,676 (Massachusetts average)

- Monthly car insurance cost ranges from $190 to $814 – That is the average car insurance cost range for drivers age 16 to 60 in Worcester.

- Car insurance rates decrease significantly from age 20 to 30 – The average 30-year-old Worcester, Massachusetts, driver will pay $2,590 less per year than a 20-year-old driver, $2,928 versus $5,518.

- Car insurance is cheaper the older you are – Car insurance rates for a 60-year-old driver in Worcester are $3,244 per year cheaper than for a 20-year-old driver.

What vehicles have the cheap car insurance in Worcester?

When every make and model is compared, the models with the cheapest average insurance rates in Worcester, MA, tend to be small SUVs and crossovers like the Kia Soul, Subaru Crosstrek, Buick Envision, and Hyundai Venue.

Average car insurance rates for those crossover SUVs cost $2,228 or less per year, or $186 per month, to have full coverage.

Additional vehicles that rank very well in our overall cost comparison are the Buick Encore, Nissan Murano, Volkswagen Tiguan, and Buick Envista. Rates are a little bit more for those models than the cheapest crossovers and small SUVs that rank at the top, but they still have average rates of $2,382 or less per year ($199 per month).

The next table lists the 20 car, truck, and SUV models with the cheapest auto insurance in Worcester, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $2,026 | $169 |

| 2 | Chevrolet Trailblazer | $2,060 | $172 |

| 3 | Kia Soul | $2,140 | $178 |

| 4 | Nissan Kicks | $2,158 | $180 |

| 5 | Honda Passport | $2,186 | $182 |

| 6 | Buick Envision | $2,198 | $183 |

| 7 | Toyota Corolla Cross | $2,210 | $184 |

| 8 | Hyundai Venue | $2,228 | $186 |

| 9 | Mazda CX-5 | $2,236 | $186 |

| 10 | Ford Bronco Sport | $2,246 | $187 |

| 11 | Volkswagen Tiguan | $2,268 | $189 |

| 12 | Acura RDX | $2,294 | $191 |

| 13 | Nissan Murano | $2,302 | $192 |

| 14 | Buick Encore | $2,328 | $194 |

| 15 | Subaru Outback | $2,336 | $195 |

| 16 | Honda CR-V | $2,338 | $195 |

| 17 | Buick Envista | $2,342 | $195 |

| 18 | Volkswagen Taos | $2,348 | $196 |

| 19 | Kia Niro | $2,360 | $197 |

| 20 | Toyota GR Corolla | $2,382 | $199 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Worcester, MA Zip Codes. Updated October 24, 2025

A table showing 20 ranked vehicles is not the best way to show a comprehesive view of the cost of car insurance. Due to the fact that we track over 700 vehicles, a ton of models get left out.

So let’s dig deeper and display the most affordable vehicles differently. The sections below rank the top 20 models with the cheapest insurance rates in Worcester for the six main vehicle segments.

Cheapest car insurance rates in Worcester, MA

The three highest ranking non-luxury sedans with the cheapest auto insurance in Worcester are the Toyota GR Corolla at $2,382 per year, the Nissan Leaf at $2,400 per year, and the Honda Civic at $2,428 per year.

Additional cars that have affordable average insurance rates include the Toyota Corolla, Kia K5, Honda Accord, and Chevrolet Malibu, with average insurance cost of $2,670 per year or less.

In the lower half of the top 20 cars to insure, models like the Mitsubishi Mirage G4, Hyundai Ioniq 6, Mazda 3, Toyota Crown, Volkswagen Jetta, and Volkswagen Arteon average between $2,670 and $2,834 per year for full-coverage insurance in Worcester.

Auto insurance in Worcester for this segment for an average middle-age driver starts at an average of $199 per month, depending on where you live and the company you use.

When vehicle size is considered, the cheapest compact car to insure in Worcester is the Toyota GR Corolla at $2,382 per year, or $199 per month. For midsize 2024 models, the Kia K5 has the cheapest rates at $2,642 per year, or $220 per month. And for full-size non-luxury cars, the Chrysler 300 is cheapest to insure at $2,610 per year, or $218 per month.

The comparison table below ranks the twenty cars with the cheapest insurance rates in Worcester, starting with the Toyota GR Corolla at $199 per month and ending with the Mazda 3 at $236 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Toyota GR Corolla | Compact | $2,382 | $199 |

| Nissan Leaf | Compact | $2,400 | $200 |

| Honda Civic | Compact | $2,428 | $202 |

| Nissan Sentra | Compact | $2,512 | $209 |

| Subaru Impreza | Compact | $2,520 | $210 |

| Toyota Prius | Compact | $2,562 | $214 |

| Kia K5 | Midsize | $2,642 | $220 |

| Honda Accord | Midsize | $2,650 | $221 |

| Chevrolet Malibu | Midsize | $2,660 | $222 |

| Toyota Corolla | Compact | $2,670 | $223 |

| Kia Forte | Compact | $2,676 | $223 |

| Volkswagen Arteon | Midsize | $2,694 | $225 |

| Nissan Versa | Compact | $2,704 | $225 |

| Subaru Legacy | Midsize | $2,706 | $226 |

| Hyundai Ioniq 6 | Midsize | $2,728 | $227 |

| Mitsubishi Mirage G4 | Compact | $2,768 | $231 |

| Volkswagen Jetta | Compact | $2,772 | $231 |

| Toyota Crown | Midsize | $2,774 | $231 |

| Hyundai Sonata | Midsize | $2,780 | $232 |

| Mazda 3 | Compact | $2,834 | $236 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Worcester, MA Zip Codes. Updated October 24, 2025

See our comprehensive guides for compact car insurance, midsize car insurance, and full-size car insurance to view data for vehicles not featured in the table.

Don’t see your vehicle? No sweat! Enter your zip code at the bottom of the table and click the orange ‘GO’ button to get free Worcester car insurance quotes from top-rated companies in Massachusetts.

Cheapest SUV insurance rates in Worcester, MA

The top three SUVs with the lowest-cost car insurance in Worcester are the Subaru Crosstrek at $2,026 per year, the Chevrolet Trailblazer at $2,060 per year, and the Kia Soul at $2,140 per year.

Rounding out the top 10 are models like the Ford Bronco Sport, Hyundai Venue, Toyota Corolla Cross, and Buick Envision, with average insurance cost of $2,246 per year or less.

Ranked from 10th to 20th place, models like the Volkswagen Taos, Subaru Outback, Honda CR-V, Volkswagen Tiguan, and Honda HR-V average between $2,246 and $2,386 per year for full-coverage insurance in Worcester.

As a cost per month, full-coverage insurance on this segment in Worcester will start around $169 per month, depending on where you live. The next table ranks the SUVs with the most affordable car insurance in Worcester, starting with the Subaru Crosstrek at $169 per month and ending with the Subaru Ascent at $199 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Subaru Crosstrek | Compact | $2,026 | $169 |

| Chevrolet Trailblazer | Compact | $2,060 | $172 |

| Kia Soul | Compact | $2,140 | $178 |

| Nissan Kicks | Compact | $2,158 | $180 |

| Honda Passport | Midsize | $2,186 | $182 |

| Buick Envision | Compact | $2,198 | $183 |

| Toyota Corolla Cross | Compact | $2,210 | $184 |

| Hyundai Venue | Compact | $2,228 | $186 |

| Mazda CX-5 | Compact | $2,236 | $186 |

| Ford Bronco Sport | Compact | $2,246 | $187 |

| Volkswagen Tiguan | Compact | $2,268 | $189 |

| Nissan Murano | Midsize | $2,302 | $192 |

| Buick Encore | Compact | $2,328 | $194 |

| Subaru Outback | Midsize | $2,336 | $195 |

| Honda CR-V | Compact | $2,338 | $195 |

| Buick Envista | Midsize | $2,342 | $195 |

| Volkswagen Taos | Compact | $2,348 | $196 |

| Kia Niro | Compact | $2,360 | $197 |

| Honda HR-V | Compact | $2,386 | $199 |

| Subaru Ascent | Midsize | $2,386 | $199 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Worcester, MA Zip Codes. Updated October 24, 2025

See our guides for compact SUV insurance, midsize SUV insurance, and full-size SUV insurance to compare rates for all makes and models.

Don’t see rates for your SUV? Enter your zip code at the bottom of the table and click the orange ‘GO’ button to get free Worcester car insurance quotes from top-rated auto insurance companies in Massachusetts.

Cheapest sports cars to insure in Worcester

The four most affordable sports cars to insure in Worcester are the Mazda MX-5 Miata at $2,536 per year, Toyota GR86 at $2,890 per year, Ford Mustang at $3,014 per year, and BMW Z4 at $3,028 per year.

Additional models that have cheaper rates are the Toyota GR Supra, BMW M2, Lexus RC F, and Nissan Z, with average annual insurance rates of $3,280 per year or less.

Additional cars that rank well include the Jaguar F-Type, Porsche 911, Chevrolet Corvette, BMW M3, and Porsche 718, which cost between $3,280 and $4,644 per year for insurance.

On a monthly basis, car insurance in Worcester on this segment for a safe driver can cost as low as $211 per month, depending on your location and insurance company. The comparison table below ranks the twenty sports cars with the most affordable insurance rates in Worcester, starting with the Mazda MX-5 Miata at $2,536 per year ($211 per month) and ending with the Porsche Taycan at $4,644 per year ($387 per month).

| Make and Model | Vehicle Type | Annual Premium | Cost Per Month |

|---|---|---|---|

| Mazda MX-5 Miata | Sports Car | $2,536 | $211 |

| Toyota GR86 | Sports Car | $2,890 | $241 |

| Ford Mustang | Sports Car | $3,014 | $251 |

| BMW Z4 | Sports Car | $3,028 | $252 |

| Subaru WRX | Sports Car | $3,078 | $257 |

| Toyota GR Supra | Sports Car | $3,080 | $257 |

| BMW M2 | Sports Car | $3,170 | $264 |

| Nissan Z | Sports Car | $3,176 | $265 |

| Lexus RC F | Sports Car | $3,240 | $270 |

| Subaru BRZ | Sports Car | $3,280 | $273 |

| BMW M3 | Sports Car | $3,462 | $289 |

| Porsche 718 | Sports Car | $3,532 | $294 |

| Chevrolet Camaro | Sports Car | $3,566 | $297 |

| Chevrolet Corvette | Sports Car | $3,800 | $317 |

| Porsche 911 | Sports Car | $3,930 | $328 |

| BMW M4 | Sports Car | $4,092 | $341 |

| Lexus LC 500 | Sports Car | $4,114 | $343 |

| Jaguar F-Type | Sports Car | $4,326 | $361 |

| Mercedes-Benz AMG GT53 | Sports Car | $4,538 | $378 |

| Porsche Taycan | Sports Car | $4,644 | $387 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Worcester, MA Zip Codes. Updated October 24, 2025

Need rates for a different vehicle? Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free car insurance quotes from top companies in Worcester.

Cheapest pickup truck insurance rates in Worcester

Ranking at the top of the list for the cheapest Worcester car insurance rates in the pickup truck segment are the Ford Maverick, Nissan Frontier, Ford Ranger, Chevrolet Colorado, and Nissan Titan. Auto insurance rates for these vehicles average $2,658 or less per year.

Not the cheapest, but still in the top 10, are pickups like the Honda Ridgeline, GMC Canyon, Toyota Tacoma, and Hyundai Santa Cruz, with average annual insurance rates of $2,820 per year or less.

As a cost per month, car insurance in this segment for the average driver can cost as low as $202 per month, depending on the company and your location.

The table below ranks the pickups with the cheapest car insurance in Worcester, starting with the Chevrolet Colorado at $2,418 per year ($202 per month) and ending with the Ram Truck at $3,170 per year ($264 per month).

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Chevrolet Colorado | Midsize | $2,418 | $202 |

| Nissan Titan | Full-size | $2,566 | $214 |

| Nissan Frontier | Midsize | $2,594 | $216 |

| Ford Ranger | Midsize | $2,618 | $218 |

| Ford Maverick | Midsize | $2,658 | $222 |

| Honda Ridgeline | Midsize | $2,720 | $227 |

| Hyundai Santa Cruz | Midsize | $2,766 | $231 |

| Toyota Tacoma | Midsize | $2,778 | $232 |

| GMC Sierra 2500 HD | Heavy Duty | $2,790 | $233 |

| GMC Canyon | Midsize | $2,820 | $235 |

| Jeep Gladiator | Midsize | $2,888 | $241 |

| GMC Sierra 3500 | Heavy Duty | $2,904 | $242 |

| Chevrolet Silverado HD 3500 | Heavy Duty | $2,930 | $244 |

| Chevrolet Silverado HD 2500 | Heavy Duty | $3,010 | $251 |

| GMC Sierra | Full-size | $3,028 | $252 |

| Chevrolet Silverado | Full-size | $3,030 | $253 |

| Nissan Titan XD | Heavy Duty | $3,030 | $253 |

| Ford F150 | Full-size | $3,066 | $256 |

| GMC Hummer EV Pickup | Full-size | $3,146 | $262 |

| Ram Truck | Full-size | $3,170 | $264 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Worcester, MA Zip Codes. Updated October 24, 2025

See our guides for midsize pickup insurance and large pickup insurance to view any trucks not shown in the table.

Don’t see your truck in the table above? No problem! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free car insurance quotes from top auto insurance companies in Massachusetts.

Cheapest luxury cars to insure in Worcester

The four top-ranked luxury cars with the most affordable average insurance rates in Worcester are the Acura Integra at $2,438 per year, BMW 330i at $2,792 per year, Mercedes-Benz CLA250 at $2,822 per year, and Lexus IS 300 at $2,828 per year.

Some other luxury cars that have affordable average insurance rates are the Genesis G70, Cadillac CT4, Lexus RC 300, and Lexus ES 350, with average cost of $2,882 per year or less.

Some additional 2024 luxury models that make the list include the Lexus IS 350, BMW 230i, Lexus RC 350, and BMW 330e, which cost between $2,882 and $3,074 per year for auto insurance.

From a monthly standpoint, auto insurance on this segment in Worcester for a middle-age safe driver can cost as low as $203 per month, depending on where you live and the company you use.

The cheapest compact luxury car to insure in Worcester is the Acura Integra at $2,438 per year. For midsize 2024 models, the Mercedes-Benz CLA250 is cheapest to insure at $2,822 per year. And for full-size luxury cars, the Audi A5 has the cheapest rates at $3,258 per year.

The table below ranks the twenty cars with the most affordable average car insurance rates in Worcester, starting with the Acura Integra at $203 per month and ending with the Audi S3 at $256 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura Integra | Compact | $2,438 | $203 |

| BMW 330i | Compact | $2,792 | $233 |

| Mercedes-Benz CLA250 | Midsize | $2,822 | $235 |

| Lexus IS 300 | Midsize | $2,828 | $236 |

| Acura TLX | Compact | $2,838 | $237 |

| Lexus ES 350 | Midsize | $2,862 | $239 |

| Cadillac CT4 | Compact | $2,864 | $239 |

| Genesis G70 | Compact | $2,870 | $239 |

| Mercedes-Benz AMG CLA35 | Midsize | $2,876 | $240 |

| Lexus RC 300 | Midsize | $2,882 | $240 |

| Lexus IS 350 | Compact | $2,894 | $241 |

| Jaguar XF | Midsize | $2,902 | $242 |

| Cadillac CT5 | Midsize | $2,954 | $246 |

| Lexus ES 250 | Midsize | $2,966 | $247 |

| Lexus RC 350 | Compact | $2,974 | $248 |

| BMW 330e | Compact | $2,978 | $248 |

| BMW 228i | Compact | $2,982 | $249 |

| BMW 230i | Compact | $3,006 | $251 |

| Lexus ES 300h | Midsize | $3,010 | $251 |

| Audi S3 | Compact | $3,074 | $256 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Worcester, MA Zip Codes. Updated October 24, 2025

See our guide for luxury car insurance to view any vehicles not shown in the table.

Don’t see rates for your luxury car? No sweat! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get cheap Worcester car insurance quotes from top-rated companies in Massachusetts.

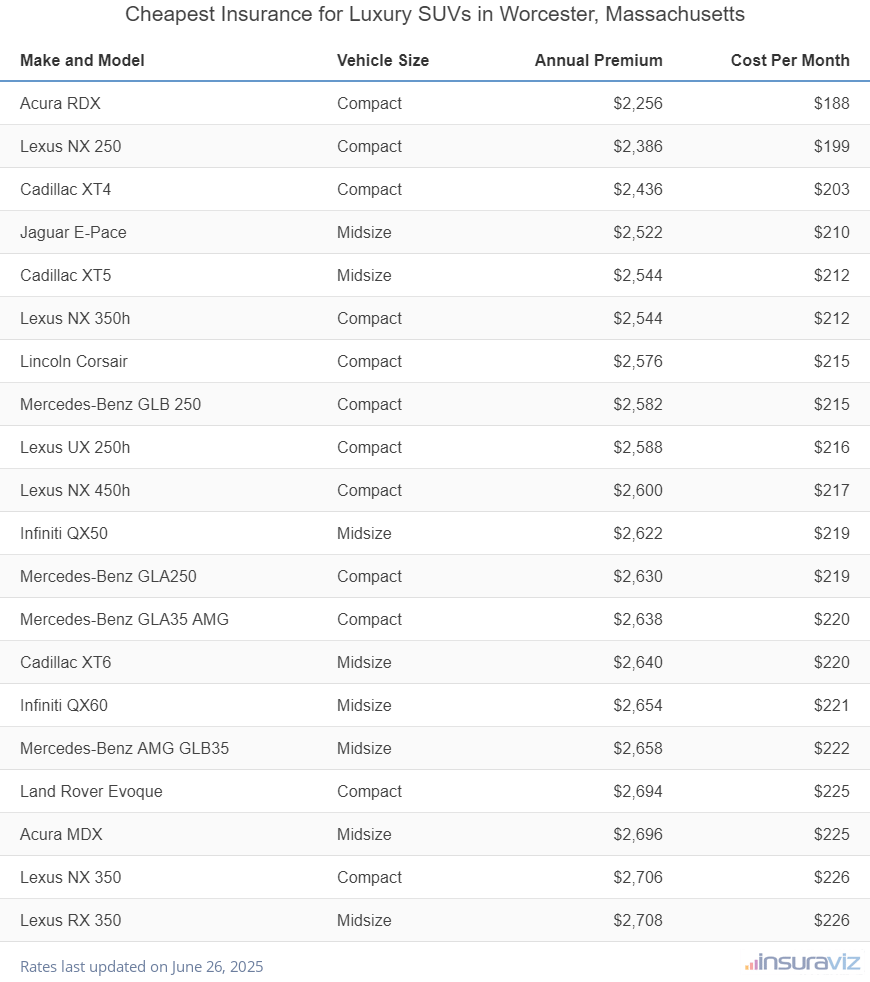

Cheapest luxury SUV insurance rates in Worcester

The four cheapest luxury SUVs to insure in Worcester are the Acura RDX at $2,294 per year, Lexus NX 250 at $2,428 per year, Cadillac XT4 at $2,476 per year, and Jaguar E-Pace at $2,564 per year.

Additional models that are affordable to insure include the Lexus NX 450h, Lincoln Corsair, Lexus NX 350h, and Lexus UX 250h, with an average cost of $2,644 per year or less.

Full-coverage insurance for this segment in Worcester can cost as low as $191 per month, depending on the company and where you live. The rate comparison table below ranks the twenty SUVs with the cheapest average auto insurance rates in Worcester, starting with the Acura RDX at $2,294 per year ($191 per month) and ending with the Lexus RX 350 at $2,752 per year ($229 per month).

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura RDX | Compact | $2,294 | $191 |

| Lexus NX 250 | Compact | $2,428 | $202 |

| Cadillac XT4 | Compact | $2,476 | $206 |

| Jaguar E-Pace | Midsize | $2,564 | $214 |

| Cadillac XT5 | Midsize | $2,586 | $216 |

| Lexus NX 350h | Compact | $2,588 | $216 |

| Lincoln Corsair | Compact | $2,618 | $218 |

| Mercedes-Benz GLB 250 | Compact | $2,624 | $219 |

| Lexus UX 250h | Compact | $2,628 | $219 |

| Lexus NX 450h | Compact | $2,644 | $220 |

| Infiniti QX50 | Midsize | $2,664 | $222 |

| Mercedes-Benz GLA250 | Compact | $2,674 | $223 |

| Mercedes-Benz GLA35 AMG | Compact | $2,682 | $224 |

| Cadillac XT6 | Midsize | $2,684 | $224 |

| Infiniti QX60 | Midsize | $2,698 | $225 |

| Mercedes-Benz AMG GLB35 | Midsize | $2,700 | $225 |

| Land Rover Evoque | Compact | $2,736 | $228 |

| Acura MDX | Midsize | $2,740 | $228 |

| Lexus NX 350 | Compact | $2,750 | $229 |

| Lexus RX 350 | Midsize | $2,752 | $229 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Worcester, MA Zip Codes. Updated October 24, 2025

See our comprehensive guide for luxury SUV insurance to view data for vehicles not featured in the table.

Don’t see rates for your luxury SUV? No sweat! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get cheap Worcester car insurance quotes from the best companies in Massachusetts.

Prices vary based on driver risk

To reinforce the amount that the cost of a car insurance policy can fluctuate for different drivers (and also emphasize the importance of accurate rate quotes), the sections below present detailed car insurance rates for four popular vehicles in Worcester: the Ford F150, Nissan Sentra, Toyota RAV4, and Honda Pilot.

Each example shows average rates for a range of driver profiles to show the potential rate difference based on driver risk or policy deductible limits.

Ford F150 insurance rates

Auto insurance for a Ford F150 in Worcester costs an average of $3,066 per year (about $256 per month) and has a range of $2,546 to $7,086 per year for the different driver risk profiles in the next insurance cost chart.

The Ford F150 is considered a full-size truck, and other similar models from the same segment include the Toyota Tundra, Ram Truck, and GMC Sierra.

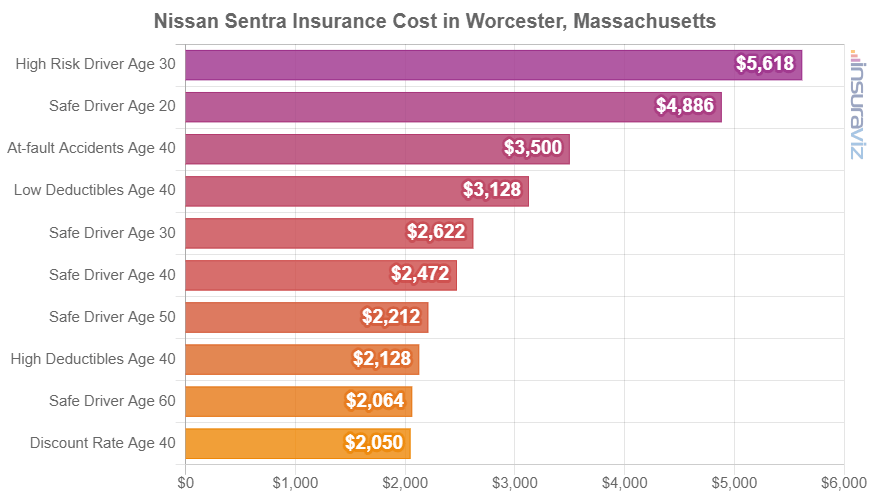

Nissan Sentra insurance rates

Auto insurance for a Nissan Sentra in Worcester averages $2,512 per year, or around $209 per month, and varies from $2,088 to $5,712.

The Nissan Sentra belongs to the compact car segment, and other top-selling models from the same segment include the Hyundai Elantra, Toyota Corolla, and Honda Civic.

Toyota RAV4 insurance rates

Toyota RAV4 insurance in Worcester costs an average of $2,530 per year (about $211 per month) and ranges from $2,104 to $5,820 annually.

The Toyota RAV4 is part of the compact SUV segment, and additional similar models include the Subaru Forester, Nissan Rogue, and Mazda CX-5.

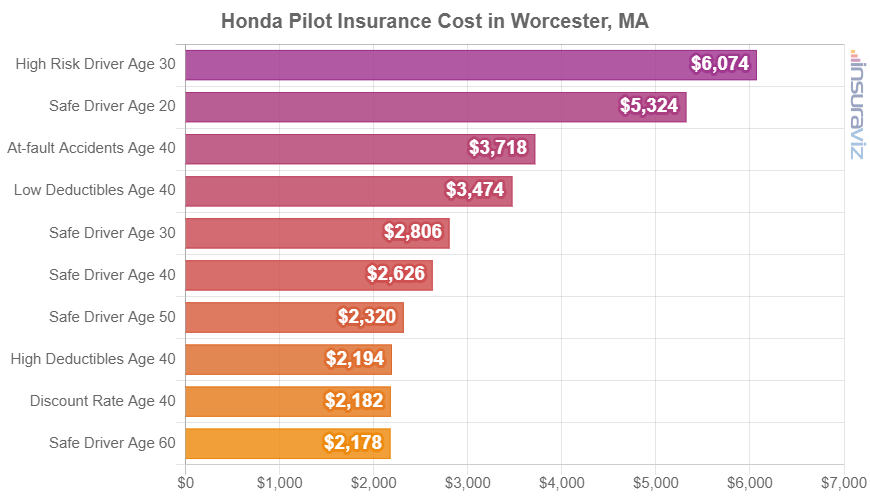

Honda Pilot insurance rates

Honda Pilot insurance in Worcester costs an average of $2,668 per year, or about $222 per month, and has a range of $2,220 to $6,172 annually.

The Honda Pilot is considered a midsize SUV, and additional similar models include the Ford Edge, Kia Sorento, and Toyota Highlander.

How to save on car insurance in Worcester

Resourceful drivers in Worcester are always looking to save money on insurance, so take a minute or two to look through the money-saving ideas in this next list and maybe you’ll be able to save a little money on your next policy.

- More discounts equals more savings. Discounted rates may be available if the insured drivers insure their home and car with the same company, are homeowners, are accident-free, insure multiple vehicles on the same policy, or many other policy discounts which could save the average Worcester driver as much as $462 per year.

- Raising physical damage deductibles lowers cost. Raising the comprehensive and collision deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.

- Your job could save you money. The large majority of car insurance providers offer policy discounts for certain occupations like emergency medical technicians, lawyers, nurses, police officers and law enforcement, architects, and others. If your profession qualifies you for this discount, you may save between $82 and $267 on your annual insurance cost.

- Pay small claims out-of-pocket. Car insurance companies offer a discount for not filing any claims. Insurance should only be used to protect you from significant claims, not for minor claims that can easily be paid out-of-pocket.

- Compare insurance costs before buying a car. Different models, and even different trim levels of the same model, have very different costs for insurance, and car insurance companies can sell coverages with a wide range of costs. Check the cost of insurance before you purchase so you can avoid insurance sticker shock when you see your first insurance bill.

- Choose vehicles that have cheaper auto insurance. Vehicle type has a big impact on the price you pay for insurance. As an example, a Kia Sportage costs $2,346 less per year to insure in Worcester than a BMW i8. Buy cheaper models and save money.

- Avoid accidents to save on Worcester car insurance. Too many at-fault accidents can cost more, possibly as much as $1,324 per year for a 30-year-old driver and as much as $828 per year for a 50-year-old driver. So drive safe and save!