- Kia Soul insurance costs an average of $1,872 per year or around $156 per month, depending on the trim level.

- With an insurance cost range of $134, the cheapest Soul trim level to insure is the LX at around $1,792 per year, and the most expensive trim being the EX at $1,926 annually.

- The Soul ranks third out of 47 vehicles in the small SUV class for insurance affordability.

- On a state level, average insurance rates range from a low of $1,426 per year in Maine to $2,256 in Michigan. Rates in some of the larger cities in the U.S. include $1,824 in Fort Worth, TX, $1,932 in Milwaukee, WI, and $2,140 in San Jose, CA.

How much does Kia Soul insurance cost?

Car insurance on a 2024 Kia Soul averages $1,872 per year. Drivers can expect to have a monthly insurance payment of around $149 for the cheapest LX Soul model.

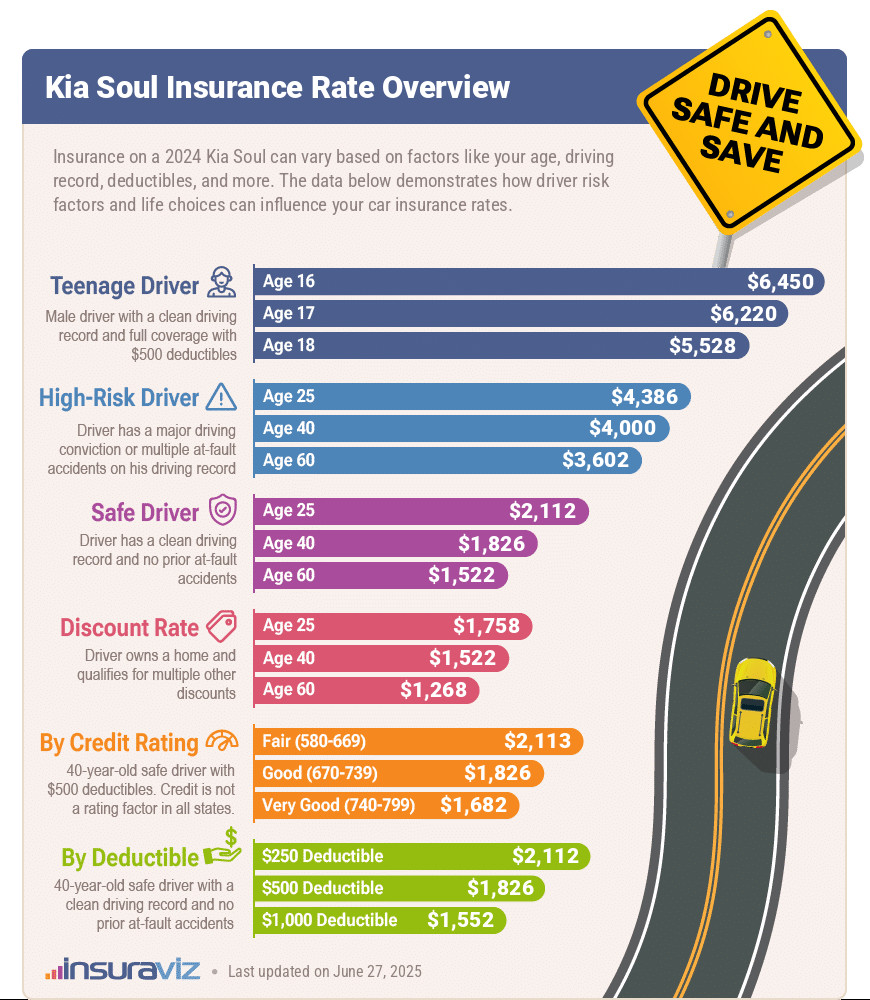

The infographic below details average 2024 Kia Soul insurance rates using different risk profiles and driver ages.

The data in the graphic shows how much rates can vary based on different driver ages, risk profiles, and policy coverages. From a low of $1,300 per year for a 60-year-old driver who qualifies for discounts up to $6,608 for a 16-year-old driver.

The majority of drivers will fall into the Safe Driver category, with variations of that rate dependent upon credit score and policy deductibles.

Your location is another factor that has considerable impact on your rate. State insurance laws vary and some states use a no-fault legal structure for car insurance damages. This results in higher rates in those states. Other states use a tort structure, which helps keep car insurance rates down.

Which Kia Soul trim levels are cheap to insure?

With Kia Soul car insurance rates ranging from $1,792 to $1,926 annually, the most budget-friendly model to insure is the LX. The second cheapest trim level to insure is the S at $1,874 per year. Plan on budgeting a minimum of $149 per month for full coverage insurance.

The costliest models of Kia Soul to insure are the EX at $1,926 and the GT-Line at $1,902 per year. Those trims will cost an extra $134 and $110 per year, respectively, over the least expensive LX model.

The next table shows the average annual, 6-month, and monthly full coverage auto insurance costs for the 2024 Kia Soul.

| 2024 Kia Soul Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| LX | $1,792 | $149 |

| S | $1,874 | $156 |

| GT-Line | $1,902 | $159 |

| EX | $1,926 | $161 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Kia Soul vs. small SUVs: Where does insurance cost rank?

The Kia Soul ranks third out of 47 total vehicles in the 2024 small SUV segment for insurance affordability. The Soul costs an average of $1,872 per year for insurance, while the segment average rate is $2,206 per year, a difference of $334 per year.

When average rates are compared to the top-selling vehicles in the small SUV segment, insurance for a Kia Soul costs $340 less per year than the Toyota RAV4, $174 less than the Honda CR-V, $338 less than the Chevrolet Equinox, and $282 less than the Nissan Rogue.

The table below shows how the entire 2024 compact SUV class ranks for insurance cost, and also shows the difference in average annual cost between each model and the Kia Soul.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,772 | -$100 |

| 2 | Chevrolet Trailblazer | $1,804 | -$68 |

| 3 | Kia Soul | $1,872 | -- |

| 4 | Nissan Kicks | $1,888 | $16 |

| 5 | Buick Envision | $1,922 | $50 |

| 6 | Toyota Corolla Cross | $1,932 | $60 |

| 7 | Hyundai Venue | $1,950 | $78 |

| 8 | Mazda CX-5 | $1,956 | $84 |

| 9 | Ford Bronco Sport | $1,966 | $94 |

| 10 | Volkswagen Tiguan | $1,984 | $112 |

| 11 | Buick Encore | $2,038 | $166 |

| 12 | Honda CR-V | $2,046 | $174 |

| 13 | Volkswagen Taos | $2,056 | $184 |

| 14 | Kia Niro | $2,066 | $194 |

| 15 | Honda HR-V | $2,088 | $216 |

| 16 | Subaru Forester | $2,134 | $262 |

| 17 | Kia Seltos | $2,144 | $272 |

| 18 | GMC Terrain | $2,148 | $276 |

| 19 | Nissan Rogue | $2,154 | $282 |

| 20 | Hyundai Kona | $2,158 | $286 |

| 21 | Mazda CX-30 | $2,164 | $292 |

| 22 | Volkswagen ID4 | $2,176 | $304 |

| 23 | Ford Escape | $2,188 | $316 |

| 24 | Chevrolet Equinox | $2,210 | $338 |

| 25 | Toyota RAV4 | $2,212 | $340 |

| 26 | Mazda MX-30 | $2,226 | $354 |

| 27 | Hyundai Tucson | $2,232 | $360 |

| 28 | Chevrolet Trax | $2,264 | $392 |

| 29 | Mini Cooper Clubman | $2,274 | $402 |

| 30 | Mini Cooper | $2,278 | $406 |

| 31 | Mitsubishi Eclipse Cross | $2,302 | $430 |

| 32 | Jeep Renegade | $2,308 | $436 |

| 33 | Mitsubishi Outlander | $2,336 | $464 |

| 34 | Kia Sportage | $2,350 | $478 |

| 35 | Hyundai Ioniq 5 | $2,358 | $486 |

| 36 | Fiat 500X | $2,368 | $496 |

| 37 | Mini Cooper Countryman | $2,374 | $502 |

| 38 | Subaru Solterra | $2,376 | $504 |

| 39 | Mazda CX-50 | $2,380 | $508 |

| 40 | Nissan Ariya | $2,386 | $514 |

| 41 | Toyota bz4X | $2,390 | $518 |

| 42 | Mitsubishi Mirage | $2,398 | $526 |

| 43 | Kia EV6 | $2,474 | $602 |

| 44 | Dodge Hornet | $2,554 | $682 |

| 45 | Jeep Compass | $2,594 | $722 |

| 46 | Hyundai Nexo | $2,648 | $776 |

| 47 | Ford Mustang Mach-E | $2,806 | $934 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

How much is insurance on a used Kia Soul?

Skipping the newest models and instead driving a used Soul can definitely save money on insurance. For example, the annual insurance cost for a 2013 Soul is $580 cheaper on average than a 2024 model. Since older models have less value due to depreciation, insurance costs less.

The data below shows typical Kia Soul insurance rates for new and used models back to the 2013 model year. Average policy cost ranges from the cheapest rate of $1,090 for a 60-year-old driver rated on a 2013 Kia Soul to the highest rate of $3,736 for a 20-year-old with a 2019 Soul.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Kia Soul | $3,710 | $1,872 | $1,560 |

| 2023 Kia Soul | $4,178 | $2,070 | $1,730 |

| 2022 Kia Soul | $4,174 | $2,070 | $1,730 |

| 2021 Kia Soul | $3,700 | $1,832 | $1,532 |

| 2020 Kia Soul | $3,592 | $1,778 | $1,486 |

| 2019 Kia Soul | $3,736 | $1,850 | $1,544 |

| 2018 Kia Soul | $3,516 | $1,744 | $1,456 |

| 2017 Kia Soul | $3,358 | $1,662 | $1,392 |

| 2016 Kia Soul | $3,294 | $1,640 | $1,378 |

| 2015 Kia Soul | $3,034 | $1,512 | $1,270 |

| 2014 Kia Soul | $2,692 | $1,336 | $1,126 |

| 2013 Kia Soul | $2,586 | $1,292 | $1,090 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Kia Soul trim levels for each model year. Updated October 24, 2025

Eventually, as a vehicle gets some miles on it, it probably will make sense to drop the physical damage coverages from an insurance policy. As a vehicle ages, the cost required to keep physical damage coverage exceeds the benefits of having it.

Deleting physical damage coverage on an older Kia Soul could save around $616 annually, depending on the deductible level and the age of the rated driver.

Average Kia Soul insurance rates by location

The insurance cost for a Soul varies widely from cheaper premiums like $1,614 a year in Columbus, OH, or $1,460 in Raleigh, NC, to expensive rates such as $2,722 a year in Los Angeles, CA, and $2,732 in Philadelphia.

The insurance costs for a Kia Soul in some other cities include Seattle, WA, at $1,990 per year, Boston, MA, costing $2,068, Albuquerque, NM, at $1,908, and Colorado Springs, CO, averaging $2,170.

The chart below visualizes typical insurance policy costs for a Kia Soul for the thirty largest cities in America.

When looking at average Kia Soul rates from the state level, states like Virginia ($1,508), Maine ($1,426), and Iowa ($1,514) tend to have cheaper car insurance rates, while states like Michigan ($2,256), Louisiana ($2,104), and Florida ($2,180) have higher insurance rates.

The table below details annual, semi-annual, and monthly average insurance rates for the Kia Soul in all fifty U.S. states.

| U.S. State | Annual Premium | Cost Per Month |

|---|---|---|

| Alabama | $1,832 | $153 |

| Alaska | $1,636 | $136 |

| Arizona | $1,852 | $154 |

| Arkansas | $2,028 | $169 |

| California | $2,250 | $188 |

| Colorado | $2,064 | $172 |

| Connecticut | $2,120 | $177 |

| Delaware | $2,154 | $180 |

| Florida | $2,180 | $182 |

| Georgia | $1,998 | $167 |

| Hawaii | $1,534 | $128 |

| Idaho | $1,574 | $131 |

| Illinois | $1,802 | $150 |

| Indiana | $1,620 | $135 |

| Iowa | $1,514 | $126 |

| Kansas | $1,946 | $162 |

| Kentucky | $2,062 | $172 |

| Louisiana | $2,104 | $175 |

| Maine | $1,426 | $119 |

| Maryland | $1,870 | $156 |

| Massachusetts | $2,088 | $174 |

| Michigan | $2,256 | $188 |

| Minnesota | $1,772 | $148 |

| Mississippi | $1,932 | $161 |

| Missouri | $2,140 | $178 |

| Montana | $1,854 | $155 |

| Nebraska | $1,740 | $145 |

| Nevada | $2,234 | $186 |

| New Hampshire | $1,518 | $127 |

| New Jersey | $2,256 | $188 |

| New Mexico | $1,724 | $144 |

| New York | $2,180 | $182 |

| North Carolina | $1,456 | $121 |

| North Dakota | $1,732 | $144 |

| Ohio | $1,554 | $130 |

| Oklahoma | $2,106 | $176 |

| Oregon | $1,876 | $156 |

| Pennsylvania | $1,912 | $159 |

| Rhode Island | $2,292 | $191 |

| South Carolina | $1,746 | $146 |

| South Dakota | $2,004 | $167 |

| Tennessee | $1,902 | $159 |

| Texas | $1,868 | $156 |

| Utah | $1,798 | $150 |

| Vermont | $1,596 | $133 |

| Virginia | $1,508 | $126 |

| Washington | $1,832 | $153 |

| West Virginia | $1,816 | $151 |

| Wisconsin | $1,578 | $132 |

| Wyoming | $1,816 | $151 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

Additional rates and observations

- Good credit can save money. In states that have laws allowing a driver’s credit history to be used as a factor in determining insurance rates, drivers who have credit scores over 800 could experience savings as high as $294 per year versus a credit score ranging from 670-739. Conversely, a weak credit rating could cost around $341 more per year.

- Lower the cost of your policy by increasing deductibles. Boosting your deductibles from $500 to $1,000 could save around $280 per year for a 40-year-old driver and $536 per year for a 20-year-old driver.

- Low physical damage deductibles increase costs. Cutting your deductibles from $500 to $250 could cost an additional $292 per year for a 40-year-old driver and $564 per year for a 20-year-old driver.

- Tickets and violations cost money. To get the best deal on Soul insurance rates, it pays to avoid traffic tickets. In fact, just a few traffic citations can raise policy rates by at least $490 per year.

- Avoiding accidents saves money. Causing frequent accidents will increase insurance cost, potentially up to $2,610 per year for a 20-year-old driver and as much as $448 per year for a 60-year-old driver.

- Policy discounts mean cheaper Soul insurance. Discounts may be available if the insured drivers are homeowners, are military or federal employees, are accident-free, insure multiple vehicles on the same policy, are claim-free, or many other discounts which could save the average driver as much as $314 per year on the cost of insuring a Soul.

- Get cheaper rates because of your choice of occupation. Some auto insurance providers offer discounts for working in professions like engineers, nurses, members of the military, college professors, lawyers, and other occupations. Being employed in a qualifying occupation could save between $56 and $233 on your yearly Soul insurance cost, subject to the policy coverages selected.