- Mobile, AL car insurance rates average $2,478 per year for full coverage, or about $207 on a monthly basis.

- Mobile auto insurance costs $134 per year more than the Alabama state average cost and $202 per year more than the average for all 50 states.

- Car insurance rates for a few popular vehicles in Mobile include the Subaru Forester at $184 per month, Honda Accord at $200, and Jeep Cherokee at $223.

- For cheap car insurance in Mobile, small crossovers likethe Ford Bronco Sport, Hyundai Venue, and Nissan Kicks have the best rates.

- A few vehicles with the lowest cost auto insurance in Mobile in their segment include the Acura Integra, Jaguar E-Pace, Acura RDX, and Mercedes-Benz CLA250.

How much does Mobile car insurance cost?

Average car insurance rates in Mobile cost $2,478 per year, or about $207 per month. When compared to the U.S. overall average rate, Mobile car insurance cost is 8.5% more expensive per year.

The average cost of car insurance in Alabama is $2,344 per year, so Mobile, Alabama, drivers pay an average of $134 more per year than the overall Alabama state-wide average rate. The average cost of car insurance in Mobile compared to other Alabama cities is approximately $54 per year cheaper than in Birmingham, $102 per year more expensive than in Montgomery, and $158 per year more than in Huntsville.

The age of the driver has the single biggest impact on the price you pay for auto insurance. The list below details how driver age influences cost by breaking out average car insurance rates in Mobile based on the age of the driver.

Average cost of car insurance in Mobile, Alabama, for drivers age 16 to 60

- 16 year old – $8,826 per year or $736 per month

- 17 year old – $8,551 per year or $713 per month

- 18 year old – $7,663 per year or $639 per month

- 19 year old – $6,981 per year or $582 per month

- 20 year old – $4,984 per year or $415 per month

- 30 year old – $2,644 per year or $220 per month

- 40 year old – $2,478 per year or $207 per month

- 50 year old – $2,196 per year or $183 per month

- 60 year old – $2,056 per year or $171 per month

The next chart shows average Mobile auto insurance cost broken out not only by the age of the driver, but also by three different physical damage coverage deductibles. Rates are averaged for all 2024 vehicle models including luxury models.

In the chart above, the cost of car insurance in Mobile ranges from $1,738 per year for a 60-year-old driver with a high deductible policy to $5,796 per year for a 20-year-old driver with policy with low comprehensive and collision deductibles. When converted to a monthly rate, the average cost in the previous chart ranges from $145 to $483 per month.

Mobile car insurance rates have extreme variability and slight changes in driver risk profiles can have consequential effects on car insurance cost. The potential for significant variability reinforces the need to get accurate auto insurance quotes when shopping for the cheapest car insurance.

The cost to insure specific vehicles

The car insurance costs referenced previously take all 2024 models and come up with an average cost, which is handy when making big picture comparisons like the average cost difference for different locations or driver risk profiles. But for more useful auto insurance rate comparisons, the cost data will be more precise if we compare rates for the specific make and model of vehicle being insured.

If you read farther in this article, we show lots of rates for different makes and models, but for now, a handful of the most popular vehicles will be shown to see how car insurance prices size up in Mobile.

The list below displays average insurance rates for both annual and monthly policy terms for popular cars, trucks, and SUVs on the streets of Mobile. Later, we’ll explore insurance cost for a few of these models in much more detail.

Average auto insurance rates for popular Mobile vehicles

- Subaru Forester – $2,206 per year or $184 per month

- Honda Accord – $2,396 per year or $200 per month

- Jeep Cherokee – $2,674 per year or $223 per month

- Nissan Altima – $2,684 per year or $224 per month

- Honda CR-V – $2,112 per year or $176 per month

- Ford Escape – $2,260 per year or $188 per month

- Chevrolet Silverado – $2,740 per year or $228 per month

- Nissan Rogue – $2,226 per year or $186 per month

- Toyota Camry – $2,662 per year or $222 per month

- Honda Civic – $2,194 per year or $183 per month

The most popular vehicles in Mobile tend to be compact and midsize cars like the Honda Civic and Toyota Camry and compact and midsize SUVs like the Nissan Rogue and Toyota Highlander.

Some additional popular models in Mobile from other segments include luxury models like the Infiniti Q50, Acura MDX, and Lexus RX 350 and sports cars like the Nissan GT-R, Chevy Corvette, and Audi TT.

We will get into auto insurance rates for many more models in a bit, but before that, let’s go over the key concepts that we have covered in the data above.

- Car insurance cost decreases the older you are – Insurance rates for a 50-year-old driver in Mobile are $2,788 per year cheaper than for a 20-year-old driver.

- Car insurance rates drop a lot in your twenties – The average 30-year-old Mobile, Alabama, driver will pay $2,340 less each year than a 20-year-old driver, $2,644 versus $4,984.

- Low deductibles cost more than high deductibles – A 40-year-old driver pays an average of $804 more per year for $250 physical damage deductibles versus $1,000.

- Mobile car insurance prices are more expensive than the Alabama state average – $2,478 (Mobile average) compared to $2,344 (Alabama average)

- Teenage females pay less than teenage males – Teenage female drivers age 16 to 19 pay $1,080 to $582 less per year than their male counterparts.

- Mobile, Alabama, car insurance costs more than the U.S. average – $2,478 (Mobile average) versus $2,276 (U.S. average)

Which vehicles are cheapest to insure in Mobile, Alabama?

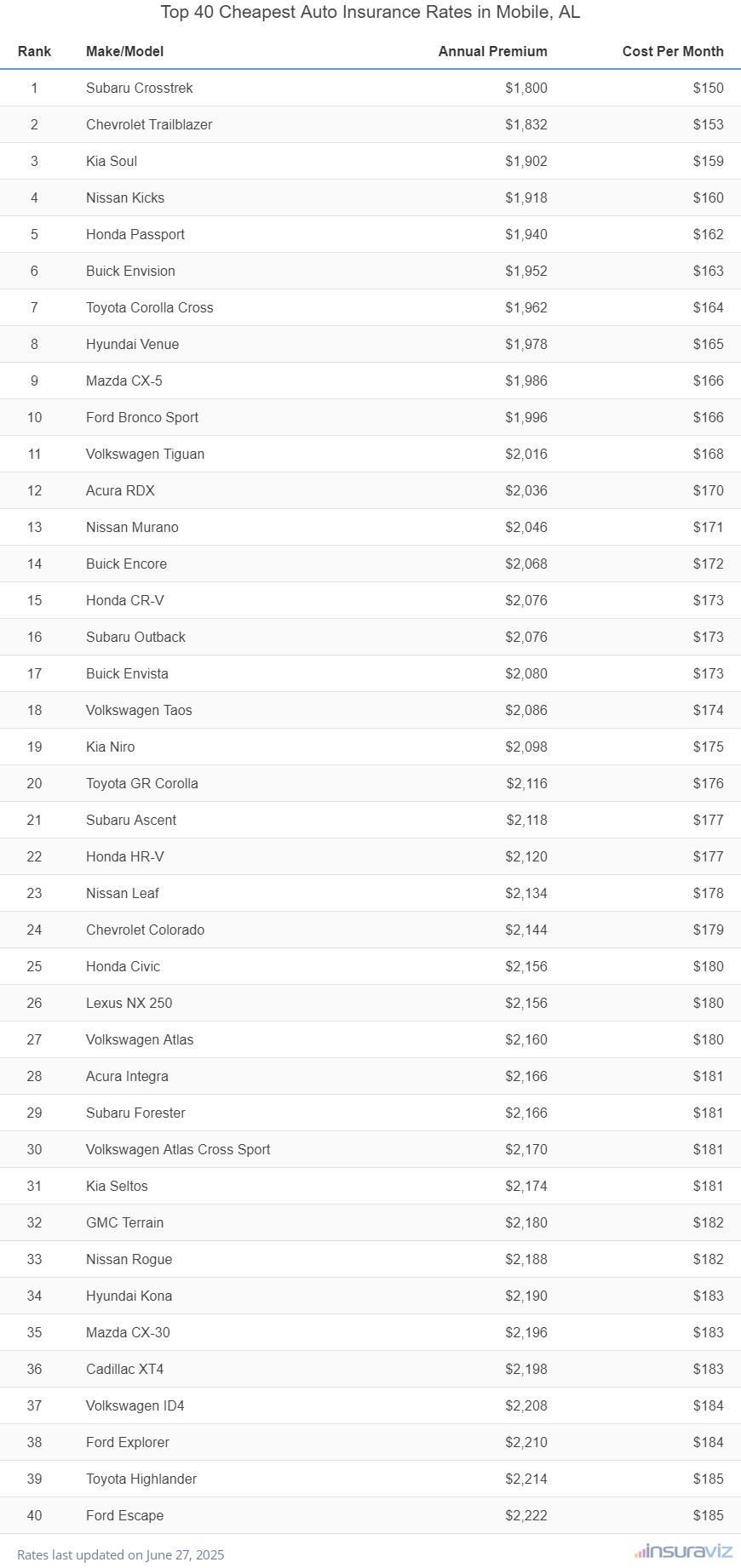

The vehicles with the most affordable car insurance prices in Mobile, AL, tend to be crossover SUVs like the Kia Soul, Chevrolet Trailblazer, Hyundai Venue, and Toyota Corolla Cross. Average auto insurance quotes for those vehicles cost $2,014 or less per year for a policy with full coverage.

A few other models that rank towards the top in the cost comparison table are the Buick Envista, Volkswagen Tiguan, Buick Encore, and Kia Niro. Rates are slightly higher for those models than the cheapest small SUVs at the top of the list, but they still have an average cost of $2,152 or less per year in Mobile.

The following table lists the 40 cars, trucks, and SUVs with the cheapest insurance rates in Mobile, ordered starting with the cheapest.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,780 | $148 |

| 2 | Chevrolet Trailblazer | $1,810 | $151 |

| 3 | Kia Soul | $1,882 | $157 |

| 4 | Nissan Kicks | $1,898 | $158 |

| 5 | Honda Passport | $1,914 | $160 |

| 6 | Buick Envision | $1,928 | $161 |

| 7 | Toyota Corolla Cross | $1,944 | $162 |

| 8 | Hyundai Venue | $1,962 | $164 |

| 9 | Mazda CX-5 | $1,964 | $164 |

| 10 | Ford Bronco Sport | $1,972 | $164 |

| 11 | Volkswagen Tiguan | $1,992 | $166 |

| 12 | Acura RDX | $2,012 | $168 |

| 13 | Nissan Murano | $2,022 | $169 |

| 14 | Buick Encore | $2,044 | $170 |

| 15 | Subaru Outback | $2,050 | $171 |

| 16 | Honda CR-V | $2,052 | $171 |

| 17 | Buick Envista | $2,064 | $172 |

| 18 | Volkswagen Taos | $2,066 | $172 |

| 19 | Kia Niro | $2,072 | $173 |

| 20 | Subaru Ascent | $2,090 | $174 |

| 21 | Toyota GR Corolla | $2,090 | $174 |

| 22 | Honda HR-V | $2,098 | $175 |

| 23 | Nissan Leaf | $2,110 | $176 |

| 24 | Chevrolet Colorado | $2,120 | $177 |

| 25 | Lexus NX 250 | $2,128 | $177 |

| 26 | Honda Civic | $2,130 | $178 |

| 27 | Volkswagen Atlas | $2,132 | $178 |

| 28 | Acura Integra | $2,138 | $178 |

| 29 | Volkswagen Atlas Cross Sport | $2,142 | $179 |

| 30 | Subaru Forester | $2,144 | $179 |

| 31 | GMC Terrain | $2,154 | $180 |

| 32 | Kia Seltos | $2,154 | $180 |

| 33 | Nissan Rogue | $2,166 | $181 |

| 34 | Hyundai Kona | $2,170 | $181 |

| 35 | Cadillac XT4 | $2,172 | $181 |

| 36 | Mazda CX-30 | $2,174 | $181 |

| 37 | Volkswagen ID4 | $2,182 | $182 |

| 38 | Ford Explorer | $2,184 | $182 |

| 39 | Toyota Highlander | $2,188 | $182 |

| 40 | Toyota Venza | $2,196 | $183 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Mobile, AL Zip Codes. Updated October 24, 2025

A table showing 40 vehicle models with cheap Mobile car insurance is great if you’re just wanting the lowest rates. Considering we track over 700 vehicles, the majority of models get omitted from the list. Let’s rethink this, dig deeper, and list the vehicles with the best rates a better way.

This next section goes into more detail about the average cost of car insurance by vehicle segment. The average rates shown will give you a better idea of which vehicles have the overall most affordable auto insurance rates in Mobile. If you read beyond the chart, the next six sections display the 20 models with the cheapest car insurance in each unique segment.

Insurance rates by vehicle segment

If you’re looking around at new or used cars, it’s in your best interest to know which styles of vehicles have better insurance rates.

To illustrate this, maybe you’re wondering if midsize cars are cheaper to insure than full-size cars or if regular SUVs cost less to insure than luxury SUVs.

The next chart displays the average cost of car insurance rates in Mobile for different vehicle segments. From a segment comparison perspective, compact and midsize SUVs, vans, and midsize pickups tend to have the most affordable rates, while exotic models have the most expensive average cost to insure.

Average insurance rates by segment are precise enough for making an overall comparison, but cost ranges considerably within each automotive segment displayed in the above chart.

For example, in the small SUV segment, average Mobile insurance rates range from the Subaru Crosstrek costing $1,830 per year for a full coverage policy up to the Ford Mustang Mach-E at $2,896 per year.

Also, in the large SUV segment, the cost of insurance ranges from the Chevrolet Tahoe costing $2,326 per year up to the Toyota Sequoia costing $3,102 per year, a difference of $776 within that segment.

In the next parts of this article, we remove some of this variability by comparing the cost of car insurance in Mobile on a model level.

Cheapest cars to insure in Mobile

The lowest-cost sedans and hatchbacks to insure in Mobile are the Toyota GR Corolla at $2,152 per year, the Nissan Leaf at $2,168 per year, and the Honda Civic at $2,194 per year.

Additional models that are affordable to insure are the Toyota Prius, Toyota Corolla, Kia K5, and Honda Accord, with an average cost to insure of $2,414 per year or less.

On a monthly basis, full-coverage auto insurance on this segment in Mobile starts at an average of $179 per month, depending on where you live and the company you use.

If ranked by vehicle size, the most affordable non-luxury compact car to insure in Mobile is the Toyota GR Corolla at $2,152 per year. For midsize models, the Kia K5 has the best rates at $2,386 per year. And for full-size sedans, the Chrysler 300 is the cheapest model to insure at $2,360 per year.

The next table ranks the cars with the most affordable insurance rates in Mobile, starting with the Toyota GR Corolla at $179 per month and ending with the Mazda 3 at $214 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Toyota GR Corolla | Compact | $2,152 | $179 |

| Nissan Leaf | Compact | $2,168 | $181 |

| Honda Civic | Compact | $2,194 | $183 |

| Nissan Sentra | Compact | $2,272 | $189 |

| Subaru Impreza | Compact | $2,276 | $190 |

| Toyota Prius | Compact | $2,316 | $193 |

| Kia K5 | Midsize | $2,386 | $199 |

| Honda Accord | Midsize | $2,396 | $200 |

| Chevrolet Malibu | Midsize | $2,406 | $201 |

| Toyota Corolla | Compact | $2,414 | $201 |

| Kia Forte | Compact | $2,422 | $202 |

| Volkswagen Arteon | Midsize | $2,436 | $203 |

| Nissan Versa | Compact | $2,444 | $204 |

| Subaru Legacy | Midsize | $2,444 | $204 |

| Hyundai Ioniq 6 | Midsize | $2,466 | $206 |

| Mitsubishi Mirage G4 | Compact | $2,500 | $208 |

| Toyota Crown | Midsize | $2,508 | $209 |

| Volkswagen Jetta | Compact | $2,508 | $209 |

| Hyundai Sonata | Midsize | $2,510 | $209 |

| Mazda 3 | Compact | $2,562 | $214 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Mobile, AL Zip Codes. Updated October 24, 2025

For all vehicle comparisons, see our guides for compact car insurance, midsize car insurance, and full-size car insurance.

Looking for a different vehicle? Enter your zip code at the bottom of the table and click the orange ‘GO’ button to get free car insurance quotes from top auto insurance companies in Alabama.

Cheapest SUVs to insure in Mobile

The top three non-luxury SUVs with the lowest-cost average insurance rates in Mobile are the Subaru Crosstrek at $1,830 per year, the Chevrolet Trailblazer at $1,862 per year, and the Kia Soul at $1,932 per year.

Other SUVs that have cheaper rates are the Hyundai Venue, Ford Bronco Sport, Toyota Corolla Cross, and Mazda CX-5, with average rates of $2,028 per year or less.

As a cost per month, auto insurance rates in Mobile on this segment starts at an average of $153 per month, depending on where you live.

When ranked by vehicle size, the lowest-cost compact SUV to insure in Mobile is the Subaru Crosstrek at $1,830 per year. For midsize SUVs, the Honda Passport has the cheapest rates at $1,974 per year. And for full-size non-luxury SUVs, the Chevrolet Tahoe has the cheapest rates at $2,326 per year.

The comparison table below ranks the SUVs with the lowest-cost auto insurance rates in Mobile.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Subaru Crosstrek | Compact | $1,830 | $153 |

| Chevrolet Trailblazer | Compact | $1,862 | $155 |

| Kia Soul | Compact | $1,932 | $161 |

| Nissan Kicks | Compact | $1,952 | $163 |

| Honda Passport | Midsize | $1,974 | $165 |

| Buick Envision | Compact | $1,986 | $166 |

| Toyota Corolla Cross | Compact | $1,996 | $166 |

| Hyundai Venue | Compact | $2,014 | $168 |

| Mazda CX-5 | Compact | $2,020 | $168 |

| Ford Bronco Sport | Compact | $2,028 | $169 |

| Volkswagen Tiguan | Compact | $2,050 | $171 |

| Nissan Murano | Midsize | $2,082 | $174 |

| Buick Encore | Compact | $2,104 | $175 |

| Subaru Outback | Midsize | $2,110 | $176 |

| Honda CR-V | Compact | $2,112 | $176 |

| Buick Envista | Midsize | $2,118 | $177 |

| Volkswagen Taos | Compact | $2,122 | $177 |

| Kia Niro | Compact | $2,134 | $178 |

| Honda HR-V | Compact | $2,156 | $180 |

| Subaru Ascent | Midsize | $2,156 | $180 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Mobile, AL Zip Codes. Updated October 24, 2025

See our guides for compact SUV insurance, midsize SUV insurance, and full-size SUV insurance to view any vehicles not shown in the table.

Is your SUV not in the list? No problem! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free car insurance quotes from top companies in Alabama.

Cheapest sports cars to insure in Mobile

The Mazda MX-5 Miata ranks in the top spot for the most affordable sports car to insure in Mobile, followed by the Toyota GR86, Ford Mustang, BMW Z4, and Subaru WRX. The 2024 model averages $2,292 per year to insure with full coverage.

Not the cheapest, but still very affordable, are cars like the Nissan Z, Subaru BRZ, BMW M2, and Toyota GR Supra, with average rates of $2,962 per year or less.

On a monthly basis, car insurance rates in Mobile on this segment starts at an average of $191 per month, depending on the company.

The next table ranks the sports cars with the most affordable car insurance rates in Mobile.

| Make and Model | Vehicle Type | Annual Premium | Cost Per Month |

|---|---|---|---|

| Mazda MX-5 Miata | Sports Car | $2,292 | $191 |

| Toyota GR86 | Sports Car | $2,612 | $218 |

| Ford Mustang | Sports Car | $2,722 | $227 |

| BMW Z4 | Sports Car | $2,736 | $228 |

| Subaru WRX | Sports Car | $2,778 | $232 |

| Toyota GR Supra | Sports Car | $2,782 | $232 |

| BMW M2 | Sports Car | $2,864 | $239 |

| Nissan Z | Sports Car | $2,870 | $239 |

| Lexus RC F | Sports Car | $2,928 | $244 |

| Subaru BRZ | Sports Car | $2,962 | $247 |

| BMW M3 | Sports Car | $3,128 | $261 |

| Porsche 718 | Sports Car | $3,192 | $266 |

| Chevrolet Camaro | Sports Car | $3,220 | $268 |

| Chevrolet Corvette | Sports Car | $3,432 | $286 |

| Porsche 911 | Sports Car | $3,550 | $296 |

| BMW M4 | Sports Car | $3,696 | $308 |

| Lexus LC 500 | Sports Car | $3,718 | $310 |

| Jaguar F-Type | Sports Car | $3,908 | $326 |

| Mercedes-Benz AMG GT53 | Sports Car | $4,102 | $342 |

| Porsche Taycan | Sports Car | $4,196 | $350 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Mobile, AL Zip Codes. Updated October 24, 2025

Don’t see insurance rates for your vehicle? No sweat! Enter your zip code at the bottom of the table and click the orange ‘GO’ button to get free car insurance quotes from the best auto insurance companies in Alabama.

Cheapest pickup trucks to insure in Mobile, Alabama

The cheapest pickups to insure in Mobile are the Chevrolet Colorado at $2,184 per year, the Nissan Titan at $2,318 per year, and the Nissan Frontier at $2,344 per year.

Additional pickups that rank well are the Toyota Tacoma, Honda Ridgeline, Hyundai Santa Cruz, and GMC Canyon, with an average cost to insure of $2,550 per year or less.

Auto insurance rates in this segment for the average driver can cost as low as $182 per month, depending on your location and insurance company. The rate comparison table below ranks the twenty pickups with the cheapest car insurance rates in Mobile, starting with the Chevrolet Colorado at $182 per month and ending with the Ram Truck at $239 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Chevrolet Colorado | Midsize | $2,184 | $182 |

| Nissan Titan | Full-size | $2,318 | $193 |

| Nissan Frontier | Midsize | $2,344 | $195 |

| Ford Ranger | Midsize | $2,368 | $197 |

| Ford Maverick | Midsize | $2,404 | $200 |

| Honda Ridgeline | Midsize | $2,458 | $205 |

| Hyundai Santa Cruz | Midsize | $2,500 | $208 |

| Toyota Tacoma | Midsize | $2,510 | $209 |

| GMC Sierra 2500 HD | Heavy Duty | $2,520 | $210 |

| GMC Canyon | Midsize | $2,550 | $213 |

| Jeep Gladiator | Midsize | $2,612 | $218 |

| GMC Sierra 3500 | Heavy Duty | $2,628 | $219 |

| Chevrolet Silverado HD 3500 | Heavy Duty | $2,648 | $221 |

| Chevrolet Silverado HD 2500 | Heavy Duty | $2,720 | $227 |

| GMC Sierra | Full-size | $2,736 | $228 |

| Nissan Titan XD | Heavy Duty | $2,738 | $228 |

| Chevrolet Silverado | Full-size | $2,740 | $228 |

| Ford F150 | Full-size | $2,772 | $231 |

| GMC Hummer EV Pickup | Full-size | $2,842 | $237 |

| Ram Truck | Full-size | $2,864 | $239 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Mobile, AL Zip Codes. Updated October 24, 2025

For all pickup insurance comparisons, see our guides for midsize pickup insurance and large pickup insurance.

Need rates for a different pickup model? Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get cheap Mobile car insurance quotes from top auto insurance companies in Alabama.

Cheapest luxury cars to insure in Mobile

Ranking at the top of the list for the most affordable Mobile car insurance rates in the luxury car segment are the Mercedes-Benz CLA250, Acura Integra, BMW 330i, Acura TLX, and Lexus IS 300. Car insurance quotes for these vehicles average $214 or less per month.

Other luxury cars that have affordable insurance rates are the Genesis G70, Lexus ES 350, Cadillac CT4, and Mercedes-Benz AMG CLA35, with average cost of $2,604 per year or less.

Auto insurance rates for this segment in Mobile for the average driver will start around $184 per month, depending on where you live.

When vehicle size is considered, the most budget-friendly compact luxury car to insure in Mobile is the Acura Integra at $2,202 per year. For midsize luxury models, the Mercedes-Benz CLA250 has the cheapest rates at $2,548 per year. And for full-size luxury cars, the Audi A5 is most affordable to insure at $2,944 per year.

The next table ranks the twenty cars with the most affordable average car insurance rates in Mobile, starting with the Acura Integra at $184 per month and ending with the Audi S3 at $232 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura Integra | Compact | $2,202 | $184 |

| BMW 330i | Compact | $2,522 | $210 |

| Mercedes-Benz CLA250 | Midsize | $2,548 | $212 |

| Lexus IS 300 | Midsize | $2,552 | $213 |

| Acura TLX | Compact | $2,564 | $214 |

| Cadillac CT4 | Compact | $2,588 | $216 |

| Lexus ES 350 | Midsize | $2,588 | $216 |

| Genesis G70 | Compact | $2,594 | $216 |

| Mercedes-Benz AMG CLA35 | Midsize | $2,598 | $217 |

| Lexus RC 300 | Midsize | $2,604 | $217 |

| Lexus IS 350 | Compact | $2,614 | $218 |

| Jaguar XF | Midsize | $2,620 | $218 |

| Cadillac CT5 | Midsize | $2,670 | $223 |

| Lexus ES 250 | Midsize | $2,680 | $223 |

| Lexus RC 350 | Compact | $2,688 | $224 |

| BMW 330e | Compact | $2,690 | $224 |

| BMW 228i | Compact | $2,694 | $225 |

| BMW 230i | Compact | $2,714 | $226 |

| Lexus ES 300h | Midsize | $2,720 | $227 |

| Audi S3 | Compact | $2,778 | $232 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Mobile, AL Zip Codes. Updated October 24, 2025

See our guide for luxury car insurance to view any vehicles not shown in the table.

Need rates for a different vehicle? No sweat! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get cheap Mobile car insurance quotes from top auto insurance companies in Alabama.

Cheapest luxury SUVs to insure in Mobile, AL

The four most affordable luxury SUV models to insure in Mobile are the Acura RDX at $2,072 per year, Lexus NX 250 at $2,192 per year, Cadillac XT4 at $2,238 per year, and Jaguar E-Pace at $2,316 per year.

Also ranking well in our comparison are SUVs like the Lincoln Corsair, Lexus NX 350h, Lexus UX 250h, and Lexus NX 450h, with average insurance cost of $2,390 per year or less.

Ranked in the bottom half of the top 20 cheapest luxury SUVs to insure, SUVs like the Lexus RX 350, Cadillac XT6, Mercedes-Benz AMG GLB35, Mercedes-Benz GLA250, and Acura MDX cost between $2,390 and $2,486 per year for auto insurance in Mobile.

From a monthly standpoint, car insurance in this segment for a safe driver can cost as low as $173 per month, depending on your location and insurance company.

When prices are compared by vehicle size, the most affordable compact luxury SUV to insure in Mobile is the Acura RDX at $2,072 per year. For midsize luxury models, the Jaguar E-Pace is cheapest to insure at $2,316 per year. And for full-size luxury models, the Infiniti QX80 is the cheapest model to insure at $2,778 per year.

The rate comparison table below ranks the twenty luxury SUVs with the lowest-cost car insurance in Mobile.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura RDX | Compact | $2,072 | $173 |

| Lexus NX 250 | Compact | $2,192 | $183 |

| Cadillac XT4 | Compact | $2,238 | $187 |

| Jaguar E-Pace | Midsize | $2,316 | $193 |

| Cadillac XT5 | Midsize | $2,338 | $195 |

| Lexus NX 350h | Compact | $2,338 | $195 |

| Lincoln Corsair | Compact | $2,366 | $197 |

| Mercedes-Benz GLB 250 | Compact | $2,370 | $198 |

| Lexus UX 250h | Compact | $2,374 | $198 |

| Lexus NX 450h | Compact | $2,390 | $199 |

| Infiniti QX50 | Midsize | $2,408 | $201 |

| Mercedes-Benz GLA250 | Compact | $2,416 | $201 |

| Cadillac XT6 | Midsize | $2,424 | $202 |

| Mercedes-Benz GLA35 AMG | Compact | $2,424 | $202 |

| Infiniti QX60 | Midsize | $2,438 | $203 |

| Mercedes-Benz AMG GLB35 | Midsize | $2,442 | $204 |

| Land Rover Evoque | Compact | $2,472 | $206 |

| Acura MDX | Midsize | $2,476 | $206 |

| Lexus NX 350 | Compact | $2,484 | $207 |

| Lexus RX 350 | Midsize | $2,486 | $207 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Mobile, AL Zip Codes. Updated October 24, 2025

See our guide for luxury SUV insurance to view luxury vehicles not shown in the table.

Don’t see insurance rates for your luxury SUV? No sweat! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free Mobile car insurance quotes from top auto insurance companies in Alabama.

Examples of car insurance rate variation

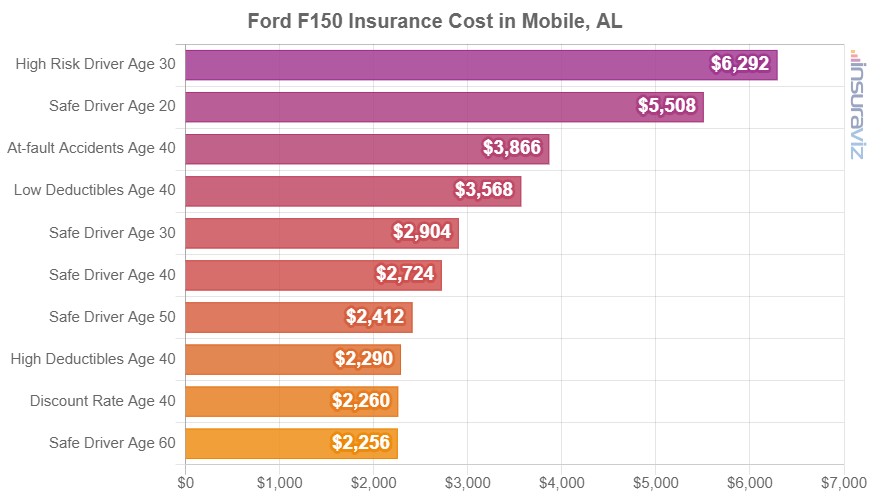

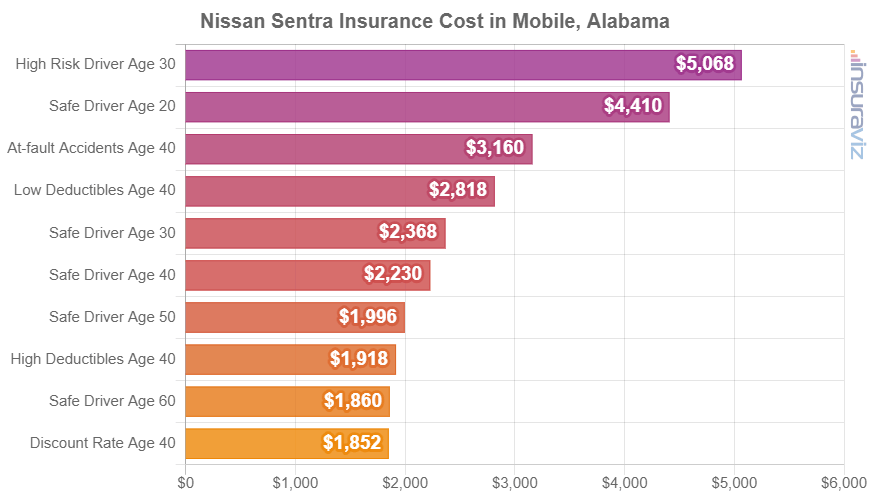

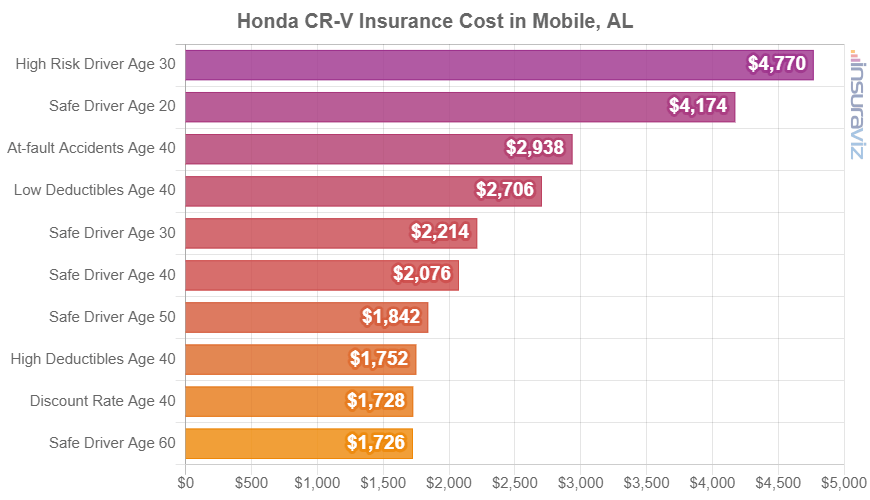

To stress the importance of how much car insurance cost can fluctuate between drivers (and also stress the importance of requesting multiple rate quotes), the examples below present many different rates for three popular models in Mobile: the Ford F150, Nissan Sentra, and Honda CR-V.

The example for each vehicle shows rates for a variety of different driver profiles to illustrate the possible variation when changes are made to the driver rated on the policy.

Ford F150 insurance rates

Insurance for a Ford F150 in Mobile averages $2,772 per year (about $231 per month) and ranges from $2,300 to $6,404 per year.

The Ford F150 is considered a full-size truck, and other top-selling models from the same segment include the Nissan Titan, Toyota Tundra, and GMC Sierra.

Nissan Sentra insurance rates

Car insurance for a Nissan Sentra in Mobile costs an average of $2,272 per year ($189 per month) and varies from $1,886 to $5,160.

The Nissan Sentra is part of the compact car segment, and additional similar models include the Honda Civic, Chevrolet Cruze, and Hyundai Elantra.

Honda CR-V insurance rates

Insurance for a Honda CR-V in Mobile costs an average of $2,112 per year ($176 per month) and ranges from $1,756 to $4,854.

The Honda CR-V is part of the compact SUV segment, and other models from that segment that are popular in Mobile include the Toyota RAV4, Mazda CX-5, Subaru Forester, and Ford Escape.

How to find cheaper Mobile auto insurance

Smart drivers should always be searching for ways to reduce their monthly insurance expenses. So study the money-saving tips in the list below to see if you can save some money insuring your vehicle.

- Careless drivers pay higher car insurance rates in Mobile. Having a few at-fault accidents can really raise rates, possibly up to $1,198 per year for a 30-year-old driver and as much as $604 per year for a 60-year-old driver. So drive safe and save!

- Compare car insurance quote before buying a car. Different cars, trucks, and SUVs have significantly different auto insurance rates, and companies can sell coverages with a wide range of prices. Get quotes before you buy in order to avoid any surprises when you see your first bill.

- Get cheaper rates because of your employer. The vast majority of car insurance providers offer discounts for working in professions like doctors, architects, high school and elementary teachers, college professors, firefighters, and others. By qualifying for an occupational discount, you could potentially save between $74 and $241 on your annual car insurance bill, subject to the policy coverages selected.

- Raising deductibles results in a cheaper policy. Jacking up your deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.

- Remove optional coverage on older vehicles. Removing comprehensive and/or collision coverage from vehicles whose value does not support the cost of the coverage will reduce the cost of auto insurance substantially.