- Average car insurance in Rock Hill costs $2,326 per year, or $194 per month for full coverage.

- Auto insurance rates for a few popular models in Rock Hill include the Nissan Rogue at $174 per month, Jeep Grand Cherokee at $194, and Nissan Sentra at $178.

- For cheap auto insurance in Rock Hill, small crossovers like the Volkswagen Tiguan, Buick Encore, Buick Envision, and Nissan Kicks cost less than most other vehicles.

How much does car insurance cost in Rock Hill?

In Rock Hill, the average price for car insurance is $2,326 per year, which is 2.2% more than the national average rate of $2,276. Per month, Rock Hill car insurance costs approximately $194 for a policy that provides full coverage.

In the state of South Carolina, the average car insurance expense is $2,238 per year, so the average cost in Rock Hill is $88 more per year. When rates are compared to other locations in South Carolina, the average cost to insure a vehicle in Rock Hill is $72 per year cheaper than in North Charleston, $86 per year more than in Mount Pleasant, and $32 per year cheaper than in Charleston.

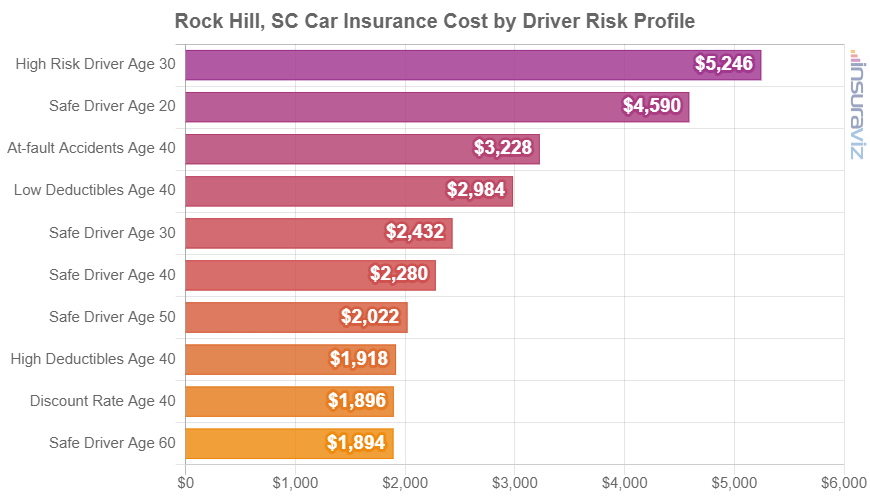

The next chart shows examples of average Rock Hill auto insurance cost. Rates are averaged for all Rock Hill Zip Codes and shown for different driver ages and common risk profiles.

The average cost of auto insurance per month in Rock Hill is $194, and ranges from $161 to $446 for the driver ages and policy risk profiles shown above.

Auto insurance rates are extremely variable and can also be very different depending on the company. Since there is so much rate volatility, this stresses the need to get multiple car insurance quotes when shopping online for cheaper car insurance.

The age of the rated driver significantly impacts the price of car insurance, so the list below details how driver age influences cost by breaking out average car insurance rates depending on driver age.

Average car insurance cost for Rock Hill, South Carolina, drivers age 16 to 60

- 16-year-old rated driver – $8,278 per year or $690 per month

- 17-year-old rated driver – $8,020 per year or $668 per month

- 18-year-old rated driver – $7,187 per year or $599 per month

- 19-year-old rated driver – $6,546 per year or $546 per month

- 20-year-old rated driver – $4,678 per year or $390 per month

- 30-year-old rated driver – $2,482 per year or $207 per month

- 40-year-old rated driver – $2,326 per year or $194 per month

- 50-year-old rated driver – $2,062 per year or $172 per month

- 60-year-old rated driver – $1,928 per year or $161 per month

The previous rates shown for teenage drivers were based on the rated driver being male. The chart below breaks out the average cost to insure teen drivers in Rock Hill, SC, by gender. Female drivers tend to have cheaper car insurance rates, in particular in the teen years.

Auto insurance for a female 16-year-old driver in Rock Hill costs an average of $541 less per year than the cost for a male driver, while at age 19, it still costs $1,009 less per year for females than males.

Popular vehicles and the cost to insure them

The rates referenced earlier in this article consist of an average based on every 2024 vehicle model, which is practical when making general comparisons such as the cost difference between driver ages or locations. Average car insurance rates are excellent when trying to find the answer to questions like “is Rock Hill auto insurance cheaper than Columbia?” or “are South Carolina auto insurance rates cheaper than in Colorado?”.

But for more useful price comparisons, the rates will be more accurate if we analyze the exact make and model of vehicle being insured. Each individual model has different risk exposures for determining the cost of car insurance and this data makes it possible to do more detailed insurance cost analysis.

The chart below details average insurance rates for the more popular models on the roads of Rock Hill. Later on, we examine the cost of insuring some of these models in more detail.

Models popular with drivers in Rock Hill tend to be compact and midsize sedans like the Nissan Sentra, Hyundai Elantra, and Kia K5 and compact and midsize SUVs like the Honda CR-V, Toyota RAV4, and Subaru Outback.

Some additional popular models in Rock Hill from other vehicle segments include luxury SUVs like the Cadillac XT5 and Lexus RX 350, luxury cars like the BMW 530i and Tesla Model S, and pickup trucks like the Ram 1500 and Ford Ranger.

We will get into different rates in much more detail later in this article, but before we do that, let’s go over the comparisons and concepts that were covered up to this point.

- Auto insurance rates decline considerably between ages 20 and 30 – The average 30-year-old Rock Hill, SC, driver will pay $2,196 less annually than a 20-year-old driver, $2,482 compared to $4,678.

- Low deductible auto insurance costs more – A 20-year-old driver pays an average of $1,248 more per year for $250 deductibles versus $1,000 deductibles.

- Rock Hill car insurance rates are more expensive than the South Carolina state average – $2,326 (Rock Hill average) compared to $2,238 (South Carolina average)

- Rock Hill, SC, car insurance cost is more than the U.S. average – $2,326 (Rock Hill average) compared to $2,276 (U.S. average)

- Auto insurance cost decreases as you age – Rates for a 50-year-old driver in Rock Hill are $2,616 per year cheaper than for a 20-year-old driver.

- Insuring teen drivers is expensive in Rock Hill – Cost ranges from $5,537 to $8,278 per year for teenage driver insurance in Rock Hill, SC.

- Teenage female drivers pay less than teen males – Teenage females age 16 to 19 pay $1,009 to $541 less per year than males of the same age.

What are the cheapest car insurance rates in Rock Hill, SC?

When comparing models from every automotive segment, the vehicles with the cheapest average insurance prices in Rock Hill tend to be small SUVs and crossovers like the Subaru Crosstrek, Chevrolet Trailblazer, Toyota Corolla Cross, and Hyundai Venue. Average auto insurance rates for those compact SUVs cost $157 or less per month for a policy with full coverage.

Additional models that rank in the top 20 in the comparison table below are the Toyota GR Corolla, Kia Niro, Nissan Murano, and Acura RDX.

Insurance is slightly more for those models than the cheapest crossover SUVs that rank near the top, but they still have average rates of $2,022 or less per year, or $169 per month.

The table below details the vehicles with the cheapest overall insurance rates in Rock Hill, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,720 | $143 |

| 2 | Chevrolet Trailblazer | $1,748 | $146 |

| 3 | Kia Soul | $1,816 | $151 |

| 4 | Nissan Kicks | $1,830 | $153 |

| 5 | Honda Passport | $1,852 | $154 |

| 6 | Buick Envision | $1,866 | $156 |

| 7 | Toyota Corolla Cross | $1,874 | $156 |

| 8 | Hyundai Venue | $1,886 | $157 |

| 9 | Mazda CX-5 | $1,898 | $158 |

| 10 | Ford Bronco Sport | $1,904 | $159 |

| 11 | Volkswagen Tiguan | $1,926 | $161 |

| 12 | Acura RDX | $1,944 | $162 |

| 13 | Nissan Murano | $1,954 | $163 |

| 14 | Buick Encore | $1,974 | $165 |

| 15 | Honda CR-V | $1,982 | $165 |

| 16 | Subaru Outback | $1,982 | $165 |

| 17 | Buick Envista | $1,988 | $166 |

| 18 | Volkswagen Taos | $1,992 | $166 |

| 19 | Kia Niro | $2,000 | $167 |

| 20 | Toyota GR Corolla | $2,022 | $169 |

| 21 | Honda HR-V | $2,024 | $169 |

| 22 | Subaru Ascent | $2,024 | $169 |

| 23 | Nissan Leaf | $2,038 | $170 |

| 24 | Chevrolet Colorado | $2,048 | $171 |

| 25 | Honda Civic | $2,060 | $172 |

| 26 | Lexus NX 250 | $2,060 | $172 |

| 27 | Volkswagen Atlas | $2,064 | $172 |

| 28 | Acura Integra | $2,068 | $172 |

| 29 | Subaru Forester | $2,070 | $173 |

| 30 | Volkswagen Atlas Cross Sport | $2,074 | $173 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Rock Hill, SC Zip Codes. Updated October 24, 2025

A list of 30 of the cheapest vehicles to insure in Rock Hill doesn’t really give the complete picture of the cost of auto insurance in Rock Hill. Considering we track over 700 vehicles, a lot of models get left out.

So let’s dig deeper and show the models with the lowest rates differently, by vehicle segment. The next six sections show the top 20 models with the cheapest car insurance rates in Rock Hill for the six main segments.

Cheapest cars to insure in Rock Hill, South Carolina

The four lowest-cost non-luxury two and four door cars to insure in Rock Hill are the Toyota GR Corolla at $2,022 per year, Nissan Leaf at $2,038 per year, Honda Civic at $2,060 per year, and Nissan Sentra at $2,132 per year.

Some other cars that have cheaper rates include the Chevrolet Malibu, Toyota Prius, Kia K5, and Honda Accord, with average cost of $2,264 per year or less.

On a monthly basis, car insurance in Rock Hill on this segment for the average driver starts at around $169 per month, depending on where you live and the company you use.

The cheapest compact car to insure in Rock Hill is the Toyota GR Corolla at $2,022 per year. For midsize cars, the Kia K5 has the cheapest rates at $2,240 per year. And for full-size cars, the Chrysler 300 has the cheapest car insurance rates at $2,212 per year.

The rate comparison table below ranks the cars with the most affordable insurance in Rock Hill, starting with the Toyota GR Corolla at $2,022 per year and ending with the Mazda 3 at $2,404 per year.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Toyota GR Corolla | Compact | $2,022 | $169 |

| Nissan Leaf | Compact | $2,038 | $170 |

| Honda Civic | Compact | $2,060 | $172 |

| Nissan Sentra | Compact | $2,132 | $178 |

| Subaru Impreza | Compact | $2,138 | $178 |

| Toyota Prius | Compact | $2,174 | $181 |

| Kia K5 | Midsize | $2,240 | $187 |

| Honda Accord | Midsize | $2,246 | $187 |

| Chevrolet Malibu | Midsize | $2,254 | $188 |

| Toyota Corolla | Compact | $2,264 | $189 |

| Kia Forte | Compact | $2,268 | $189 |

| Volkswagen Arteon | Midsize | $2,286 | $191 |

| Nissan Versa | Compact | $2,292 | $191 |

| Subaru Legacy | Midsize | $2,294 | $191 |

| Hyundai Ioniq 6 | Midsize | $2,314 | $193 |

| Mitsubishi Mirage G4 | Compact | $2,348 | $196 |

| Volkswagen Jetta | Compact | $2,350 | $196 |

| Toyota Crown | Midsize | $2,352 | $196 |

| Hyundai Sonata | Midsize | $2,358 | $197 |

| Mazda 3 | Compact | $2,404 | $200 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Rock Hill, SC Zip Codes. Updated October 24, 2025

For all vehicle comparisons, see our guides for compact car insurance, midsize car insurance, and full-size car insurance.

Don’t see insurance rates for your vehicle? Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get cheap Rock Hill car insurance quotes from top companies in South Carolina.

SUVs with cheap auto insurance

The top four SUVs with the most affordable auto insurance in Rock Hill are the Subaru Crosstrek at $1,720 per year, Chevrolet Trailblazer at $1,748 per year, Kia Soul at $1,816 per year, and Nissan Kicks at $1,830 per year.

Other models that are affordable to insure include the Hyundai Venue, Toyota Corolla Cross, Ford Bronco Sport, and Buick Envision, with average rates of $1,904 per year or less.

Additional 2024 models that make the list include the Kia Niro, Buick Envista, Honda HR-V, and Subaru Ascent, which average between $1,904 and $2,024 to insure per year.

On a monthly basis, auto insurance rates on this segment in Rock Hill for an average middle-age driver will start around $143 per month, depending on the company and where you live.

The next table ranks the twenty SUVs with the lowest-cost average auto insurance rates in Rock Hill.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Subaru Crosstrek | Compact | $1,720 | $143 |

| Chevrolet Trailblazer | Compact | $1,748 | $146 |

| Kia Soul | Compact | $1,816 | $151 |

| Nissan Kicks | Compact | $1,830 | $153 |

| Honda Passport | Midsize | $1,852 | $154 |

| Buick Envision | Compact | $1,866 | $156 |

| Toyota Corolla Cross | Compact | $1,874 | $156 |

| Hyundai Venue | Compact | $1,886 | $157 |

| Mazda CX-5 | Compact | $1,898 | $158 |

| Ford Bronco Sport | Compact | $1,904 | $159 |

| Volkswagen Tiguan | Compact | $1,926 | $161 |

| Nissan Murano | Midsize | $1,954 | $163 |

| Buick Encore | Compact | $1,974 | $165 |

| Honda CR-V | Compact | $1,982 | $165 |

| Subaru Outback | Midsize | $1,982 | $165 |

| Buick Envista | Midsize | $1,988 | $166 |

| Volkswagen Taos | Compact | $1,992 | $166 |

| Kia Niro | Compact | $2,000 | $167 |

| Honda HR-V | Compact | $2,024 | $169 |

| Subaru Ascent | Midsize | $2,024 | $169 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Rock Hill, SC Zip Codes. Updated October 24, 2025

For all vehicle comparisons, see our guides for compact SUV insurance, midsize SUV insurance, and full-size SUV insurance.

Don’t see your SUV in the list? Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free car insurance quotes from top companies in South Carolina.

Pickup trucks with cheap auto insurance

The four most affordable pickup trucks to insure in Rock Hill are the Chevrolet Colorado at $2,048 per year, Nissan Titan at $2,176 per year, Nissan Frontier at $2,198 per year, and Ford Ranger at $2,220 per year.

Not the cheapest in the list, but still ranking well, are pickups like the Toyota Tacoma, Hyundai Santa Cruz, GMC Canyon, and Honda Ridgeline, with average rates of $2,392 per year or less.

From a monthly standpoint, full-coverage car insurance on this segment in Rock Hill for a good driver starts at around $171 per month, depending on your location and insurance company. The next table ranks the twenty pickups with the lowest-cost car insurance rates in Rock Hill, starting with the Chevrolet Colorado at $2,048 per year ($171 per month) and ending with the Ram Truck at $2,690 per year ($224 per month).

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Chevrolet Colorado | Midsize | $2,048 | $171 |

| Nissan Titan | Full-size | $2,176 | $181 |

| Nissan Frontier | Midsize | $2,198 | $183 |

| Ford Ranger | Midsize | $2,220 | $185 |

| Ford Maverick | Midsize | $2,256 | $188 |

| Honda Ridgeline | Midsize | $2,308 | $192 |

| Hyundai Santa Cruz | Midsize | $2,346 | $196 |

| Toyota Tacoma | Midsize | $2,354 | $196 |

| GMC Sierra 2500 HD | Heavy Duty | $2,364 | $197 |

| GMC Canyon | Midsize | $2,392 | $199 |

| Jeep Gladiator | Midsize | $2,448 | $204 |

| GMC Sierra 3500 | Heavy Duty | $2,462 | $205 |

| Chevrolet Silverado HD 3500 | Heavy Duty | $2,486 | $207 |

| Chevrolet Silverado HD 2500 | Heavy Duty | $2,552 | $213 |

| GMC Sierra | Full-size | $2,568 | $214 |

| Chevrolet Silverado | Full-size | $2,572 | $214 |

| Nissan Titan XD | Heavy Duty | $2,572 | $214 |

| Ford F150 | Full-size | $2,600 | $217 |

| GMC Hummer EV Pickup | Full-size | $2,666 | $222 |

| Ram Truck | Full-size | $2,690 | $224 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Rock Hill, SC Zip Codes. Updated October 24, 2025

For more pickup insurance comparisons, see our guides for midsize pickup insurance and large pickup insurance.

Don’t see rates for your pickup? That’s no problem! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free Rock Hill car insurance quotes from top car insurance companies in South Carolina.

Sports cars with cheap car insurance rates in Rock Hill

Ranking highest for the lowest-cost Rock Hill car insurance rates in the performance and sports car segment are the Toyota GR86, Ford Mustang, Subaru WRX, BMW Z4, and Mazda MX-5 Miata. Insurance rates for these vehicles average $2,606 or less per year.

Additional sports cars that have affordable average insurance rates are the Subaru BRZ, Lexus RC F, Nissan Z, and Toyota GR Supra, with average annual insurance rates of $2,782 per year or less.

From a cost per month standpoint, auto insurance rates in Rock Hill on this segment for a safe driver starts at an average of $179 per month, depending on your location and insurance company. The comparison table below ranks the twenty sports cars with the cheapest average car insurance rates in Rock Hill, starting with the Mazda MX-5 Miata at $2,152 per year ($179 per month) and ending with the Porsche Taycan at $3,938 per year ($328 per month).

| Make and Model | Vehicle Type | Annual Premium | Cost Per Month |

|---|---|---|---|

| Mazda MX-5 Miata | Sports Car | $2,152 | $179 |

| Toyota GR86 | Sports Car | $2,450 | $204 |

| Ford Mustang | Sports Car | $2,554 | $213 |

| BMW Z4 | Sports Car | $2,568 | $214 |

| Subaru WRX | Sports Car | $2,606 | $217 |

| Toyota GR Supra | Sports Car | $2,612 | $218 |

| BMW M2 | Sports Car | $2,688 | $224 |

| Nissan Z | Sports Car | $2,694 | $225 |

| Lexus RC F | Sports Car | $2,746 | $229 |

| Subaru BRZ | Sports Car | $2,782 | $232 |

| BMW M3 | Sports Car | $2,938 | $245 |

| Porsche 718 | Sports Car | $2,994 | $250 |

| Chevrolet Camaro | Sports Car | $3,022 | $252 |

| Chevrolet Corvette | Sports Car | $3,220 | $268 |

| Porsche 911 | Sports Car | $3,332 | $278 |

| BMW M4 | Sports Car | $3,470 | $289 |

| Lexus LC 500 | Sports Car | $3,490 | $291 |

| Jaguar F-Type | Sports Car | $3,670 | $306 |

| Mercedes-Benz AMG GT53 | Sports Car | $3,848 | $321 |

| Porsche Taycan | Sports Car | $3,938 | $328 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Rock Hill, SC Zip Codes. Updated October 24, 2025

Don’t see your sports car in the list? No problem! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free car insurance quotes from top companies in South Carolina.

Most affordable luxury cars to insure

The three top-ranked luxury car models with the most affordable average auto insurance rates in Rock Hill are the Acura Integra at $2,068 per year, the BMW 330i at $2,366 per year, and the Mercedes-Benz CLA250 at $2,392 per year.

Other luxury cars that have affordable average insurance rates include the Lexus RC 300, Mercedes-Benz AMG CLA35, Genesis G70, and Lexus ES 350, with average rates of $2,444 per year or less.

Some additional vehicles that make the list include the Lexus ES 250, Lexus IS 350, Lexus ES 300h, BMW 228i, and BMW 230i, which average between $2,444 and $2,608 to insure per year.

From a monthly standpoint, car insurance rates in Rock Hill on this segment for the average driver can cost as low as $172 per month, depending on your location.

The cheapest small luxury car to insure in Rock Hill is the Acura Integra at $2,068 per year. For midsize luxury cars, the Mercedes-Benz CLA250 is the cheapest model to insure at $2,392 per year. And for large luxury cars, the Audi A5 is cheapest to insure at $2,764 per year.

The rate comparison table below ranks the cars with the lowest-cost insurance in Rock Hill, starting with the Acura Integra at $2,068 per year ($172 per month) and ending with the Audi S3 at $2,608 per year ($217 per month).

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura Integra | Compact | $2,068 | $172 |

| BMW 330i | Compact | $2,366 | $197 |

| Mercedes-Benz CLA250 | Midsize | $2,392 | $199 |

| Lexus IS 300 | Midsize | $2,398 | $200 |

| Acura TLX | Compact | $2,404 | $200 |

| Cadillac CT4 | Compact | $2,428 | $202 |

| Lexus ES 350 | Midsize | $2,428 | $202 |

| Genesis G70 | Compact | $2,434 | $203 |

| Mercedes-Benz AMG CLA35 | Midsize | $2,438 | $203 |

| Lexus RC 300 | Midsize | $2,444 | $204 |

| Lexus IS 350 | Compact | $2,454 | $205 |

| Jaguar XF | Midsize | $2,460 | $205 |

| Cadillac CT5 | Midsize | $2,504 | $209 |

| Lexus ES 250 | Midsize | $2,514 | $210 |

| Lexus RC 350 | Compact | $2,522 | $210 |

| BMW 330e | Compact | $2,526 | $211 |

| BMW 228i | Compact | $2,530 | $211 |

| BMW 230i | Compact | $2,550 | $213 |

| Lexus ES 300h | Midsize | $2,554 | $213 |

| Audi S3 | Compact | $2,608 | $217 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Rock Hill, SC Zip Codes. Updated October 24, 2025

For all luxury car insurance comparisons, see our full luxury car insurance guide.

Don’t see insurance rates for your vehicle? That’s no problem! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free car insurance quotes from top-rated car insurance companies in South Carolina.

Cheapest luxury SUVs to insure

The four lowest-cost luxury SUV models to insure in Rock Hill are the Acura RDX at $1,944 per year, Lexus NX 250 at $2,060 per year, Cadillac XT4 at $2,098 per year, and Jaguar E-Pace at $2,176 per year.

Other luxury SUVs that have cheaper rates include the Lexus UX 250h, Lexus NX 350h, Lincoln Corsair, and Lexus NX 450h, with an average cost to insure of $2,242 per year or less.

In the lower half of the top 20 luxury SUVs to insure, models like the Mercedes-Benz AMG GLB35, Mercedes-Benz GLA35 AMG, Land Rover Evoque, Infiniti QX50, Cadillac XT6, and Mercedes-Benz GLA250 cost between $2,242 and $2,334 per year for full-coverage insurance.

Full-coverage insurance in this segment for a middle-age safe driver starts at around $162 per month, depending on the company. The comparison table below ranks the twenty luxury SUVs with the lowest-cost average insurance rates in Rock Hill.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura RDX | Compact | $1,944 | $162 |

| Lexus NX 250 | Compact | $2,060 | $172 |

| Cadillac XT4 | Compact | $2,098 | $175 |

| Jaguar E-Pace | Midsize | $2,176 | $181 |

| Cadillac XT5 | Midsize | $2,194 | $183 |

| Lexus NX 350h | Compact | $2,194 | $183 |

| Lincoln Corsair | Compact | $2,220 | $185 |

| Mercedes-Benz GLB 250 | Compact | $2,224 | $185 |

| Lexus UX 250h | Compact | $2,230 | $186 |

| Lexus NX 450h | Compact | $2,242 | $187 |

| Infiniti QX50 | Midsize | $2,260 | $188 |

| Mercedes-Benz GLA250 | Compact | $2,266 | $189 |

| Mercedes-Benz GLA35 AMG | Compact | $2,274 | $190 |

| Cadillac XT6 | Midsize | $2,276 | $190 |

| Infiniti QX60 | Midsize | $2,290 | $191 |

| Mercedes-Benz AMG GLB35 | Midsize | $2,290 | $191 |

| Land Rover Evoque | Compact | $2,320 | $193 |

| Acura MDX | Midsize | $2,326 | $194 |

| Lexus NX 350 | Compact | $2,332 | $194 |

| Lexus RX 350 | Midsize | $2,334 | $195 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Rock Hill, SC Zip Codes. Updated October 24, 2025

For all luxury SUV comparisons, see our complete guide for luxury SUV insurance.

Is your luxury SUV not in the list? No problem! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free Rock Hill car insurance quotes from the best car insurance companies in South Carolina.

Examples of auto insurance rate variation

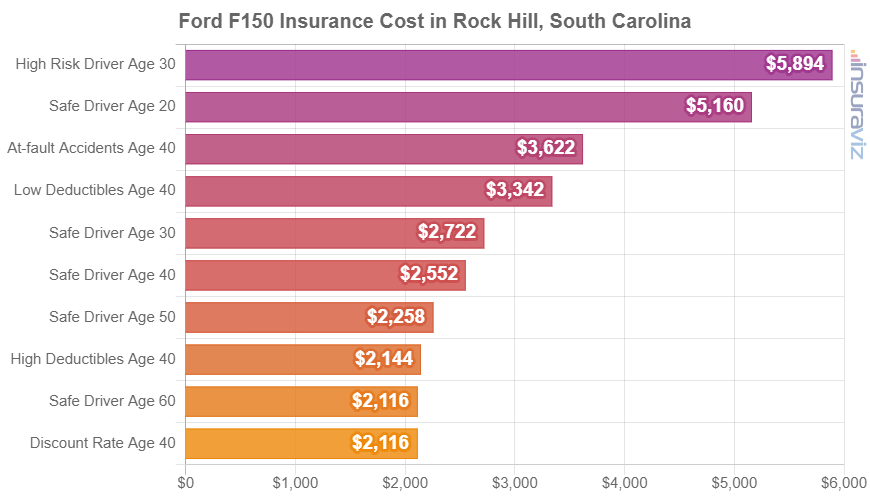

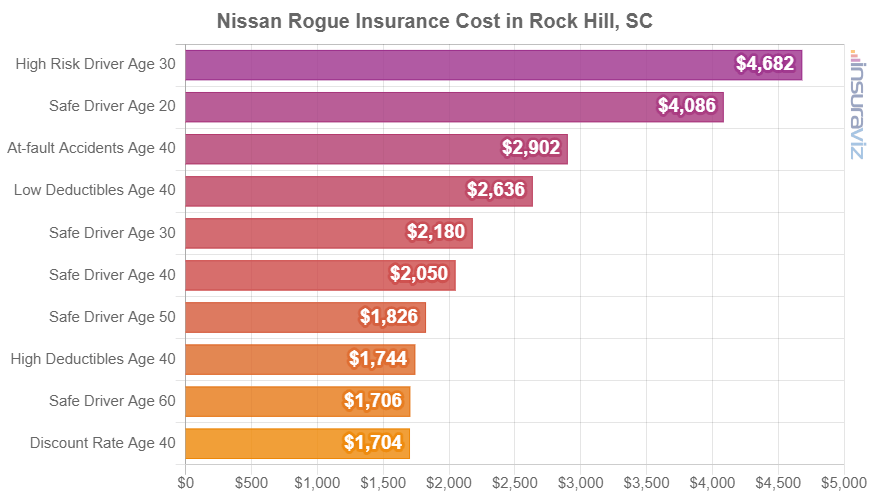

To aid in understanding how much the cost of auto insurance can fluctuate from one person to the next (and also point out the importance of multiple rate quotes), the sections below show a wide range of rates for four popular vehicles in Rock Hill: the Ford F150, Toyota Corolla, Nissan Rogue, and Kia Sorento.

The example for each vehicle shows average rates for different driver profiles to show the potential rate difference based on driver and coverage changes.

Ford F150 insurance rates

Car insurance for a Ford F150 in Rock Hill costs an average of $2,600 per year ($217 per month) and varies from $2,156 to $6,006 annually.

The Ford F150 is classified as a full-size truck, and other models in the same segment include the GMC Sierra, Nissan Titan, and Ram Truck.

Toyota Corolla insurance rates

Toyota Corolla insurance in Rock Hill averages $2,264 per year ($189 per month) and ranges from $1,880 to $5,190.

The Toyota Corolla belongs to the compact car segment, and other similar models that are popular in Rock Hill, South Carolina, include the Hyundai Elantra, Volkswagen Jetta, Chevrolet Cruze, and Honda Civic.

Nissan Rogue insurance rates

In Rock Hill, Nissan Rogue insurance costs an average of $2,090 per year (about $174 per month) and has a range of $1,736 to $4,774 annually.

The Nissan Rogue is part of the compact SUV segment, and other models popular in Rock Hill include the Honda CR-V, Toyota RAV4, and Subaru Forester.

Kia Sorento insurance rates

Kia Sorento insurance in Rock Hill averages $2,206 per year (about $184 per month) and ranges from $1,836 to $5,068.

The Kia Sorento is considered a midsize SUV, and additional similar models from the same segment include the Ford Edge, Ford Explorer, Honda Pilot, and Toyota Highlander.

How to find affordable Rock Hill car insurance

Resourceful drivers in Rock Hill should always be searching for ways to cut the monthly cost of insurance So read through the savings concepts in this next list and it’s very likely you can save some money on your next policy.

- Remove unneeded coverage on older vehicles. Removing physical damage coverage from vehicles that are older can cheapen the cost considerably.

- Save money due to your employment. Just about all car insurance companies offer policy discounts for being employed in professions like college professors, accountants, lawyers, police officers and law enforcement, dentists, nurses, and others. If your occupation qualifies you for this discount, you could potentially save between $70 and $226 on your yearly car insurance bill, subject to policy limits.

- Save by raising your deductibles. Increasing deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.

- Safe drivers have lower car insurance rates. Having frequent accidents may increase rates, possibly by an extra $3,320 per year for a 20-year-old driver and even as much as $566 per year for a 60-year-old driver. So be a careful driver and save!

- Choose a vehicle with lower car insurance rates. The type of vehicle you drive is an important factor in the price you pay for car insurance. As an example, a Mazda CX-30 costs $1,122 less per year to insure in Rock Hill than a Chevrolet Corvette. Lower performance vehicles save money.