- Lowell car insurance cost averages $2,538 per year, or about $212 per month for a full coverage policy.

- Lowell auto insurance costs an average of $138 per year less than the Massachusetts state average cost and $262 per year more than the average for all 50 states.

- Monthly car insurance rates for a few popular vehicles in Lowell include the Jeep Cherokee at $228, Mazda CX-5 at $172, and Tesla Model 3 at $248.

- For cheap car insurance in Lowell, SUV models like the Ford Bronco Sport, Volkswagen Tiguan, Hyundai Venue, and Nissan Kicks rank very well for overall cost.

- Models with the cheapest auto insurance in Lowell for their respective segments include the Jaguar E-Pace, Kia K5, Acura RDX, Nissan Titan, and Honda Passport.

How much is car insurance in Lowell, Massachusetts?

The average car insurance expense in Lowell is $2,538 per year, which is 10.9% more than the U.S. average rate of $2,276 per year. Average car insurance cost per month in Lowell is $212 for full coverage.

In the state of Massachusetts, the average price for car insurance is $2,676 per year, so the cost in Lowell averages $138 less per year. When rates are compared to other larger cities in Massachusetts, the average cost of car insurance in Lowell is about $112 per year cheaper than in Boston, $354 per year cheaper than in Springfield, and $204 per year less than in Worcester.

The next chart shows average Lowell auto insurance rates for 2024 model year vehicles for both different driver ages and policy deductible amounts.

Average car insurance rates in the previous chart range from $1,778 per year for a policy with high physical damage deductibles for a 60-year-old driver to $5,938 per year for a 20-year-old driver with a policy with low comprehensive and collision deductibles.

When the rates in the chart are converted for monthly budgeting, the average cost of car insurance per month in Lowell ranges from $148 to $495.

Car insurance rates can have significant differences in cost and can also be very different depending on the company. Due to the high likelihood of rate variability, this increases the need for accurate free auto insurance quotes when trying to find cheaper auto insurance.

The age of the rated driver has the single biggest impact on the cost of auto insurance, so the list below details how age impacts cost by breaking out average car insurance rates in Lowell depending on driver age.

Average cost of car insurance in Lowell for drivers age 16 to 60

- 16-year-old driver – $9,038 per year or $753 per month

- 17-year-old driver – $8,757 per year or $730 per month

- 18-year-old driver – $7,847 per year or $654 per month

- 19-year-old driver – $7,144 per year or $595 per month

- 20-year-old driver – $5,108 per year or $426 per month

- 30-year-old driver – $2,708 per year or $226 per month

- 40-year-old driver – $2,538 per year or $212 per month

- 50-year-old driver – $2,248 per year or $187 per month

- 60-year-old driver – $2,104 per year or $175 per month

The rates listed above for teenage drivers assumed the driver was male. The next chart goes into more detail for teenage car insurance rates and separates average car insurance cost for teenagers in Lowell, Massachusetts, by gender. Female drivers tend to have slightly cheaper auto insurance rates, especially at younger ages.

Car insurance for a 16-year-old female driver in Lowell costs an average of $592 less per year than the cost for a male driver, while at age 19, it’s still $1,098 cheaper per year for females than males.

Insurance rates for popular cars, trucks, and SUVs

The rates referenced above take the cost to insure each 2024 vehicle model and average them, which is useful for making overall comparisons such as the average cost difference between two Massachusetts cities.

But for more comprehensive price comparisons, it makes more sense to instead look at the exact make and model of vehicle being insured. Later on in this article, we explore both segment rates and rates for specific vehicles, but for now, we will just use the more popular vehicles to discover how car insurance rates compare in Lowell.

The list below shows average insurance cost by year and month in Lowell for some of the most popular cars, trucks, and SUVs.

Auto insurance rates for popular vehicles in Lowell

- Jeep Cherokee – $2,928 per year or $244 per month

- Mazda CX-5 – $2,220 per year or $185 per month

- Tesla Model 3 – $3,200 per year or $267 per month

- Toyota Corolla – $2,649 per year or $221 per month

- Hyundai Elantra – $2,953 per year or $246 per month

- Nissan Sentra – $2,488 per year or $207 per month

- Nissan Rogue – $2,442 per year or $204 per month

- Ford Explorer – $2,470 per year or $206 per month

- Honda Civic – $2,408 per year or $201 per month

- Toyota RAV4 – $2,511 per year or $209 per month

The vehicles that sell well in Lowell tend to be compact and midsize cars like the Nissan Sentra, Volkswagen Jetta, and Nissan Altima and small or midsize SUVs like the Toyota RAV4 and Chevy Traverse.

Other popular models from different automotive segments include luxury models like the Lexus ES 350 and Acura MDX, pickup trucks like the Toyota Tacoma and Chevy Silverado, and sports cars like the Nissan GT-R and Ford Mustang.

We will get into rates for many more vehicles in the upcoming sections, but before we do that, let’s take a look at some of the general concepts covered up to this point.

- Low deductible car insurance costs more – A 20-year-old driver pays an average of $1,366 more per year for $250 deductibles compared to $1,000 deductibles.

- Lowell car insurance costs more than the U.S. average – $2,538 (Lowell average) versus $2,276 (U.S. average)

- Car insurance cost decreases as you age – Car insurance rates for a 60-year-old driver in Lowell are $3,004 per year cheaper than for a 20-year-old driver.

- Teen female drivers pay cheaper rates than teen males – Female drivers age 16 to 19 pay $1,098 to $592 less each year than males of the same age.

- Auto insurance rates decrease significantly between ages 20 and 30 – The average 30-year-old Lowell driver will pay $2,400 less each year than a 20-year-old driver, $2,708 versus $5,108.

- Lowell auto insurance prices are cheaper than the Massachusetts state average – $2,538 (Lowell average) versus $2,676 (Massachusetts average)

Which vehicles have cheap insurance in Lowell?

The models with the lowest cost average car insurance quotes in Lowell tend to be compact SUVs and crossovers like the Kia Soul, Chevrolet Trailblazer, and Hyundai Venue.

Average insurance rates for those vehicles cost $2,205 or less per year, or $184 per month, to have full coverage.

Some additional vehicles that are highly ranked in the comparison table below are the Buick Envista, Volkswagen Tiguan, Ford Bronco Sport, and Buick Encore. Insurance is somewhat higher for those models than the cheapest crossovers and small SUVs that rank at the top, but they still have average rates of $2,367 or less per year, or about $197 per month in Lowell.

The following table details the top 30 cheapest vehicles to insure in Lowell, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,822 | $152 |

| 2 | Chevrolet Trailblazer | $1,854 | $155 |

| 3 | Kia Soul | $1,924 | $160 |

| 4 | Nissan Kicks | $1,942 | $162 |

| 5 | Honda Passport | $1,960 | $163 |

| 6 | Buick Envision | $1,972 | $164 |

| 7 | Toyota Corolla Cross | $1,988 | $166 |

| 8 | Hyundai Venue | $2,006 | $167 |

| 9 | Mazda CX-5 | $2,010 | $168 |

| 10 | Ford Bronco Sport | $2,020 | $168 |

| 11 | Volkswagen Tiguan | $2,038 | $170 |

| 12 | Acura RDX | $2,060 | $172 |

| 13 | Nissan Murano | $2,072 | $173 |

| 14 | Buick Encore | $2,094 | $175 |

| 15 | Subaru Outback | $2,098 | $175 |

| 16 | Honda CR-V | $2,102 | $175 |

| 17 | Buick Envista | $2,112 | $176 |

| 18 | Volkswagen Taos | $2,116 | $176 |

| 19 | Kia Niro | $2,122 | $177 |

| 20 | Toyota GR Corolla | $2,138 | $178 |

| 21 | Subaru Ascent | $2,140 | $178 |

| 22 | Honda HR-V | $2,148 | $179 |

| 23 | Nissan Leaf | $2,160 | $180 |

| 24 | Chevrolet Colorado | $2,170 | $181 |

| 25 | Lexus NX 250 | $2,178 | $182 |

| 26 | Honda Civic | $2,180 | $182 |

| 27 | Volkswagen Atlas | $2,184 | $182 |

| 28 | Acura Integra | $2,192 | $183 |

| 29 | Subaru Forester | $2,192 | $183 |

| 30 | Volkswagen Atlas Cross Sport | $2,192 | $183 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Lowell, MA Zip Codes. Updated October 24, 2025

A table of 30 vehicle rankings is not the best way to show a complete view of Lowell car insurance cost. Considering the fact that we have over 700 models in our database, there are a lot of rates not being shown. So let’s dig deeper and display the models with the lowest rates in a format that makes more sense, by automotive segment.

The next section further discusses the average price of car insurance in Lowell for each vehicle segment. These rates should give you a better idea of which vehicles have the least expensive auto insurance rates in Lowell. The subsequent sections will break out the 20 models with the most affordable insurance in each segment.

Lowell auto insurance rates by automotive segment

If you’re shopping around for a different vehicle, it’s useful to have an idea of which kinds of vehicles are more affordable to insure. For instance, you may be wondering if midsize SUVs are cheaper to insure than small SUVs or if regular SUVs have more affordable insurance than luxury SUVs.

The next chart displays the average cost of car insurance rates in Lowell for different vehicle segments. When looking at rates from a segment perspective, compact SUVs, vans, and midsize pickups tend to have the least expensive average rates, while exotic performance cars have the most expensive average cost to insure.

Rates by different vehicle segments are precise enough for general comparisons, but rates vary quite a lot within each automotive segment shown above.

For example, in the midsize luxury car segment, average Lowell auto insurance rates range from the Mercedes-Benz CLA250 costing $2,610 per year for a full coverage policy up to the BMW M8 at $4,274 per year, a difference of $1,664 within that segment. In the sports car segment, insurance rates range from the Mazda MX-5 Miata at $2,346 per year to the Mercedes-Benz SL 63 at $5,212 per year, a difference of $2,866 within that segment.

In the next sections of the article, we remove some of this variability by looking at car insurance cost in Lowell for individual vehicle models.

Cheapest car insurance rates in Lowell

Ranking at the top of the list for the lowest-cost Lowell auto insurance rates in the car segment (excluding luxury models) are the Nissan Sentra, Toyota GR Corolla, Subaru Impreza, Nissan Leaf, and Honda Civic. Car insurance prices for these 2024 models average $2,332 or less per year.

Not the cheapest in the list, but still ranking well, are models like the Toyota Prius, Honda Accord, Kia K5, and Chevrolet Malibu, with an average cost to insure of $2,472 per year or less.

Some additional vehicles that make the list include the Hyundai Ioniq 6, Mazda 3, Nissan Versa, Mitsubishi Mirage G4, and Toyota Crown, which average between $2,472 and $2,622 per year for full-coverage insurance.

From a monthly standpoint, car insurance in this segment for the average driver starts at around $184 per month, depending on the company.

If insurance rates are ranked by vehicle size, the lowest-cost non-luxury compact car to insure in Lowell is the Toyota GR Corolla at $2,204 per year, or $184 per month. For midsize 2024 models, the Kia K5 is the cheapest model to insure at $2,444 per year, or $204 per month. And for full-size sedans, the Chrysler 300 has the most affordable rates at $2,416 per year, or $201 per month.

The rate comparison table below ranks the twenty cars with the cheapest insurance in Lowell, starting with the Toyota GR Corolla at $2,204 per year ($184 per month) and ending with the Mazda 3 at $2,622 per year ($219 per month).

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Toyota GR Corolla | Compact | $2,204 | $184 |

| Nissan Leaf | Compact | $2,222 | $185 |

| Honda Civic | Compact | $2,244 | $187 |

| Nissan Sentra | Compact | $2,324 | $194 |

| Subaru Impreza | Compact | $2,332 | $194 |

| Toyota Prius | Compact | $2,370 | $198 |

| Kia K5 | Midsize | $2,444 | $204 |

| Honda Accord | Midsize | $2,450 | $204 |

| Chevrolet Malibu | Midsize | $2,460 | $205 |

| Toyota Corolla | Compact | $2,472 | $206 |

| Kia Forte | Compact | $2,476 | $206 |

| Volkswagen Arteon | Midsize | $2,492 | $208 |

| Nissan Versa | Compact | $2,500 | $208 |

| Subaru Legacy | Midsize | $2,502 | $209 |

| Hyundai Ioniq 6 | Midsize | $2,522 | $210 |

| Mitsubishi Mirage G4 | Compact | $2,562 | $214 |

| Volkswagen Jetta | Compact | $2,564 | $214 |

| Toyota Crown | Midsize | $2,566 | $214 |

| Hyundai Sonata | Midsize | $2,574 | $215 |

| Mazda 3 | Compact | $2,622 | $219 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Lowell, MA Zip Codes. Updated October 24, 2025

See our comprehensive guides for compact car insurance, midsize car insurance, and full-size car insurance to view data for vehicles not featured in the table.

Is your vehicle not in the list? Enter your zip code at the bottom of the table and click the orange ‘GO’ button to get cheap Lowell car insurance quotes from top-rated companies in Massachusetts.

Cheapest SUV insurance rates in Lowell

The Subaru Crosstrek ranks in the top spot for the cheapest SUV to insure in Lowell, followed closely by the Chevrolet Trailblazer, Kia Soul, Nissan Kicks, and Honda Passport. The 2024 model costs an average of $1,874 per year for full-coverage auto insurance.

Some other SUVs that have cheaper rates include the Buick Envision, Ford Bronco Sport, Hyundai Venue, and Toyota Corolla Cross, with average rates of $2,076 per year or less.

Some additional 2024 models worth mentioning include the Subaru Outback, Volkswagen Taos, Buick Envista, and Buick Encore, which average between $2,076 and $2,206 per year for full-coverage insurance in Lowell.

From a cost per month standpoint, car insurance on this segment in Lowell can cost as low as $156 per month, depending on where you live and the company you use. The table below ranks the twenty SUVs with the lowest-cost car insurance rates in Lowell, starting with the Subaru Crosstrek at $1,874 per year ($156 per month) and ending with the Subaru Ascent at $2,206 per year ($184 per month).

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Subaru Crosstrek | Compact | $1,874 | $156 |

| Chevrolet Trailblazer | Compact | $1,906 | $159 |

| Kia Soul | Compact | $1,980 | $165 |

| Nissan Kicks | Compact | $1,998 | $167 |

| Honda Passport | Midsize | $2,020 | $168 |

| Buick Envision | Compact | $2,032 | $169 |

| Toyota Corolla Cross | Compact | $2,044 | $170 |

| Hyundai Venue | Compact | $2,060 | $172 |

| Mazda CX-5 | Compact | $2,068 | $172 |

| Ford Bronco Sport | Compact | $2,076 | $173 |

| Volkswagen Tiguan | Compact | $2,100 | $175 |

| Nissan Murano | Midsize | $2,128 | $177 |

| Buick Encore | Compact | $2,152 | $179 |

| Honda CR-V | Compact | $2,160 | $180 |

| Subaru Outback | Midsize | $2,162 | $180 |

| Buick Envista | Midsize | $2,170 | $181 |

| Volkswagen Taos | Compact | $2,172 | $181 |

| Kia Niro | Compact | $2,182 | $182 |

| Subaru Ascent | Midsize | $2,206 | $184 |

| Honda HR-V | Compact | $2,208 | $184 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Lowell, MA Zip Codes. Updated October 24, 2025

See our guides for compact SUV insurance, midsize SUV insurance, and full-size SUV insurance to view any vehicles not shown in the table.

Don’t see your vehicle? No problem! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get cheap Lowell car insurance quotes from the best companies in Massachusetts.

Cheapest pickups to insure in Lowell

The #1 ranking in Lowell for cheapest auto insurance in the pickup truck segment is the Chevrolet Colorado, at an average of $2,234 per year. Second place is the Nissan Titan at $2,374 per year, in third place is the Nissan Frontier, at an average of $2,400 per year, and coming in fourth is the Ford Ranger, costing an average of $2,422 per year.

Also ranking well are models like the Toyota Tacoma, Honda Ridgeline, GMC Canyon, and GMC Sierra 2500 HD, with an average car insurance cost of $2,610 per year or less.

Auto insurance in this segment starts at around $186 per month, depending on where you live. The comparison table below ranks the twenty pickups with the cheapest car insurance in Lowell, starting with the Chevrolet Colorado at $2,234 per year ($186 per month) and ending with the Ram Truck at $2,936 per year ($245 per month).

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Chevrolet Colorado | Midsize | $2,234 | $186 |

| Nissan Titan | Full-size | $2,374 | $198 |

| Nissan Frontier | Midsize | $2,400 | $200 |

| Ford Ranger | Midsize | $2,422 | $202 |

| Ford Maverick | Midsize | $2,462 | $205 |

| Honda Ridgeline | Midsize | $2,516 | $210 |

| Hyundai Santa Cruz | Midsize | $2,560 | $213 |

| Toyota Tacoma | Midsize | $2,568 | $214 |

| GMC Sierra 2500 HD | Heavy Duty | $2,582 | $215 |

| GMC Canyon | Midsize | $2,610 | $218 |

| Jeep Gladiator | Midsize | $2,672 | $223 |

| GMC Sierra 3500 | Heavy Duty | $2,688 | $224 |

| Chevrolet Silverado HD 3500 | Heavy Duty | $2,712 | $226 |

| Chevrolet Silverado HD 2500 | Heavy Duty | $2,786 | $232 |

| GMC Sierra | Full-size | $2,802 | $234 |

| Nissan Titan XD | Heavy Duty | $2,804 | $234 |

| Chevrolet Silverado | Full-size | $2,806 | $234 |

| Ford F150 | Full-size | $2,842 | $237 |

| GMC Hummer EV Pickup | Full-size | $2,912 | $243 |

| Ram Truck | Full-size | $2,936 | $245 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Lowell, MA Zip Codes. Updated October 24, 2025

For all pickup insurance comparisons, see our guides for midsize pickup insurance and large pickup insurance.

Don’t see your truck in the table above? No problem! Enter your zip code at the bottom of the table and click the orange ‘GO’ button to get free Lowell car insurance quotes from top-rated companies in Massachusetts.

Cheapest sports car insurance rates

The top five most budget-friendly sports cars to insure in Lowell are the Mazda MX-5 Miata, Toyota GR86, Ford Mustang, BMW Z4, and Subaru WRX. Average insurance rates for for these vehicles range from $2,346 to $2,844 per year.

Some other sports cars that are affordable to insure are the Toyota GR Supra, BMW M2, Subaru BRZ, and Nissan Z, with an average cost of $3,034 per year or less.

From a monthly standpoint, full-coverage insurance in Lowell on this segment for a middle-age safe driver starts at around $196 per month, depending on the company and where you live. The table below ranks the twenty sports cars with the lowest-cost average car insurance rates in Lowell.

| Make and Model | Vehicle Type | Annual Premium | Cost Per Month |

|---|---|---|---|

| Mazda MX-5 Miata | Sports Car | $2,346 | $196 |

| Toyota GR86 | Sports Car | $2,672 | $223 |

| Ford Mustang | Sports Car | $2,790 | $233 |

| BMW Z4 | Sports Car | $2,802 | $234 |

| Subaru WRX | Sports Car | $2,844 | $237 |

| Toyota GR Supra | Sports Car | $2,850 | $238 |

| BMW M2 | Sports Car | $2,934 | $245 |

| Nissan Z | Sports Car | $2,940 | $245 |

| Lexus RC F | Sports Car | $2,998 | $250 |

| Subaru BRZ | Sports Car | $3,034 | $253 |

| BMW M3 | Sports Car | $3,204 | $267 |

| Porsche 718 | Sports Car | $3,266 | $272 |

| Chevrolet Camaro | Sports Car | $3,296 | $275 |

| Chevrolet Corvette | Sports Car | $3,516 | $293 |

| Porsche 911 | Sports Car | $3,634 | $303 |

| BMW M4 | Sports Car | $3,788 | $316 |

| Lexus LC 500 | Sports Car | $3,806 | $317 |

| Jaguar F-Type | Sports Car | $4,002 | $334 |

| Mercedes-Benz AMG GT53 | Sports Car | $4,198 | $350 |

| Porsche Taycan | Sports Car | $4,298 | $358 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Lowell, MA Zip Codes. Updated October 24, 2025

Don’t see insurance cost for your sports car? Not a problem! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free car insurance quotes from the best auto insurance companies in Lowell.

Cheapest luxury car insurance rates

Ranking at the top for the cheapest Lowell auto insurance rates in the luxury car segment are the Lexus IS 300, Mercedes-Benz CLA250, Acura Integra, Acura TLX, and BMW 330i. Rates for these models average $2,624 or less per year.

Not the cheapest in the list, but still ranking well, are luxury cars like the Lexus ES 350, Mercedes-Benz AMG CLA35, Cadillac CT4, and Lexus RC 300, with average insurance cost of $2,666 per year or less.

Additional 2024 models worth mentioning include the Lexus IS 350, Jaguar XF, Cadillac CT5, Audi S3, and BMW 330e, which cost between $2,666 and $2,842 per year for insurance in Lowell.

Full-coverage auto insurance in Lowell for this segment for a good driver will start around $188 per month, depending on where you live.

If insurance rates are ranked by vehicle size, the most affordable compact luxury car to insure in Lowell is the Acura Integra at $2,254 per year. For midsize luxury cars, the Mercedes-Benz CLA250 is cheapest to insure at $2,610 per year. And for full-size luxury cars, the Audi A5 has the cheapest rates at $3,014 per year.

The rate comparison table below ranks the luxury cars with the lowest-cost insurance in Lowell, starting with the Acura Integra at $2,254 per year and ending with the Audi S3 at $2,842 per year.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura Integra | Compact | $2,254 | $188 |

| BMW 330i | Compact | $2,580 | $215 |

| Mercedes-Benz CLA250 | Midsize | $2,610 | $218 |

| Lexus IS 300 | Midsize | $2,614 | $218 |

| Acura TLX | Compact | $2,624 | $219 |

| Lexus ES 350 | Midsize | $2,646 | $221 |

| Cadillac CT4 | Compact | $2,648 | $221 |

| Genesis G70 | Compact | $2,654 | $221 |

| Mercedes-Benz AMG CLA35 | Midsize | $2,660 | $222 |

| Lexus RC 300 | Midsize | $2,666 | $222 |

| Lexus IS 350 | Compact | $2,678 | $223 |

| Jaguar XF | Midsize | $2,682 | $224 |

| Cadillac CT5 | Midsize | $2,734 | $228 |

| Lexus ES 250 | Midsize | $2,742 | $229 |

| Lexus RC 350 | Compact | $2,750 | $229 |

| BMW 330e | Compact | $2,754 | $230 |

| BMW 228i | Compact | $2,760 | $230 |

| BMW 230i | Compact | $2,780 | $232 |

| Lexus ES 300h | Midsize | $2,786 | $232 |

| Audi S3 | Compact | $2,842 | $237 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Lowell, MA Zip Codes. Updated October 24, 2025

See our guide for luxury car insurance to view any vehicles not shown in the table.

Need rates for a different vehicle? Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get cheap Lowell car insurance quotes from top auto insurance companies in Massachusetts.

Cheapest luxury SUV insurance rates

Sitting at number one in Lowell for cheapest auto insurance rates in the luxury SUV segment is the Acura RDX, with an average cost of $2,120 per year. Second place is the Lexus NX 250 at $2,244 per year, and the third cheapest is the Cadillac XT4, at an average of $2,288 per year.

Not the cheapest, but still very affordable, are luxury SUVs like the Lincoln Corsair, Lexus NX 450h, Lexus UX 250h, and Mercedes-Benz GLB 250, with an average cost to insure of $2,446 per year or less.

As a cost per month, full-coverage insurance in this segment for a safe driver can cost as low as $177 per month, depending on the company and where you live.

The table below ranks the twenty luxury SUVs with the lowest-cost insurance rates in Lowell.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura RDX | Compact | $2,120 | $177 |

| Lexus NX 250 | Compact | $2,244 | $187 |

| Cadillac XT4 | Compact | $2,288 | $191 |

| Jaguar E-Pace | Midsize | $2,372 | $198 |

| Cadillac XT5 | Midsize | $2,392 | $199 |

| Lexus NX 350h | Compact | $2,392 | $199 |

| Lincoln Corsair | Compact | $2,422 | $202 |

| Mercedes-Benz GLB 250 | Compact | $2,428 | $202 |

| Lexus UX 250h | Compact | $2,432 | $203 |

| Lexus NX 450h | Compact | $2,446 | $204 |

| Infiniti QX50 | Midsize | $2,466 | $206 |

| Mercedes-Benz GLA250 | Compact | $2,472 | $206 |

| Mercedes-Benz GLA35 AMG | Compact | $2,480 | $207 |

| Cadillac XT6 | Midsize | $2,482 | $207 |

| Infiniti QX60 | Midsize | $2,494 | $208 |

| Mercedes-Benz AMG GLB35 | Midsize | $2,498 | $208 |

| Land Rover Evoque | Compact | $2,530 | $211 |

| Acura MDX | Midsize | $2,534 | $211 |

| Lexus NX 350 | Compact | $2,544 | $212 |

| Lexus RX 350 | Midsize | $2,546 | $212 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Lowell, MA Zip Codes. Updated October 24, 2025

See our guides for luxury SUV insurance to compare rates for additional makes and models.

Don’t see insurance rates for your luxury SUV? No problem! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free car insurance quotes from top-rated auto insurance companies in Massachusetts.

What to expect when buying Lowell car insurance

To reinforce the extent to which car insurance premiums can vary for different applicants (and also point out the importance of getting plenty of price quotes), the examples below visualize a large range of rates for five popular models in Lowell: the Ford F150, Nissan Sentra, Honda Pilot, Honda Accord, and Chevrolet Camaro.

The example for each vehicle shows rates for a variety of different driver profiles to illustrate the cost fluctuation based on changes in the risk profile of the driver.

Ford F150 insurance rates

Ford F150 insurance in Lowell averages $2,842 per year, or about $237 per month, and varies from $2,354 to $6,556 per year.

The Ford F150 is part of the full-size truck segment, and other popular models include the Chevrolet Silverado, Toyota Tundra, and Nissan Titan.

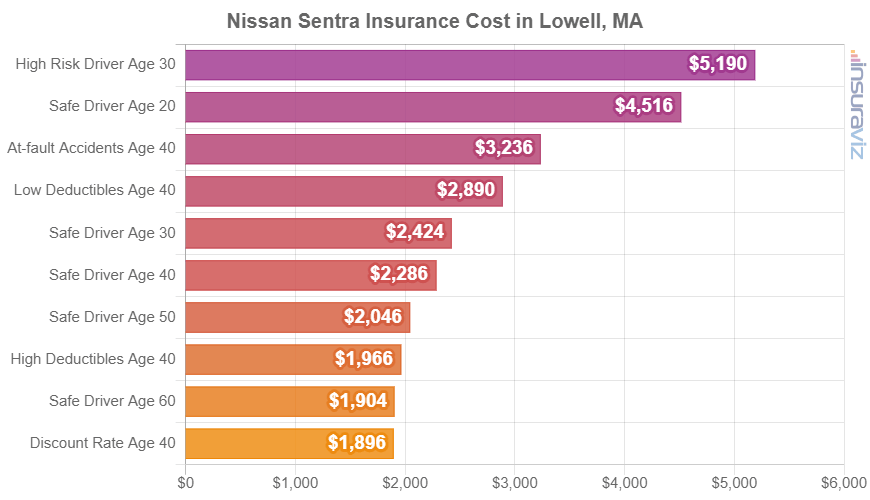

Nissan Sentra insurance rates

Car insurance for a Nissan Sentra in Lowell costs an average of $2,324 per year (about $194 per month) and ranges from $1,932 to $5,286 annually.

The Nissan Sentra is part of the compact car segment, and other top-selling models from the same segment include the Hyundai Elantra, Chevrolet Cruze, and Toyota Corolla.

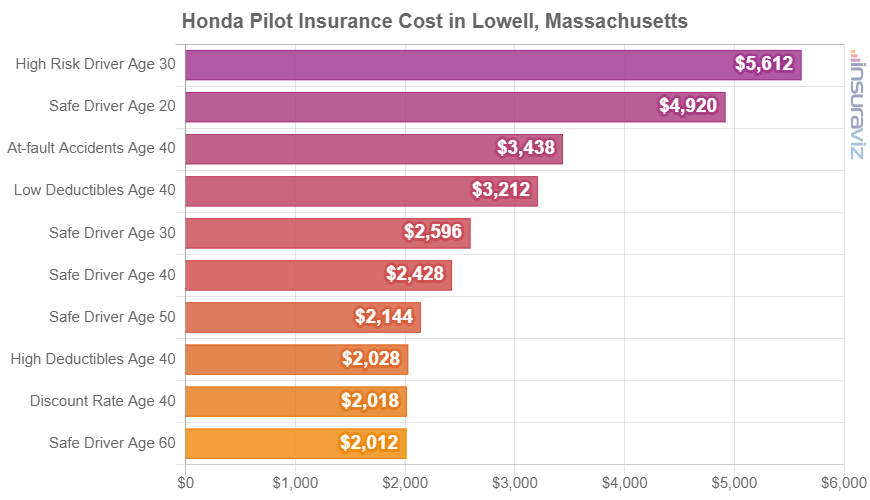

Honda Pilot insurance rates

Insurance for a Honda Pilot in Lowell averages $2,468 per year, or about $206 per month, and has a range of $2,052 to $5,710 per year.

The Honda Pilot is part of the midsize SUV segment, and other similar models that are popular in Lowell include the Kia Telluride, Ford Explorer, Jeep Grand Cherokee, and Ford Edge.

Honda Accord insurance rates

Honda Accord insurance in Lowell averages $2,450 per year (about $204 per month) and ranges from $2,036 to $5,634 annually for the driver ages and coverage limits used in the cost chart below.

The Honda Accord is part of the midsize car segment, and additional similar models include the Toyota Camry, Chevrolet Malibu, Kia K5, and Hyundai Sonata.

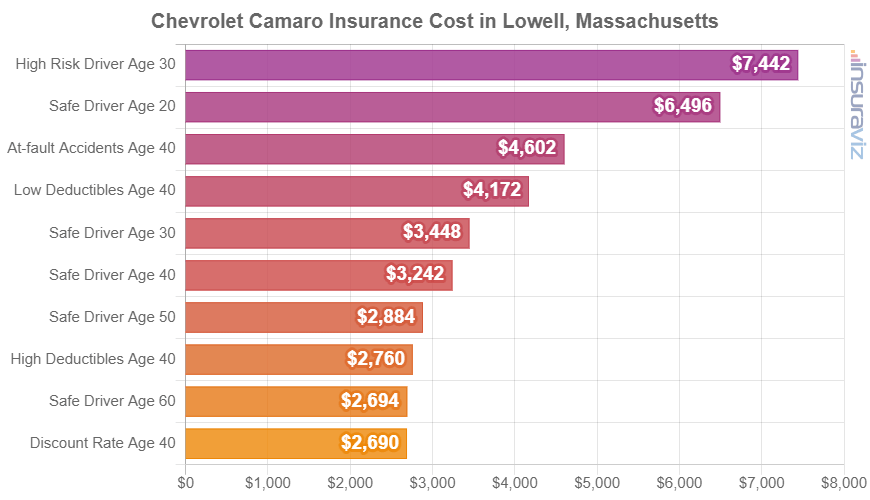

Chevrolet Camaro insurance rates

Insurance for a Chevrolet Camaro in Lowell costs an average of $3,296 per year (about $275 per month) and ranges from $2,734 to $7,572 per year.

The Chevrolet Camaro is considered a sports car, and other top-selling models from the same segment include the Subaru BRZ, Toyota Supra, and Chevrolet Corvette.

Saving money on car insurance

Drivers should always be thinking of ways to reduce their monthly auto insurance expenses. So take a minute or two to look through the savings concepts in this next list and maybe you’ll be able to save a little dough on your next auto insurance policy.

- Higher physical damage deductibles lower policy cost. Jacking up your deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.

- Bring up your credit score to save money. Having an over-800 credit score may save up to $398 per year over a credit score ranging from 670-739. Conversely, a mediocre credit rating could cost around $462 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Careless drivers have higher auto insurance rates. Having frequent at-fault accidents will raise rates, possibly by an additional $3,624 per year for a 20-year-old driver and even as much as $1,056 per year for a 40-year-old driver. So be safe and save.

- Your occupation could save you money. Some auto insurance companies offer policy discounts for having a job in professions like architects, lawyers, scientists, firefighters, high school and elementary teachers, college professors, and others. Qualifying for this discount could save between $76 and $247 on your auto insurance cost, depending on the age of the driver.

- Shop around for better rates. Setting aside 5-10 minutes to get some free car insurance quotes is a great way to save money. Companies make rate modifications frequently and switching to a different company is very easy to do.

- Compare auto insurance rates before buying a car. Different cars, trucks, and SUVs have very different costs for insurance, and insurance companies can sell coverages with very different rates. Check prices before you buy a new car to prevent any surprises when buying coverage for your new car.

- If your vehicle is older, remove optional coverages. Deleting comprehensive and collision coverage from older vehicles that are no longer worth much can cheapen the cost to insure substantially.