- Great Falls car insurance rates cost an average of $2,326 per year, or around $194 per month, for a full coverage policy.

- Car insurance rates for a few popular vehicles in Great Falls include the Nissan Rogue at $174 per month, Tesla Model 3 at $228, and Honda CR-V at $165.

- SUV models like the Kia Soul, Chevrolet Trailblazer, Ford Bronco Sport, and Volkswagen Tiguan are the top picks for cheap car insurance in Great Falls.

- A few vehicles with the most affordable auto insurance for their respective segments include the Acura RDX at $1,948 per year, Toyota GR Corolla at $2,022 per year, Nissan Titan at $2,176 per year, and Kia K5 at $2,242 per year.

What is average car insurance cost in Great Falls?

In Great Falls, average auto insurance cost is $2,326 per year, which is 2.2% more than the national average rate of $2,276. Per month, Great Falls drivers can expect to pay an average of $194 for a policy with full coverage.

In the state of Montana, average auto insurance cost is $2,376 per year, so the cost in Great Falls averages $50 less per year. When compared to other locations in Montana, the average cost to insure a vehicle in Great Falls is approximately $46 per year more than in Missoula, $36 per year less than in Billings, and $38 per year more expensive than in Butte.

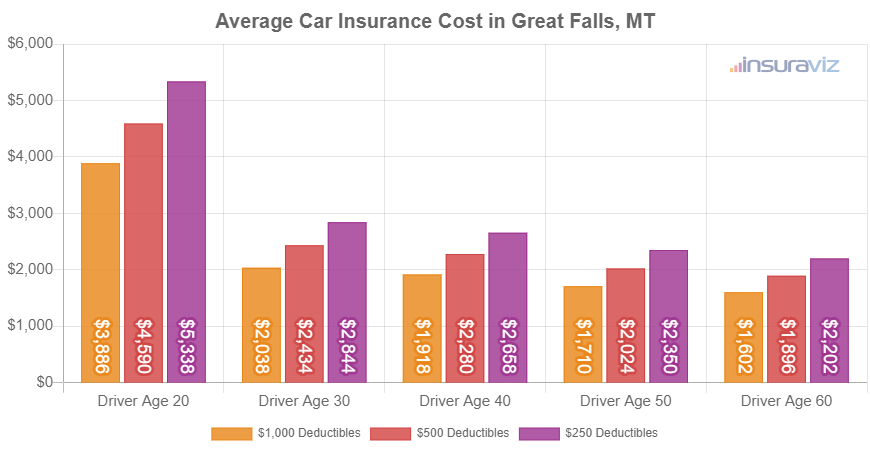

The next chart shows average auto insurance cost in Great Falls broken out not only by driver age, but also by physical damage deductibles. Rates are averaged for all 2024 vehicle models including luxury brand cars and SUVs.

Average rates in the prior chart range from $1,632 per year for a 60-year-old driver with $1,000 physical damage deductibles to $5,444 per year for a 20-year-old driver with $250 deductibles. Throughout this article, the rate used to compare the cost between models and locations is a 40-year-old driver with $500 policy deductibles, which has an average cost of $2,326 per year in Great Falls.

As a monthly amount, the average cost of auto insurance in Great Falls ranges from $136 to $454 for the same driver ages and deductibles shown in the previous chart.

Driver age is the factor that has the most impact on the price you pay for auto insurance. The list below details how age impacts cost by breaking down average car insurance rates in Great Falls for driver ages 16 through 60.

Average car insurance cost for Great Falls drivers age 16 to 60

- 16 year old – $8,284 per year or $690 per month

- 17 year old – $8,026 per year or $669 per month

- 18 year old – $7,195 per year or $600 per month

- 19 year old – $6,552 per year or $546 per month

- 20 year old – $4,682 per year or $390 per month

- 30 year old – $2,484 per year or $207 per month

- 40 year old – $2,326 per year or $194 per month

- 50 year old – $2,064 per year or $172 per month

- 60 year old – $1,930 per year or $161 per month

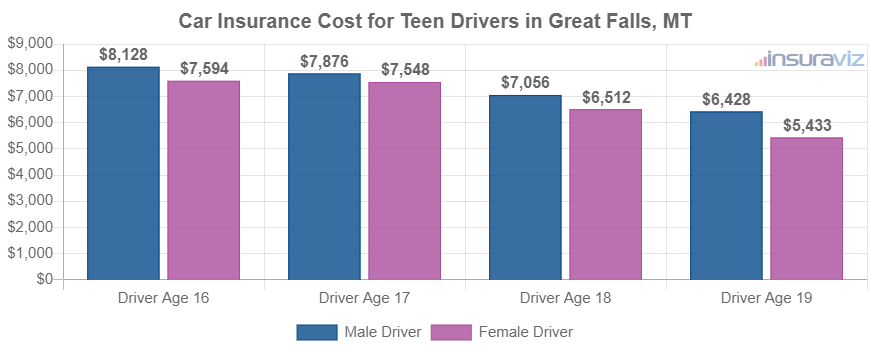

The rates shown above for insuring teenage drivers were based on a male driver. The next chart gets more specific and breaks out average car insurance cost for teenagers by gender. Teenage females are expensive to insure, but do tend to have cheaper auto insurance rates than males of the same age.

Car insurance for a 16-year-old female driver in Great Falls costs an average of $545 less per year than the cost for a 16-year-old male driver, while at age 19, the cost is still $1,010 less for a female driver.

Popular vehicles and the cost to insure them

The car insurance costs referenced previously are an average for all 2024 vehicle models, which is helpful for making general comparisons such as the cost difference between two locations.

Average auto insurance rates are perfect when presented with a question like “are Great Falls car insurance rates cheaper than in Bozeman?” or “is Montana car insurance cheaper than Illinois?”.

For deeper auto insurance comparisons, however, the data will be more accurate if we look at the exact vehicle being insured. Every make and model has different characteristics for determining how much it costs to insure it and this data allows us to perform insurance cost projections and comparisons.

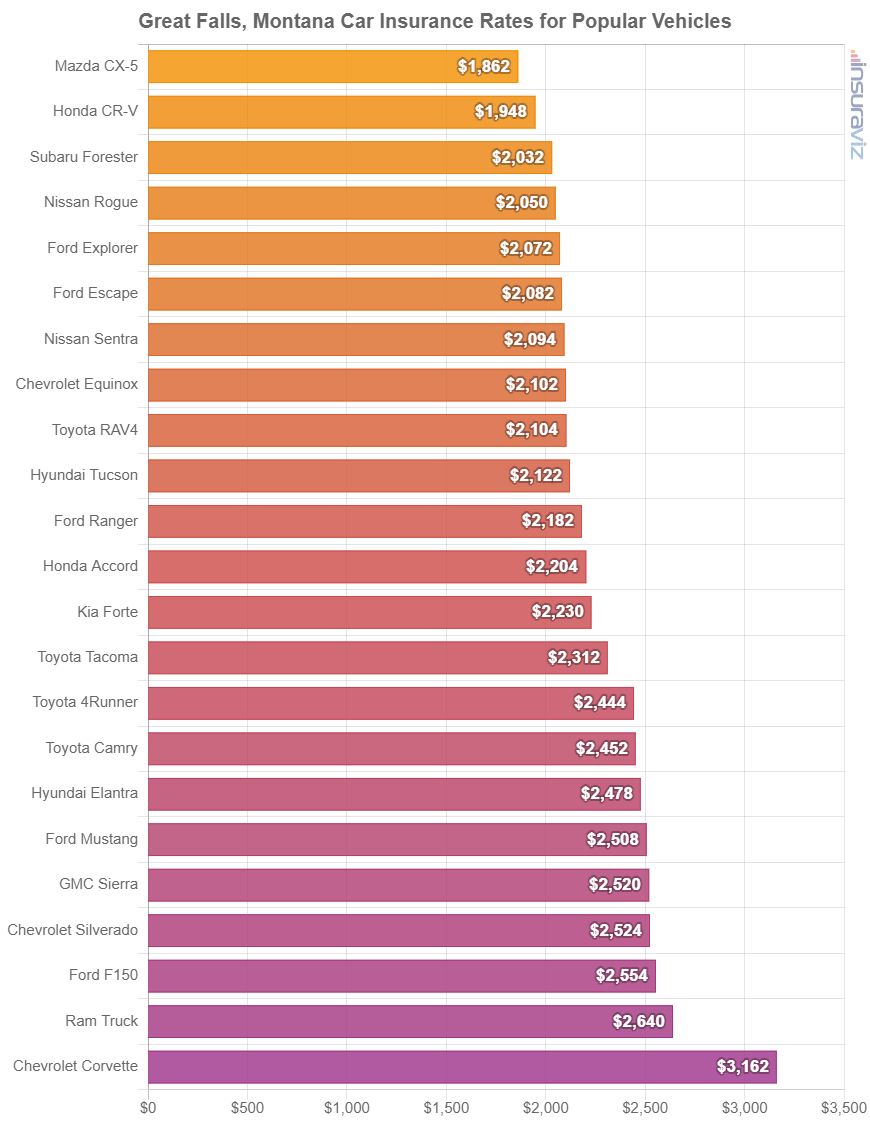

The chart below displays insurance rates for some of the more popular models on the roads of Great Falls. Later in this article, we analyze insurance cost for a few of these models in more detail.

Popular vehicle models in Great Falls tend to be compact and midsize cars like the Toyota Corolla and Toyota Camry and compact or midsize SUVs like the Toyota RAV4, Ford Escape, and Ford Explorer.

Other popular vehicles from different automotive segments include luxury SUVs like the Lexus RX 350, Infiniti QX60, and Cadillac XT5, luxury cars like the Infiniti Q50, Acura ILX, and Lexus ES 350, and pickup trucks like the Chevy Silverado, Ford Ranger, and Toyota Tacoma.

We will explore auto insurance rates for many more vehicles in a bit, but before we get into that data, let’s quickly review the key concepts and comparisons we tackled so far in the article.

- Auto insurance rates fall significantly from age 20 to 30 – The average 30-year-old Great Falls, Montana, driver will pay $2,198 less each year than a 20-year-old driver, $2,484 compared to $4,682.

- Insurance for teens can be expensive – The average cost ranges from $5,542 to $8,284 per year for teen driver car insurance in Great Falls, MT.

- Teenage females pay cheaper rates than teenage males – Teenage females age 16 to 19 pay $1,010 to $545 less per year than male drivers of the same age.

- Average cost per month ranges from $161 to $690 – That is the average car insurance price range for drivers age 16 to 60 in Great Falls, Montana.

- Great Falls, Montana, average car insurance cost is more than the U.S. average – $2,326 (Great Falls average) versus $2,276 (U.S. average)

What vehicles have the cheapest car insurance?

The models with the cheapest insurance quotes in Great Falls tend to be compact SUVs and crossovers like the Chevrolet Trailblazer, Kia Soul, Hyundai Venue, and Buick Envision. Average insurance prices for those models cost $158 or less per month to get full coverage.

Additional vehicles that rank well in our auto insurance price comparison are the Kia Niro, Toyota GR Corolla, Acura RDX, and Volkswagen Tiguan.

Average auto insurance rates are slightly more for those models than the small SUVs and crossovers at the top of the list, but they still have an average cost of $2,022 or less per year, or $169 per month in Great Falls.

The table below shows the 50 cheapest vehicles to insure in Great Falls, ordered by cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,720 | $143 |

| 2 | Chevrolet Trailblazer | $1,748 | $146 |

| 3 | Kia Soul | $1,816 | $151 |

| 4 | Nissan Kicks | $1,830 | $153 |

| 5 | Honda Passport | $1,852 | $154 |

| 6 | Buick Envision | $1,866 | $156 |

| 7 | Toyota Corolla Cross | $1,874 | $156 |

| 8 | Hyundai Venue | $1,892 | $158 |

| 9 | Mazda CX-5 | $1,898 | $158 |

| 10 | Ford Bronco Sport | $1,906 | $159 |

| 11 | Volkswagen Tiguan | $1,926 | $161 |

| 12 | Acura RDX | $1,948 | $162 |

| 13 | Nissan Murano | $1,954 | $163 |

| 14 | Buick Encore | $1,974 | $165 |

| 15 | Honda CR-V | $1,982 | $165 |

| 16 | Subaru Outback | $1,984 | $165 |

| 17 | Buick Envista | $1,988 | $166 |

| 18 | Volkswagen Taos | $1,992 | $166 |

| 19 | Kia Niro | $2,002 | $167 |

| 20 | Toyota GR Corolla | $2,022 | $169 |

| 21 | Honda HR-V | $2,024 | $169 |

| 22 | Subaru Ascent | $2,024 | $169 |

| 23 | Nissan Leaf | $2,038 | $170 |

| 24 | Chevrolet Colorado | $2,050 | $171 |

| 25 | Honda Civic | $2,060 | $172 |

| 26 | Lexus NX 250 | $2,060 | $172 |

| 27 | Volkswagen Atlas | $2,064 | $172 |

| 28 | Acura Integra | $2,068 | $172 |

| 29 | Subaru Forester | $2,072 | $173 |

| 30 | Volkswagen Atlas Cross Sport | $2,074 | $173 |

| 31 | Kia Seltos | $2,078 | $173 |

| 32 | GMC Terrain | $2,082 | $174 |

| 33 | Nissan Rogue | $2,090 | $174 |

| 34 | Hyundai Kona | $2,094 | $175 |

| 35 | Mazda CX-30 | $2,098 | $175 |

| 36 | Cadillac XT4 | $2,100 | $175 |

| 37 | Volkswagen ID4 | $2,108 | $176 |

| 38 | Ford Explorer | $2,110 | $176 |

| 39 | Toyota Highlander | $2,116 | $176 |

| 40 | Ford Escape | $2,122 | $177 |

| 41 | Honda Odyssey | $2,126 | $177 |

| 42 | Toyota Venza | $2,126 | $177 |

| 43 | Nissan Sentra | $2,132 | $178 |

| 44 | Subaru Impreza | $2,138 | $178 |

| 45 | Chevrolet Equinox | $2,142 | $179 |

| 46 | Toyota RAV4 | $2,148 | $179 |

| 47 | Mazda MX-5 Miata | $2,152 | $179 |

| 48 | Mazda MX-30 | $2,158 | $180 |

| 49 | Hyundai Tucson | $2,162 | $180 |

| 50 | Chevrolet Traverse | $2,170 | $181 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Great Falls, MT Zip Codes. Updated October 24, 2025

The table above that contains 50 vehicle rankings is not the most useful way to show the full picture of the cost of car insurance in Great Falls. A more efficient way to group rates in a practical manner is by organizing them by automotive segment.

This next section illustrates the average cost of car insurance for each vehicle segment. The average rates shown in the chart will give you a decent understanding of which automotive segments have the best Great Falls auto insurance rates. Then the six subsequent sections will break out the specific models that have the cheapest insurance rates for each segment.

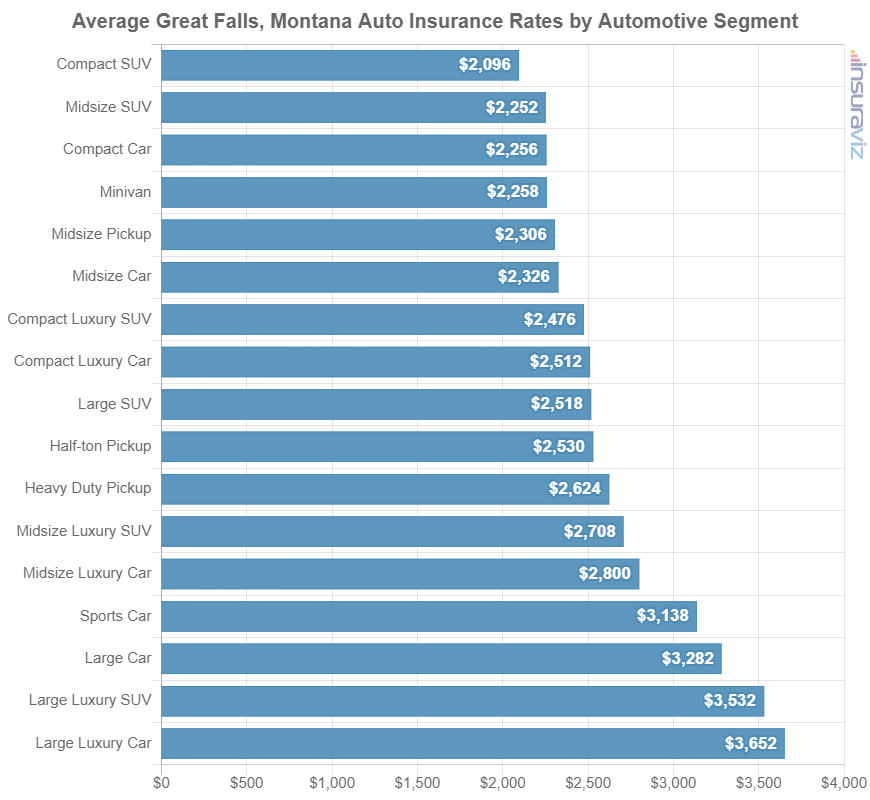

Great Falls auto insurance rates by vehicle segment

When shopping around for a new or used vehicle, it’s useful to have a basic understanding of which kinds of vehicles have less expensive car insurance rates in Great Falls. For example, you may be curious if compact cars have cheaper insurance than midsize cars or which size of luxury car has cheaper insurance.

The next chart shows the average car insurance cost in Great Falls for each automotive segment. From an overall average perspective, small SUVs and midsize pickups have the cheapest rates, with exotic performance models having the most expensive average cost to insure.

Average insurance rates by segment can be used to form a general comparison, but insurance rates for specific models range quite a lot within each vehicle category displayed in the chart above.

For example, in the midsize luxury car segment, average Great Falls auto insurance rates range from the Mercedes-Benz CLA250 at $2,394 per year to the BMW M8 costing $3,920 per year.

For another example, in the midsize truck segment, the average cost of insurance ranges from the Chevrolet Colorado costing $2,050 per year up to the Rivian R1T at $2,900 per year, a difference of $850 within that segment.

In the upcoming sections, we eliminate this variability by looking at the average cost of car insurance in Great Falls for specific vehicle models.

Cheapest cars to insure in Great Falls

The top three non-luxury sedans with the most affordable auto insurance rates in Great Falls are the Toyota GR Corolla at $2,022 per year, the Nissan Leaf at $2,038 per year, and the Honda Civic at $2,060 per year.

Not the cheapest cars to insure, but still affordable, are cars like the Toyota Corolla, Kia K5, Chevrolet Malibu, and Toyota Prius, with an average car insurance cost of $2,266 per year or less.

Additional 2024 models that rank well include the Nissan Versa, Subaru Legacy, Kia Forte, Hyundai Sonata, and Mazda 3, which cost between $2,266 and $2,406 per year to insure.

As a cost per month, car insurance in Great Falls on this segment for a good driver starts at around $169 per month, depending on where you live and the company you use.

The comparison table below ranks the cars with the most affordable insurance rates in Great Falls, starting with the Toyota GR Corolla at $169 per month and ending with the Mazda 3 at $201 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Toyota GR Corolla | Compact | $2,022 | $169 |

| Nissan Leaf | Compact | $2,038 | $170 |

| Honda Civic | Compact | $2,060 | $172 |

| Nissan Sentra | Compact | $2,132 | $178 |

| Subaru Impreza | Compact | $2,138 | $178 |

| Toyota Prius | Compact | $2,174 | $181 |

| Kia K5 | Midsize | $2,242 | $187 |

| Honda Accord | Midsize | $2,246 | $187 |

| Chevrolet Malibu | Midsize | $2,256 | $188 |

| Toyota Corolla | Compact | $2,266 | $189 |

| Kia Forte | Compact | $2,272 | $189 |

| Volkswagen Arteon | Midsize | $2,288 | $191 |

| Nissan Versa | Compact | $2,294 | $191 |

| Subaru Legacy | Midsize | $2,296 | $191 |

| Hyundai Ioniq 6 | Midsize | $2,314 | $193 |

| Mitsubishi Mirage G4 | Compact | $2,348 | $196 |

| Toyota Crown | Midsize | $2,354 | $196 |

| Volkswagen Jetta | Compact | $2,354 | $196 |

| Hyundai Sonata | Midsize | $2,358 | $197 |

| Mazda 3 | Compact | $2,406 | $201 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Great Falls, MT Zip Codes. Updated October 24, 2025

See our guides for compact car insurance, midsize car insurance, and full-size car insurance to view any vehicles not shown in the table.

Need rates for a different vehicle? No problem! Enter your zip code at the bottom of the table and click the orange ‘GO’ button to get cheap Great Falls car insurance quotes from top auto insurance companies in Montana.

Cheapest SUVs to insure in Great Falls, Montana

The Subaru Crosstrek ranks at #1 for the most budget-friendly non-luxury SUV to insure in Great Falls, followed by the Chevrolet Trailblazer, Kia Soul, Nissan Kicks, and Honda Passport. The 2024 model averages $1,720 per year to insure with full coverage.

Some other SUVs that have affordable insurance rates include the Hyundai Venue, Buick Envision, Toyota Corolla Cross, and Mazda CX-5, with an average car insurance cost of $1,906 per year or less.

Ranked in the bottom half of the top 20 cheapest SUVs to insure, SUVs like the Volkswagen Taos, Honda HR-V, Nissan Murano, Volkswagen Tiguan, and Subaru Ascent average between $1,906 and $2,024 to insure per year in Great Falls.

From a cost per month standpoint, full-coverage auto insurance in this segment for a good driver starts at an average of $143 per month, depending on where you live.

When SUV size is factored in, the most affordable non-luxury compact SUV to insure in Great Falls is the Subaru Crosstrek at $1,720 per year, or $143 per month. For midsize models, the Honda Passport is cheapest to insure at $1,852 per year, or $154 per month. And for full-size non-luxury SUVs, the Chevrolet Tahoe has the most affordable rates at $2,182 per year, or $182 per month.

The comparison table below ranks the SUVs with the most affordable average insurance rates in Great Falls, starting with the Subaru Crosstrek at $1,720 per year and ending with the Subaru Ascent at $2,024 per year.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Subaru Crosstrek | Compact | $1,720 | $143 |

| Chevrolet Trailblazer | Compact | $1,748 | $146 |

| Kia Soul | Compact | $1,816 | $151 |

| Nissan Kicks | Compact | $1,830 | $153 |

| Honda Passport | Midsize | $1,852 | $154 |

| Buick Envision | Compact | $1,866 | $156 |

| Toyota Corolla Cross | Compact | $1,874 | $156 |

| Hyundai Venue | Compact | $1,892 | $158 |

| Mazda CX-5 | Compact | $1,898 | $158 |

| Ford Bronco Sport | Compact | $1,906 | $159 |

| Volkswagen Tiguan | Compact | $1,926 | $161 |

| Nissan Murano | Midsize | $1,954 | $163 |

| Buick Encore | Compact | $1,974 | $165 |

| Honda CR-V | Compact | $1,982 | $165 |

| Subaru Outback | Midsize | $1,984 | $165 |

| Buick Envista | Midsize | $1,988 | $166 |

| Volkswagen Taos | Compact | $1,992 | $166 |

| Kia Niro | Compact | $2,002 | $167 |

| Honda HR-V | Compact | $2,024 | $169 |

| Subaru Ascent | Midsize | $2,024 | $169 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Great Falls, MT Zip Codes. Updated October 24, 2025

See our comprehensive guides for compact SUV insurance, midsize SUV insurance, and full-size SUV insurance to view data for vehicles not featured in the table.

Don’t see rates for your SUV? No problem! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free Great Falls car insurance quotes from top auto insurance companies in Montana.

Cheapest luxury car insurance rates in Great Falls

The cheapest luxury car models to insure in Great Falls are the Acura Integra at $2,068 per year, the BMW 330i at $2,368 per year, and the Mercedes-Benz CLA250 at $2,394 per year.

Other models that have cheaper rates are the Cadillac CT4, Lexus ES 350, Lexus RC 300, and Genesis G70, with an average car insurance cost of $2,444 per year or less.

Car insurance rates in this segment starts at an average of $172 per month, depending on your location and insurance company.

The most budget-friendly small luxury car to insure in Great Falls is the Acura Integra at $2,068 per year. For midsize luxury models, the Mercedes-Benz CLA250 is the cheapest model to insure at $2,394 per year. And for large luxury cars, the Audi A5 has the most affordable rates at $2,764 per year.

The comparison table below ranks the twenty luxury cars with the cheapest auto insurance rates in Great Falls.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura Integra | Compact | $2,068 | $172 |

| BMW 330i | Compact | $2,368 | $197 |

| Mercedes-Benz CLA250 | Midsize | $2,394 | $200 |

| Lexus IS 300 | Midsize | $2,398 | $200 |

| Acura TLX | Compact | $2,406 | $201 |

| Lexus ES 350 | Midsize | $2,428 | $202 |

| Cadillac CT4 | Compact | $2,430 | $203 |

| Genesis G70 | Compact | $2,436 | $203 |

| Mercedes-Benz AMG CLA35 | Midsize | $2,438 | $203 |

| Lexus RC 300 | Midsize | $2,444 | $204 |

| Lexus IS 350 | Compact | $2,456 | $205 |

| Jaguar XF | Midsize | $2,460 | $205 |

| Cadillac CT5 | Midsize | $2,508 | $209 |

| Lexus ES 250 | Midsize | $2,516 | $210 |

| Lexus RC 350 | Compact | $2,524 | $210 |

| BMW 330e | Compact | $2,526 | $211 |

| BMW 228i | Compact | $2,530 | $211 |

| BMW 230i | Compact | $2,550 | $213 |

| Lexus ES 300h | Midsize | $2,554 | $213 |

| Audi S3 | Compact | $2,608 | $217 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Great Falls, MT Zip Codes. Updated October 24, 2025

See our comprehensive guide for luxury car insurance to view data for vehicles not featured in the table.

Don’t see insurance rates for your vehicle? No problem! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get cheap Great Falls car insurance quotes from top auto insurance companies in Montana.

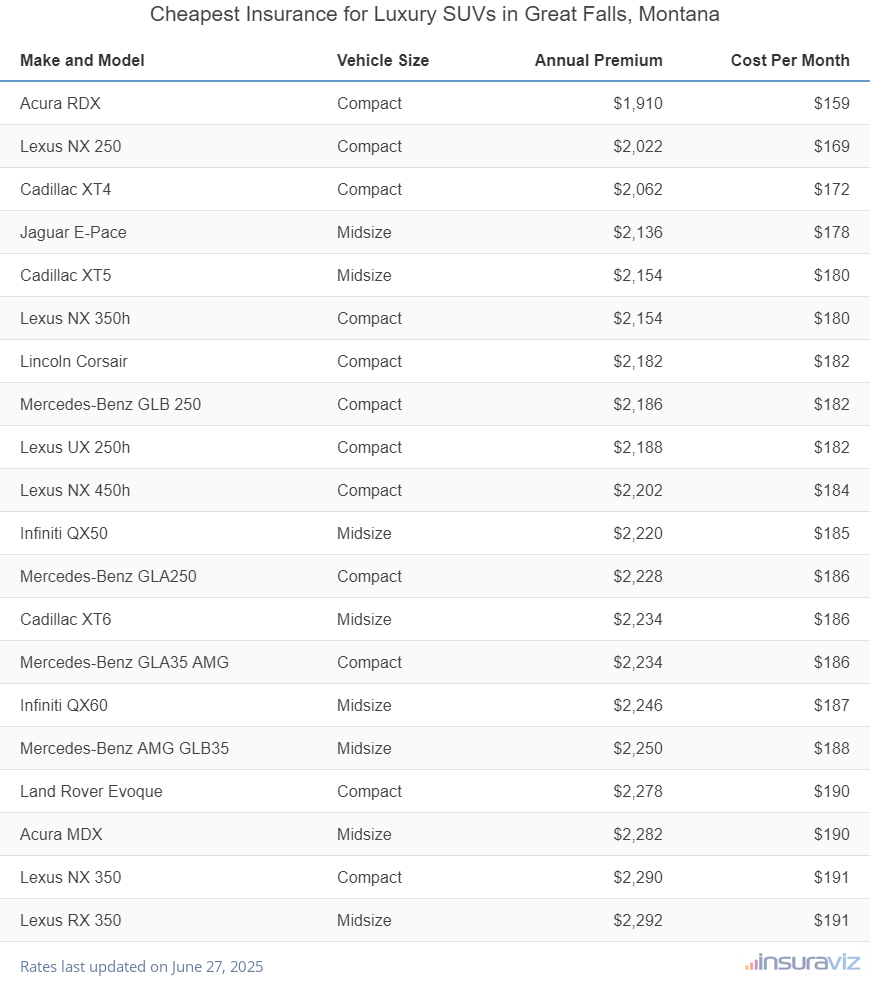

Cheapest luxury SUV insurance rates in Great Falls, MT

The cheapest luxury SUVs to insure in Great Falls are the Acura RDX at $1,948 per year, the Lexus NX 250 at $2,060 per year, and the Cadillac XT4 at $2,100 per year.

Not the cheapest to insure, but still ranked well, are models like the Lexus NX 450h, Lexus NX 350h, Lexus UX 250h, and Lincoln Corsair, with average insurance cost of $2,246 per year or less.

Car insurance in this segment for a good driver can cost as low as $162 per month, depending on your location.

When vehicle size is considered, the lowest-cost small luxury SUV to insure in Great Falls is the Acura RDX at $1,948 per year. For midsize luxury SUVs, the Jaguar E-Pace is the cheapest model to insure at $2,176 per year. And for full-size luxury SUVs, the Infiniti QX80 has the most affordable rates at $2,608 per year.

The rate comparison table below ranks the twenty luxury SUVs with the lowest-cost insurance in Great Falls, starting with the Acura RDX at $1,948 per year and ending with the Lexus RX 350 at $2,336 per year.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura RDX | Compact | $1,948 | $162 |

| Lexus NX 250 | Compact | $2,060 | $172 |

| Cadillac XT4 | Compact | $2,100 | $175 |

| Jaguar E-Pace | Midsize | $2,176 | $181 |

| Cadillac XT5 | Midsize | $2,194 | $183 |

| Lexus NX 350h | Compact | $2,194 | $183 |

| Lincoln Corsair | Compact | $2,222 | $185 |

| Mercedes-Benz GLB 250 | Compact | $2,226 | $186 |

| Lexus UX 250h | Compact | $2,230 | $186 |

| Lexus NX 450h | Compact | $2,246 | $187 |

| Infiniti QX50 | Midsize | $2,260 | $188 |

| Mercedes-Benz GLA250 | Compact | $2,268 | $189 |

| Mercedes-Benz GLA35 AMG | Compact | $2,276 | $190 |

| Cadillac XT6 | Midsize | $2,278 | $190 |

| Infiniti QX60 | Midsize | $2,290 | $191 |

| Mercedes-Benz AMG GLB35 | Midsize | $2,292 | $191 |

| Land Rover Evoque | Compact | $2,322 | $194 |

| Acura MDX | Midsize | $2,326 | $194 |

| Lexus NX 350 | Compact | $2,332 | $194 |

| Lexus RX 350 | Midsize | $2,336 | $195 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Great Falls, MT Zip Codes. Updated October 24, 2025

See our comprehensive guide for luxury SUV insurance to view data for vehicles not featured in the table.

Need rates for a different luxury SUV? Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get cheap Great Falls car insurance quotes from the best auto insurance companies in Montana.

Cheapest sports car insurance rates

The four most affordable sports cars to insure in Great Falls are the Mazda MX-5 Miata at $2,152 per year, Toyota GR86 at $2,452 per year, Ford Mustang at $2,558 per year, and BMW Z4 at $2,572 per year.

Also ranking well in our comparison are cars like the Toyota GR Supra, Lexus RC F, BMW M2, and Nissan Z, with an average cost of $2,782 per year or less.

As a cost per month, full-coverage car insurance on this segment in Great Falls starts at an average of $179 per month, depending on the company. The next table ranks the twenty sports cars with the cheapest auto insurance rates in Great Falls, starting with the Mazda MX-5 Miata at $2,152 per year ($179 per month) and ending with the Porsche Taycan at $3,940 per year ($328 per month).

| Make and Model | Vehicle Type | Annual Premium | Cost Per Month |

|---|---|---|---|

| Mazda MX-5 Miata | Sports Car | $2,152 | $179 |

| Toyota GR86 | Sports Car | $2,452 | $204 |

| Ford Mustang | Sports Car | $2,558 | $213 |

| BMW Z4 | Sports Car | $2,572 | $214 |

| Subaru WRX | Sports Car | $2,608 | $217 |

| Toyota GR Supra | Sports Car | $2,612 | $218 |

| BMW M2 | Sports Car | $2,690 | $224 |

| Nissan Z | Sports Car | $2,696 | $225 |

| Lexus RC F | Sports Car | $2,750 | $229 |

| Subaru BRZ | Sports Car | $2,782 | $232 |

| BMW M3 | Sports Car | $2,938 | $245 |

| Porsche 718 | Sports Car | $2,996 | $250 |

| Chevrolet Camaro | Sports Car | $3,024 | $252 |

| Chevrolet Corvette | Sports Car | $3,222 | $269 |

| Porsche 911 | Sports Car | $3,334 | $278 |

| BMW M4 | Sports Car | $3,472 | $289 |

| Lexus LC 500 | Sports Car | $3,490 | $291 |

| Jaguar F-Type | Sports Car | $3,670 | $306 |

| Mercedes-Benz AMG GT53 | Sports Car | $3,850 | $321 |

| Porsche Taycan | Sports Car | $3,940 | $328 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Great Falls, MT Zip Codes. Updated October 24, 2025

Don’t see your sports car? Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free car insurance quotes from the best companies in Great Falls.

Cheapest pickup insurance rates

Ranking in the top five for the lowest-cost Great Falls auto insurance rates in the pickup truck segment are the Nissan Frontier, Ford Maverick, Chevrolet Colorado, Nissan Titan, and Ford Ranger. Car insurance rates for these vehicles average $188 or less per month.

Rounding out the top 10 are trucks like the Hyundai Santa Cruz, GMC Sierra 2500 HD, GMC Canyon, and Toyota Tacoma, with average insurance cost of $2,394 per year or less.

Car insurance rates in Great Falls for this segment for a safe driver can cost as low as $171 per month, depending on where you live and the company you use. The table below ranks the twenty pickups with the cheapest car insurance in Great Falls, starting with the Chevrolet Colorado at $2,050 per year ($171 per month) and ending with the Ram Truck at $2,692 per year ($224 per month).

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Chevrolet Colorado | Midsize | $2,050 | $171 |

| Nissan Titan | Full-size | $2,176 | $181 |

| Nissan Frontier | Midsize | $2,198 | $183 |

| Ford Ranger | Midsize | $2,224 | $185 |

| Ford Maverick | Midsize | $2,256 | $188 |

| Honda Ridgeline | Midsize | $2,308 | $192 |

| Hyundai Santa Cruz | Midsize | $2,346 | $196 |

| Toyota Tacoma | Midsize | $2,356 | $196 |

| GMC Sierra 2500 HD | Heavy Duty | $2,366 | $197 |

| GMC Canyon | Midsize | $2,394 | $200 |

| Jeep Gladiator | Midsize | $2,452 | $204 |

| GMC Sierra 3500 | Heavy Duty | $2,462 | $205 |

| Chevrolet Silverado HD 3500 | Heavy Duty | $2,490 | $208 |

| Chevrolet Silverado HD 2500 | Heavy Duty | $2,554 | $213 |

| GMC Sierra | Full-size | $2,568 | $214 |

| Nissan Titan XD | Heavy Duty | $2,572 | $214 |

| Chevrolet Silverado | Full-size | $2,574 | $215 |

| Ford F150 | Full-size | $2,604 | $217 |

| GMC Hummer EV Pickup | Full-size | $2,668 | $222 |

| Ram Truck | Full-size | $2,692 | $224 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Great Falls, MT Zip Codes. Updated October 24, 2025

For more pickup insurance comparisons, see our guides for midsize pickup insurance and large pickup insurance.

Need rates for a different pickup model? No problem! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free Great Falls car insurance quotes from top-rated companies in Montana.

How to find cheaper auto insurance

Drivers are always searching for ways to pay less for insurance So take a minute and read through the tips in the list below and it’s very possible you can save a little dough on your next renewal.

- Earn a discount from your choice of occupation. Some car insurance companies offer discounts for occupations like firefighters, engineers, nurses, high school and elementary teachers, scientists, emergency medical technicians, and others. By working in a job that qualifies, you could save between $70 and $226 on your insurance premium, subject to the policy coverages selected.

- Pay small claims out-of-pocket. Insurance companies give a discount if you have no claims on your account. Car insurance should only be used for significant financial loss, not minor claims that should be paid out-of-pocket.

- Raising deductibles makes insurance more affordable. Jacking up your deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.

- Negligent drivers pay higher auto insurance rates in Great Falls. Having frequent at-fault accidents will raise rates, possibly by an extra $3,322 per year for a 20-year-old driver and even as much as $568 per year for a 60-year-old driver. So drive safe and save!

- Compare insurance rates before buying a car. Different cars, trucks, and SUVs have significantly different auto insurance rates, and insurance companies charge very different rates. Get quotes before you purchase in order to avoid price shock when you receive your first bill.

- Save money by qualifying for discounts. Discounts may be available if the insureds are good students, insure multiple vehicles on the same policy, drive low annual mileage, choose electronic billing, or many other discounts which could save the average Great Falls driver as much as $392 per year on their insurance cost.